Blog: http://thehealthcaremind.com/

Twitter: @healthcaremind

"Employers provide the majority of health insurance benefits in this country. They must have a seat at the health reform policy table."

These were the first words of advice for Michigan business owners from Rick Lord, President of Associated Industries of Massachusetts (AIM) and Michael Widmer, President of the Massachusetts Taxpayers Foundation. They represented two of the four employer organizations that worked with their state legislature to help pass universal health care coverage in 2006 for the state's 6.5 million residents.

These business leaders believe that having businesses involved in health reform policy in Massachusetts has resulted in a balanced and sustainable approach to health reform and with a much better outcome than if they had not been involved.

Here are some of their insights and words of advice on how Michigan business leaders can play a role in shaping health reform policy in our state.

1. BUSINESS LEADERS MUST SHARE A COMMON GOAL.

The Massachusetts businesses believed universal coverage was needed because they were going to pay for the uninsured one way or another, through uncompensated care assessments, cost shifting, high premiums or a less healthy workforce. The road to balanced policy was not easy, but a common goal and purpose allowed them to work through their obstacles.

2. COLLABORATION AND COMPROMISE ARE KEY TO POLICY REFORM.

Along the way, a number of proposals emerged that the business community opposed, but their representatives stayed at the table to work through the issues. For example, business leaders were able to develop a compromise over a proposed payroll tax by requiring a minimum level of employee coverage or else pay an annual employee assessment of up to $295 to help fund uncompensated care. The principle behind the compromise was that all employers should share equal responsibility for the costs of health care provided to uninsured residents.

3. THE INDIVIDUAL MANDATE DID NOT UNDERMINE EMPLOYER-SPONSORED HEALTH COVERAGE.

Despite some predictions that employers would send more of their employees to the state's insurance exchange, more agreed to offer coverage because they realized that, to remain competitive, they needed to offer health benefits. The process of working together on reform policy also helped them realize the program would work best with the shared support of businesses, individuals and the government.

4. THE BUSINESS COMMUNITY HAS AN IMPORTANT ROLE TO PLAY IN INFORMING AND EDUCATING EMPLOYERS AND THE GENERAL PUBLIC ABOUT THE BENEFITS AND REQUIREMENTS OF HEALTH CARE REFORM.

One of the results of universal coverage was to help businesses become better purchasers of health care coverage. AIM sponsored workshops, webinars and developed a guidebook to educate the employers and employees in their organization about the law's policies and regulations. Businesses were also featured that found innovative ways to improve the quality of care, implement health and wellness programs for their employees and manage costs.

5. COST CONTAINMENT IS VITAL TO REFORM BECAUSE UNIVERSAL COVERAGE WILL BE INEFFECTIVE IF HEALTH COVERAGE IS NOT AFFORDABLE.

Rob Fowler, president of the Michigan Small Business Association who spoke at this event, indicated that the cost of health care coverage is one of the biggest concerns for businesses and can keep them from being competitive. The Michigan SBA has endorsed the Medicaid expansion in our state because it will expand the pool of dollars available for care and help reduce the burden on employers who have been helping to carry the cost of uncompensated care.

Massachusetts has moved cost containment to the top of their agenda and have implemented three different laws in the past four years to regulate how much hospitals and health plans can raise their rates. They are seeing a shift to employers offering more high deductible plans and health insurance companies offering tiered network plans. Hospital and physician providers are also working together with insurance plans to manage costs. And the state has implemented a $60M wellness fund to encourage healthy lifestyles and provide tax incentives to companies that use wellness programs.

Based on the lesson from Massachusetts, Michigan businesses have a strong role to play in shaping and influencing health reform policy in our state. Or in the words of Rob Fowler, "If you are not at the table, you're on the menu."

You can watch the entire event below. re:group sponsored the live streaming of the symposium:

Lessons on Health Care Reform from Massachusetts Business Leaders from re:group inc. on Vimeo.

Health Spending Accounts (HSAs) are the government’s way of helping us to pay for needed health care expenditures beyond what is covered by provincial health plans, they are similar to RRSPs.

But unlike RRSPs, most Canadians don't know how to use a HSA and are likely over-paying for their Health Care.

What is an HSA?

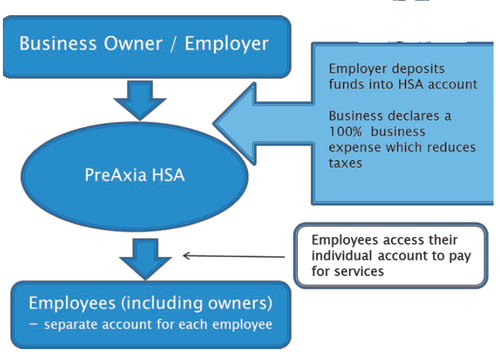

A HSA is a special bank account administered by a third party. Employers deposit funds into the account on behalf of their employees. Employees then have access to these funds for reimbursement of health care expenditures. These accounts are available to businesses of all sizes including self-employed individuals.

Similar to RRSPs, Health Spending Accounts are not taxable. These accounts must be used solely for reimbursement of health care expenses. Individuals channelling their health care expenditures through an HSA can save thousands of dollars per year.

Comparing RRSPs with HSAs can be helpful. Both are tax reducing strategies. HSAs, however, offer more immediate benefits. HSAs result in tax savings at the time of expenditure without the future tax burden that comes with an RRSP. In addition, HSAs do not require that funds be set aside for an indefinite period of time. The purpose of an HSA is to help pay for near term health related expenditures.

HSA and RRSP Comparisons

|

Health Spending Accounts (HSAs) vs. Registered Retirement Savings Plans (RRSPs) Top Reasons to Consider a HSA First

|

RRSPS were introduced in 1957 as a way to encourage Canadians to save for retirement.

It wasn’t until 1991, more than thirty years later, when their use became more widespread as a result of legislative changes.

Similarly, HSAs were created in 1986 when Finance Minister Paul Martin introduced a new way for businesses to offer health benefits to their employees.

Until recently the use of HSAs has been limited to those larger companies that have the expertise to understand and properly administer these plans.

25 years later the technology simplified HSA education and administration to the level that it is now a practical consideration for a wider group of businesses and individuals.

Whereas RRSPs are a tax deferral strategy (that is, taxes are paid on funds at a much later date) HSAs are a tax free benefit.

When investing in an RRSP, one must have excess funds to set aside until retirement at which time these funds are accessible and taxable.

On the other hand, an HSA provides a current benefit with no future taxation. It requires a little advance planning to channel funds normally spent on health related expenses during a calendar year through a Health Spending Account. This reduces taxable income, and taxes paid, for the current year.

While an RRSP remains important for retirement planning purposes, a Health Spending Account warrants consideration by any self-employed individual in Canada.

Furthermore, employers should consider HSAs as part of their employee benefits package. HSAs provide employees with a non-taxable benefit and complete discretion on use of funds while providing the employer with a greater ability to control corporate expenditures on health benefits.

A Simple Example of Overpayment - Losing $5,000/year.

|

Health Spending Accounts (HSAs) vs. Private Health Care Insurance Top Reasons to Consider a HSA First

|

Consider the hypothetical situation of Jerry. Jerry is self-employed (incorporated) and his family consists of a wife and two children.

His parents are retired.

Jerry takes medication for high cholesterol and high blood pressure. He hurt his back a few years ago and requires the services of a chiropractor.

His wife requires thyroid medication.

Their combined out of pocket health expenses of $5,000 per year are for items and services not covered by their provincial health plan.

These items include dental expenses, prescription glasses and contact lenses for three of the four family members, medical lab fees plus other miscellaneous items.

Jerry’s parents are on a fixed income as are those of his wife.

Both sets of parents rely on Jerry and his wife to help out with their medical expenses which include various prescriptions, assistive devices and services that total about $11,000 per year.

Jerry has an Average Tax Rate of about 28%.

This brings Jerry’s out of pocket health care expenditures to about $16,000 per year.

As Jerry and his family age they anticipate that these expenses could increase by 25% or more in the next five years.

Despite having a relatively successful business, Jerry struggles to pay these health care expenses along with all the other costs of home ownership and family.

Jerry should set up a Health Spending Account to cover the above expenses for him and his family. He is currently over-paying almost $5,000 year because he isn't using an HSA.

A similar scenario plays out with larger companies that want to provide their employees with competitive health benefits. A Health Spending Account offers additional benefits to these businesses. It is a tax deductible business expense. It is also a controllable expense in that only the employer can decide to change the value of this benefit.

There is no requirement that the amount of benefit be increased on an annual basis nor does the value of this benefit impact on the services available to the employee. By providing these funds monthly, rather than annually, the employer is better able to control costs by discontinuing payments for those who leave the company.

Who Else Can Benefit?

|

Health Spending Accounts (HSAs) Who Benefits the Most?

|

For employees, a Health Spending Account is a non-taxable company benefit. That is, amounts deposited into the account by their employer are not taxable to the employee.

Furthermore, the employee has complete discretion as to how the funds are used.

There are no limits on how much money can be spent on specific services. The only limitation is the amount of money available in the account.

This is different than the traditional insurance based approach where limits may be imposed on the amount covered for some services. The employee makes all decisions as to how these funds are utilized.

How Prexia's Technlogy Can Help You Right Now

Technology plays an important role in the growth of Health Spending Accounts. Similar to how the Internet has transformed how we manage our banking, HSAs can now be managed through your personal computer. Funds can be deposited directly to your HSA account via credit card or from your bank account. Claims can be filed online with receipts submitted electronically. And there is a variety of reports providing access to claims and payments history, deposits, balances and more.

Over the past 20+ years Canada has put in place the infrastructure and tax incentives to support its model for health insurance coverage. With utilization of the Internet to provide education, control and administration tools for Health Spending Accounts, Canada is in a position to deal with the pending cost containment of health care expenditures. This is partially done by utilizing the Internet to help reduce administrative costs that have become a part of the management of services that Canadians utilize for covering their individual health care needs.

Perry Shoom is Vice President of Marketing for PreAxia Health Care Payment Systems, Inc. He can be reached via e-mail at [email protected]. For more information on Health Spending Accounts, visit www.PreAxia.com/HSAforBusiness.

Interest in Health Spending Accounts (HSAs) is growing for some fundamental and basic reasons. Today's reality is that governments in Canada and the United States are working to balance their budgets by reducing expenses.

Another reality is that health care expenditures take up a significant portion of government budgets and must be reduced if governments are to be successful in their efforts.

While this funding for services is declining, demand for health care is not likely to subside.

In this second of two parts, we take a look at who is covered by HSAs and what services are covered.

Who is Covered by a HSA

When a HSA is set up for an employee or self-employed individual, it can cover allowable medical expenses for the individual and, at the individual’s discretion, their dependants. This includes a spouse or any member of a household related to the employee by blood relationship, marriage or adoption and who is financially dependent upon them within a given year. Dependants must also be a Canadian citizen residing within the country for a minimum of six months out of the year.

There are instances when a more comprehensive definition of dependant is required. For Health Spending Accounts, the complete definition of Dependant is provided in the Income Tax Act. This definition can be found at http://www.cra-arc.gc.ca/E/pub/tp/it513r/it513r-e.txt.

Dependants may include parents residing with children or in facilities such as a retirement home or nursing facility. The cost of these services can be reimbursed through a Health Spending Account.

Medical Expenses Covered by a Health Spending Account

There are three broad categories of medical expenses.

1. Medical Practitioners

Services provided by a licensed medical practitioner can be reimbursed through a HSA. Medical practitioner encompasses a wide range of individuals that work in the medical profession including but not limited to:

Doctor; Dentist; Optometrist; Osteopath; Chiropractor; Naturopath; Therapeutist (or therapist); Physiotherapist; Chiropodist (or podiatrist); Christian Science practitioner; Psychoanalyst; Psychologist; Speech-language pathologist or audiologist; Occupational therapist; Acupuncturist; Dietician; Dental hygienist

2. Medical Expenses

Medical expenses, as defined by Canada Revenue Agency, include a broader range of products and services than is typically covered through private insurers. In addition, there are no limits on how much can be spent on specific services. Following are just some of the products and services classified as medical expenses by Canada Revenue Agency:

Medications prescribed by a licensed medical practitioner; Payments to hospitals; Payments to associations such as The Arthritis Society, The Canadian Red Cross, and Victorian Order of Nurses which employ individuals that provide a variety of health services; Out of country medical services; Attendant Care; Institution/education/training for individuals with physical or medical impairment; Transportation and travel expenses for patient and accompanying individual; Artificial limbs, aids and other devices; Products required because of incontinence; Eyeglasses; Guide and hearing-ear dogs and other animals; Bone marrow or organ transplants; Renovations and alterations to a dwelling

3. Other

This complete list of services includes items such as training or education for the disabled, making a home accessible to those with physical disabilities and special equipment for individuals with breathing disorders such as asthma. A Health Spending Account can also be used to pay for many assistive aids such as a scooter or assistive devices for walking, standing, using a shower or toilet and more. For more information on allowable medical expenses, refer to CRA Publication IT519-r2 (http://www.cra-arc.gc.ca/E/pub/tp/it519r2-consolid/it519r2-consolid-e.html#P178_27514).

Learn more about Health Spending Accounts

PreAxia

PreAxia provides access to published articles and interviews about Health Spending Accounts. These can be accessed in the HSA Education Centre that can be found at www.PreAxia.com/HSA. A Frequently Asked Questions (FAQs) document on Health Spending accounts is available at the bottom of the HSA Education Centre.

Wikipedia

Wikipedia provides an excellent explanation of Health Spending Accounts and CRA Guidelines.

http://en.wikipedia.org/wiki/Health_and_welfare_trust

http://en.wikipedia.org/wiki/Private_health_services_plan

Canada Revenue Agency (CRA)

Following are bulletins and other publications by CRA pertaining to Health Spending Accounts.

IT-85R2 - Health and Welfare Trusts for Employees

http://www.cra-arc.gc.ca/E/pub/tp/it85r2/README.html

IT339R2 - Meaning of Private Health Services Plan

http://www.cra-arc.gc.ca/E/pub/tp/it339r2/README.html

IT529 Flexible Employee Benefit Programs

http://www.cra-arc.gc.ca/E/pub/tp/it529/README.html

The following CRA publications identify what are allowable medical expenses.

IT-519R2 (Consolidated) - Medical Expense and Disability Tax Credits and Attendant Care Expense Deduction

http://www.cra-arc.gc.ca/E/pub/tp/it519r2-consolid/it519r2-consolid-e.html#P178_27514

Which medical expenses are eligible?

http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/ncm-tx/rtrn/cmpltng/ddctns/lns300-350/330/llwbl-eng.html

There are many medical expenses which qualify for a Health Spending Account not identified in this document.

HSAs (Canada) as a Medical Benefit

Interest in Health Spending Accounts is growing for some fundamental and basic reasons. Today's reality is that governments in Canada and the United States are working to balance their budgets by reducing expenses.

Another reality is that health care expenditures take up a significant portion of government budgets and must be reduced if governments are to be successful in their efforts.

While this funding for services is declining, demand for health care is not likely to subside.

Who will pay for the services that are needed?

In this first of two parts, we explain the basics of Health Spending Accounts. Part two of this article details the services covered.

1. What is Health Spending Account?

Health Spending Accounts are the government's way of helping Canadians pay for their medical expenditures. (Similar devices are available in the US.)

A Health Spending Account is a special bank account administered by a third party. This account can replace or complement other employee benefits.

Employers deposit funds into the account on behalf of their employees. Employees have access to these funds for reimbursement of health care expenditures.

These accounts are available to businesses of all sizes including self-employed individuals where the employer and employee may be the same individual.

Health Spending Accounts are suitable for businesses of ALL sizes.

These accounts must be used solely for reimbursement of medical expenses. Individual business owners channelling their medical expenses through a HSA can save thousands of dollars per year.

2. How does the HSA work? Here is a simple picture.

3. How does the HSA save Money?

This is a bit tricky, but Canada Revenue Agency provides a tax benefit to employers and employees who utilize HSAs for reimbursement of medical expenses.

Insurance agents and health care advocates say many business owners and self employed remain unaware how to fund their health insurance properly

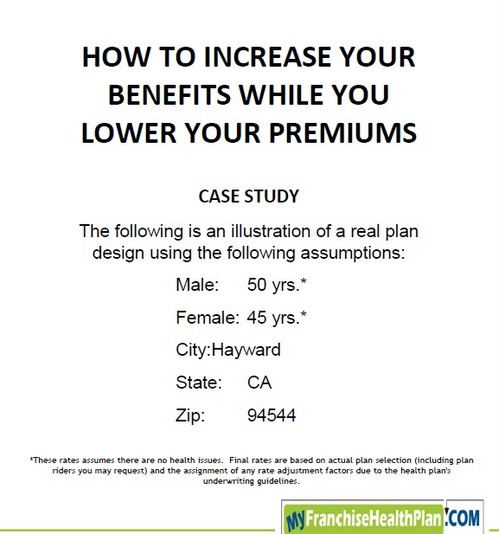

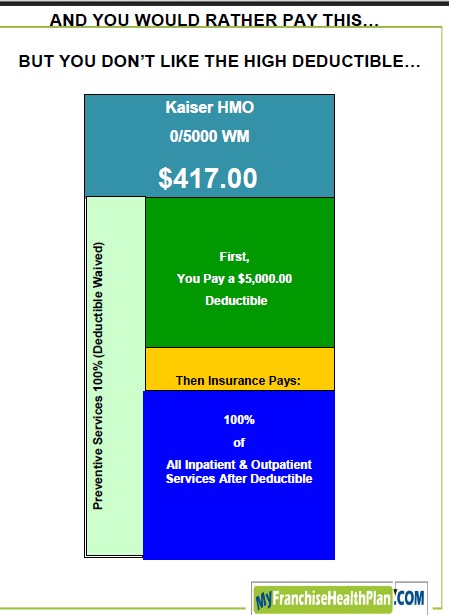

Consider this standard HMO plan, with a low deductible of $1000.00, but an unaffordable monthly rate of $795.00.

(Click on the image to enlarge it.)

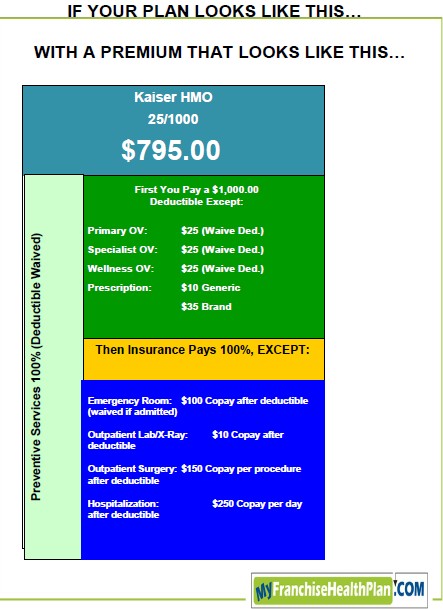

But $800 is just is too much to pay a month. What you really want is something like this, and cut your monthly payments in half.

Now, you have a monthly payment that you can afford of $400.00 but that high deductible may prove an even harder nut to crack.

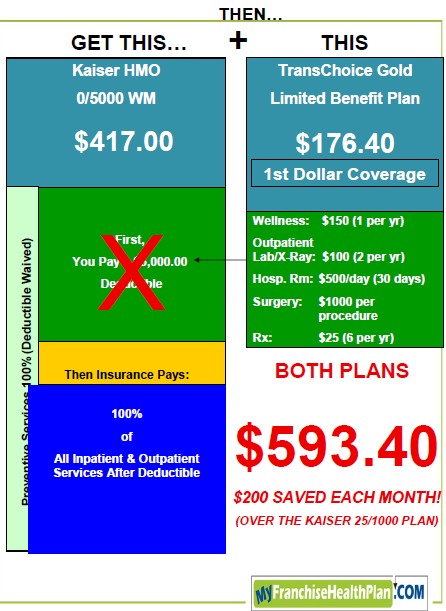

Is there a combination of plans which would lower the monthly payments, but not increase the deductible?

Yes.

The answer is that with some limited benefit plans you can bundle them to create a new HMO to create monthly rate, lower than $900, but higher than $400 and "not have to worry" about the high deductible.

For example, using the Trans Choice Gold limited benefit program, you can construct the following HMO.

(Click on image to enlarge it.)

By paying a small premium to the limited medical benefit program and bundling it with a major medical plan, you can fund most of the deductible with insurance dollars instead of your own dollars.

Assuming that all the other requirements are met, this plan would get the health care tax credit - where the limited benefits program by itself would not.

Great way to lower your monthly payments, increase your benefits, and access the health care tax credit.

(This is the second in a 7 part series about Health Insurance Myths, for the first Myth on Prescription Plans, click here.)

For years, individuals and families that couldn’t afford a standard Medical Insurance Plan had a ‘limited’ program available to them and were not considered ‘insurance’. These programs were generally sparse and covered only a handful of needs.

Today’s Limited Liability Medical Programs still do not meet the standards of ‘medical insurance’, but they are more robust and a great alternative to taking care of the basic medical needs that an individual or family may have in any given year.

These programs do not have an enrollment date, a participation requirement and are guaranteed issue. They are portable and generally offer first dollar reimbursements. These plans can be extremely affordable.

Individuals who are fortunate enough to be able to afford standard ‘health insurance’ or are able to acquire insurance through an employer’s benefit plan, may still consider looking into purchasing a Limited Liability Program and raising their current deductible in order to limit ‘out of pocket’ expenses. These can work very well with Health Savings Accounts.

There are also a number of very creative options that can come with these programs including a 24/7 telephone option to speak to a physician. This is great for traveling, midnight concerns and situations that are practically self-diagnosable. These programs also frequently come with some very basic eye and dental benefits.

Solution 2: To limit your your out of pocket expense consider managing them with a Drug Discount card which contains other savings.

To Print out Immediately your Free Prescription Drug Discount Card, Click Here Now. (Please limit yourself to (2) cards, thanks.)

- Myth 1 - My Insurance Plan provides me with the best pricing for prescription drugs.

Most Insurance Plans provide adequate coverage for prescription drugs, but many of them use a 90 day mail in orders for maintenance medications.

Some Plans have negotiated discount pricing with the Pharmacies, and they make their money, if they can convince you to participate in the mail order option.

Some Insurance Plans today still offer a ‘fixed’ co-pay amount for each prescription filled.

The co-pay could be $5, $10 $20 or higher. However not all pharmaceuticals cost what the co-pay amount is. If you are not careful, you could be paying a fixed cost of $15 for a prescription that only retails for $3.

If you have health insurance that provides for prescription drug coverage, chances are that the pharmacy or pharmacies you visit keep your information on file in a computer.

Solution 1: Check your prescription costs effortlessly.

Acquire a prescription ‘discount’ card and ask your pharmacist to keep that information on file as well. When you go to fill a prescription, simply ask the pharmacist to check the cost against both programs and go with the least expensive option.

It costs you little or nothing to have multiple options for the pricing of your medications.

To Print out Immediately your Free Prescription Drug Discount Card, Click Here Now. (Please limit yourself to (2) cards, thanks.)

Image by Getty Images via @daylife

Last fall, author Michael Pollan wrote an op-ed in the New York Times offering a simple defense of the not-yet-passed healthcare reform proposal: It would push the health insurance industry to take more interest in America's obesity problem and use its influence to reshape agricultural and food policy, he argued.

Pollan is best known for writing The Ominovore's Dilemma, and played a large role in kick starting the growing "food consciousness" in America. What began as a few scattered academic arguments about obesity and agribusiness has now morphed into a movement, with reality television shows about eating fruits and vegetables and a campaign by First Lady Michelle Obama to reverse childhood obesity, in part by offering healthier food choices in schools.

And Pollan thinks insurers can be a champion for that movement. Although health insurers have long been aware of the burden of obesity and its connection to chronic diseases, until now they have had strategies for keeping certain high-risk patients out of their pool of customers. But because insurance companies can no longer exclude patients because of pre-existing conditions or other health indicators, preventing chronic disease is now a top business priority.

"A patient with Type 2 diabetes incurs additional healthcare costs of more than $6,600 a year; over a lifetime, that can come to more than $400,000. Insurers will quickly figure out that every case of Type 2 diabetes they can prevent adds $400,000 to their bottom line. Suddenly, every can of soda or Happy Meal or chicken nugget on a school lunch menu will look like a threat to future profits," Pollan wrote.

The argument is a little simplistic, and it isn't as if insurers aren't well aware of the costs associated with obesity. But he has a point. Maybe it's time for insurers to get more involved in preventing obesity at the national level.

What if the insurance industry threw its full weight behind a tax on soda and sugary drinks? Or lobbied for agricultural policy that brought down the cost of fruits and vegetables? Individual payers could even significantly increase their reimbursements for wellness and weight loss services, and hopefully see a return on that investment in a healthier America.

Savvy insurers are already taking innovative steps to incentivize weight loss and focus on prevention. But a recent study in the American Journal of Public Health suggests some may not yet be seeing the bigger picture. Companies providing health and life insurance own roughly $1.9 billion worth of stock in the fast-food industry, according to the study.

Granted, this was probably a drop in the bucket relative to their overall portfolios. But any individual or institution interested in improving Americans' health should think twice before investing in an industry that provides the cheap, unhealthy food that helps fuel the obesity epidemic.

The campaign by Mrs. Obama to reverse childhood obesity provides a perfect jumping in point. Partnering with the White House on this initiative could not only improve the health status of the industry's future customers, but it could also help repair its tarnished public image.

And ultimately, reversing these 30-year trends will not only be good for the nation. It will be essential to insurers' bottom lines, as well.

Image via Wikipedia

We have long advocated for members of Congress to work together in a bipartisan fashion to develop an affordable and responsible means of achieving the needed reforms to our nation's health care delivery system, and unfortunately this was not the case."

These are ominous words, but there is still an opportunity for you to effect change that will improve our health care system. So, as we approach our mid-term election cycle, it is incumbent on every individual and business owner to make your voices heard on this issue when you go to your ballot box to vote.

So the law is here to stay. However, that doesn't mean the law won't be changed. Legislation is like a blueprint, in this case defining the outline of health care reform. But it is the regulators, judges, businesses and civilians interpreting, implementing and simply trying to figure out how things are supposed to work that make the law real. That process has only just begun. For example, one of the few elements of the law that takes effect in 2010 concerns the tax credits available to some small businesses to offset the cost of health insurance premiums they provide their workers. The IRS has begun providing guidelines on how this tax credit will work.

Another example: The Department of Health and Human Services has clarified an ambiguity in the law as to whether carriers must accept children for coverage regardless of any preexisting conditions. HHS has decided children under 19 years of age are eligible for guarantee issue and carriers have agreed to go along with this interpretation.

There are a lot of guidelines, clarifications and new regulations still to come. But here's the good news: like those mentioned above, they will be coming well in advance of the effective date of the health care reform package's various provisions.

All of this means now is not the time to panic. Instead, now is the time to take stock of your business practices and determine which ones foster readiness - and which don't. Now is the time to ignore the blathering of so-called news organizations that are more interested in whipping up partisan passion than informing the public (yes, I'm looking at you Fox and MSNBC). Instead, plug into the vast support network out there, starting with your insurance professionals who are ready, willing and able to help you understand not just the letter of the new health care reform law, but how it is being brought to life.

Image via Wikipedia

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=81391880-6498-4fcd-ba9f-76d1ca408cbf)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=e0cd0af5-bfdd-474d-9415-4f197353a40e)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=77b6a2d9-cafa-4659-9350-c93560759859)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=61b132fc-fb07-4120-831a-78318c2a3ac5)