Here is my takeaway:

"Thus, the barriers and transition costs employees incur when switching employers have been reduced.

Greater options and lower costs to move mean that employees can be more selective and focus on picking jobs that best fit their personal needs and desires."

Finding good employees has always been a challenge - but these days it's harder than ever. And it is unlikely to improve anytime soon.

The so-called quit rate - the share of workers who voluntarily leave their jobs - hit a new record of 3% in September 2021, according to the latest data available from the Bureau of Labor and Statistics. The rate was highest in the leisure and hospitality sector, where 6.4% of workers quit their jobs in September. In all, 20.2 million workers left their employers from May through September.

Companies are feeling the effects. In August 2021, a survey found that 73% of 380 employers in North America were having difficulty attracting employees - three times the share that said so the previous year. And 70% expect this difficulty to persist into 2022.

Observers have blamed a wide variety of factors for all the turnover, from fear of contracting COVID-19 by mixing with co-workers on the job to paltry wages and benefits being offered.

As a professor of human resource management, I examine how employment and the work environment have changed over time and the impact this has on organizations and communities. While the current resignation behavior may seem like a new trend, data shows employee turnover has been rising steadily for the past decade and may simply be the new normal employers are going to have to get used to.

The economy's seismic shifts

The U.S. - alongside other advanced economies - has been moving away from a focus on productive sectors like manufacturing to a service-based economy for decades.

In recent years, the service sector accounted for about 86% of all employment in the U.S. and 79% of all economic growth.

That change has been seismic for employers. A majority of the jobs in service-based industries require only generalizable occupational skills such as competencies in computing and communications that are often easily transportable across companies. This is true across a wide range of professions, from accountants and engineers to truck drivers and customer services representatives. As a result, in service-based economies, it is relatively easy for employees to move between companies and maintain their productivity.

And thanks to information technology and social media, it has never been easier for employees to find out about new job opportunities anywhere in the world. The growing prevalence of remote working also means that in some cases employees will no longer need to physically relocate to start a new job.

Thus, the barriers and transition costs employees incur when switching employers have been reduced.

Greater options and lower costs to move mean that employees can be more selective and focus on picking jobs that best fit their personal needs and desires. What people want from work is inherently shaped by their cultural values and life situation. The U.S. labor market is expected to become far more diverse going forward in terms of gender, ethnicity and age. Thus, employers that cannot provide greater flexibility and variety in their working environment will struggle to attract and retain workers.

Employers now have a greater obligation than in the past to convince existing and would-be employees why they should stay or join their organizations. And there is no evidence to suggest this trend will change going forward.

What companies can do to adapt

It has been estimated that the cost to the employer of replacing a departing employee is on average 122% of that employee's annual salary in terms of finding and training a replacement.

Thus, there is a large incentive for businesses to adapt to the new labor market conditions and develop innovative approaches to keeping workers happy and in their jobs.

A May 2021 survey found that 54% of employees surveyed from around the world would consider leaving their job if they were not afforded some form of flexibility in where and when they work.

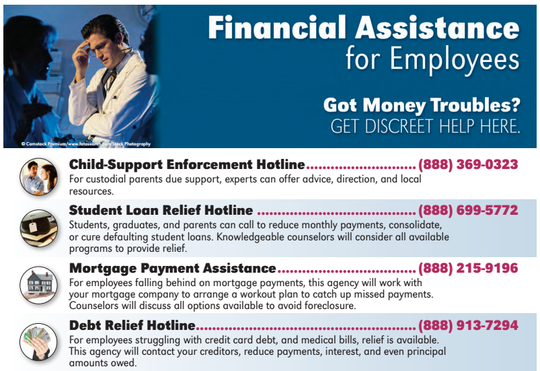

Given the heightened priority employees place on finding a job that fits their preferences, companies need to adopt a more holistic approach to the types of rewards they provide. It's also important that they tailor the types of financial, social and developmental incentives and opportunities they provide to individual employees' preferences. It's not just about paying workers more. There are even examples of companies providing employees the choice of simply being paid in a cryptocurrency like bitcoin as an inducement.

While customizing the package of rewards each employees receives may potentially increase an organization's administrative costs, this investment can help retain a highly engaged workforce.

Managing the new normal

Companies should also plan on high employee mobility to be endemic and reframe how they approach managing their workers.

One way to do this is by investing deeply in external relationships that help ensure consistent access to high-quality talent. This can include enhancing the relationships they have with educational institutions and former employees.

For example, many organizations have adopted alumni programs that specifically recruit former employees to rejoin.

These former employees are often less expensive to recruit, bring access to needed human capital and possess both an understanding of an organization's processes and an appreciation of the organization's culture.

The quit rate is likely to stay elevated for some time to come. The sooner employers accept that and adapt, the better they'll be at managing the new normal.

[You're smart and curious about the world. So are The Conversation's authors and editors. You can read us daily by subscribing to our newsletter.]![]()

Ian O. Williamson, Dean of the Paul Merage School of Business, University of California, Irvine

This article is republished from The Conversation under a Creative Commons license. Read the original article.

For the 5 Most Fascinating Stories in Franchising, a weekly report, click here & sign up.

"We want to give our franchise partners the support they deserve," says O'Brien. "GIS technology gives them the ability to maximize their potential at Culver's."

"We want to give our franchise partners the support they deserve," says O'Brien. "GIS technology gives them the ability to maximize their potential at Culver's."