Blog: http://thehealthcaremind.com/

Twitter: @healthcaremind

"Employers provide the majority of health insurance benefits in this country. They must have a seat at the health reform policy table."

These were the first words of advice for Michigan business owners from Rick Lord, President of Associated Industries of Massachusetts (AIM) and Michael Widmer, President of the Massachusetts Taxpayers Foundation. They represented two of the four employer organizations that worked with their state legislature to help pass universal health care coverage in 2006 for the state's 6.5 million residents.

These business leaders believe that having businesses involved in health reform policy in Massachusetts has resulted in a balanced and sustainable approach to health reform and with a much better outcome than if they had not been involved.

Here are some of their insights and words of advice on how Michigan business leaders can play a role in shaping health reform policy in our state.

1. BUSINESS LEADERS MUST SHARE A COMMON GOAL.

The Massachusetts businesses believed universal coverage was needed because they were going to pay for the uninsured one way or another, through uncompensated care assessments, cost shifting, high premiums or a less healthy workforce. The road to balanced policy was not easy, but a common goal and purpose allowed them to work through their obstacles.

2. COLLABORATION AND COMPROMISE ARE KEY TO POLICY REFORM.

Along the way, a number of proposals emerged that the business community opposed, but their representatives stayed at the table to work through the issues. For example, business leaders were able to develop a compromise over a proposed payroll tax by requiring a minimum level of employee coverage or else pay an annual employee assessment of up to $295 to help fund uncompensated care. The principle behind the compromise was that all employers should share equal responsibility for the costs of health care provided to uninsured residents.

3. THE INDIVIDUAL MANDATE DID NOT UNDERMINE EMPLOYER-SPONSORED HEALTH COVERAGE.

Despite some predictions that employers would send more of their employees to the state's insurance exchange, more agreed to offer coverage because they realized that, to remain competitive, they needed to offer health benefits. The process of working together on reform policy also helped them realize the program would work best with the shared support of businesses, individuals and the government.

4. THE BUSINESS COMMUNITY HAS AN IMPORTANT ROLE TO PLAY IN INFORMING AND EDUCATING EMPLOYERS AND THE GENERAL PUBLIC ABOUT THE BENEFITS AND REQUIREMENTS OF HEALTH CARE REFORM.

One of the results of universal coverage was to help businesses become better purchasers of health care coverage. AIM sponsored workshops, webinars and developed a guidebook to educate the employers and employees in their organization about the law's policies and regulations. Businesses were also featured that found innovative ways to improve the quality of care, implement health and wellness programs for their employees and manage costs.

5. COST CONTAINMENT IS VITAL TO REFORM BECAUSE UNIVERSAL COVERAGE WILL BE INEFFECTIVE IF HEALTH COVERAGE IS NOT AFFORDABLE.

Rob Fowler, president of the Michigan Small Business Association who spoke at this event, indicated that the cost of health care coverage is one of the biggest concerns for businesses and can keep them from being competitive. The Michigan SBA has endorsed the Medicaid expansion in our state because it will expand the pool of dollars available for care and help reduce the burden on employers who have been helping to carry the cost of uncompensated care.

Massachusetts has moved cost containment to the top of their agenda and have implemented three different laws in the past four years to regulate how much hospitals and health plans can raise their rates. They are seeing a shift to employers offering more high deductible plans and health insurance companies offering tiered network plans. Hospital and physician providers are also working together with insurance plans to manage costs. And the state has implemented a $60M wellness fund to encourage healthy lifestyles and provide tax incentives to companies that use wellness programs.

Based on the lesson from Massachusetts, Michigan businesses have a strong role to play in shaping and influencing health reform policy in our state. Or in the words of Rob Fowler, "If you are not at the table, you're on the menu."

You can watch the entire event below. re:group sponsored the live streaming of the symposium:

Lessons on Health Care Reform from Massachusetts Business Leaders from re:group inc. on Vimeo.

Health Spending Accounts (HSAs) are the government’s way of helping us to pay for needed health care expenditures beyond what is covered by provincial health plans, they are similar to RRSPs.

But unlike RRSPs, most Canadians don't know how to use a HSA and are likely over-paying for their Health Care.

What is an HSA?

A HSA is a special bank account administered by a third party. Employers deposit funds into the account on behalf of their employees. Employees then have access to these funds for reimbursement of health care expenditures. These accounts are available to businesses of all sizes including self-employed individuals.

Similar to RRSPs, Health Spending Accounts are not taxable. These accounts must be used solely for reimbursement of health care expenses. Individuals channelling their health care expenditures through an HSA can save thousands of dollars per year.

Comparing RRSPs with HSAs can be helpful. Both are tax reducing strategies. HSAs, however, offer more immediate benefits. HSAs result in tax savings at the time of expenditure without the future tax burden that comes with an RRSP. In addition, HSAs do not require that funds be set aside for an indefinite period of time. The purpose of an HSA is to help pay for near term health related expenditures.

HSA and RRSP Comparisons

|

Health Spending Accounts (HSAs) vs. Registered Retirement Savings Plans (RRSPs) Top Reasons to Consider a HSA First

|

RRSPS were introduced in 1957 as a way to encourage Canadians to save for retirement.

It wasn’t until 1991, more than thirty years later, when their use became more widespread as a result of legislative changes.

Similarly, HSAs were created in 1986 when Finance Minister Paul Martin introduced a new way for businesses to offer health benefits to their employees.

Until recently the use of HSAs has been limited to those larger companies that have the expertise to understand and properly administer these plans.

25 years later the technology simplified HSA education and administration to the level that it is now a practical consideration for a wider group of businesses and individuals.

Whereas RRSPs are a tax deferral strategy (that is, taxes are paid on funds at a much later date) HSAs are a tax free benefit.

When investing in an RRSP, one must have excess funds to set aside until retirement at which time these funds are accessible and taxable.

On the other hand, an HSA provides a current benefit with no future taxation. It requires a little advance planning to channel funds normally spent on health related expenses during a calendar year through a Health Spending Account. This reduces taxable income, and taxes paid, for the current year.

While an RRSP remains important for retirement planning purposes, a Health Spending Account warrants consideration by any self-employed individual in Canada.

Furthermore, employers should consider HSAs as part of their employee benefits package. HSAs provide employees with a non-taxable benefit and complete discretion on use of funds while providing the employer with a greater ability to control corporate expenditures on health benefits.

A Simple Example of Overpayment - Losing $5,000/year.

|

Health Spending Accounts (HSAs) vs. Private Health Care Insurance Top Reasons to Consider a HSA First

|

Consider the hypothetical situation of Jerry. Jerry is self-employed (incorporated) and his family consists of a wife and two children.

His parents are retired.

Jerry takes medication for high cholesterol and high blood pressure. He hurt his back a few years ago and requires the services of a chiropractor.

His wife requires thyroid medication.

Their combined out of pocket health expenses of $5,000 per year are for items and services not covered by their provincial health plan.

These items include dental expenses, prescription glasses and contact lenses for three of the four family members, medical lab fees plus other miscellaneous items.

Jerry’s parents are on a fixed income as are those of his wife.

Both sets of parents rely on Jerry and his wife to help out with their medical expenses which include various prescriptions, assistive devices and services that total about $11,000 per year.

Jerry has an Average Tax Rate of about 28%.

This brings Jerry’s out of pocket health care expenditures to about $16,000 per year.

As Jerry and his family age they anticipate that these expenses could increase by 25% or more in the next five years.

Despite having a relatively successful business, Jerry struggles to pay these health care expenses along with all the other costs of home ownership and family.

Jerry should set up a Health Spending Account to cover the above expenses for him and his family. He is currently over-paying almost $5,000 year because he isn't using an HSA.

A similar scenario plays out with larger companies that want to provide their employees with competitive health benefits. A Health Spending Account offers additional benefits to these businesses. It is a tax deductible business expense. It is also a controllable expense in that only the employer can decide to change the value of this benefit.

There is no requirement that the amount of benefit be increased on an annual basis nor does the value of this benefit impact on the services available to the employee. By providing these funds monthly, rather than annually, the employer is better able to control costs by discontinuing payments for those who leave the company.

Who Else Can Benefit?

|

Health Spending Accounts (HSAs) Who Benefits the Most?

|

For employees, a Health Spending Account is a non-taxable company benefit. That is, amounts deposited into the account by their employer are not taxable to the employee.

Furthermore, the employee has complete discretion as to how the funds are used.

There are no limits on how much money can be spent on specific services. The only limitation is the amount of money available in the account.

This is different than the traditional insurance based approach where limits may be imposed on the amount covered for some services. The employee makes all decisions as to how these funds are utilized.

How Prexia's Technlogy Can Help You Right Now

Technology plays an important role in the growth of Health Spending Accounts. Similar to how the Internet has transformed how we manage our banking, HSAs can now be managed through your personal computer. Funds can be deposited directly to your HSA account via credit card or from your bank account. Claims can be filed online with receipts submitted electronically. And there is a variety of reports providing access to claims and payments history, deposits, balances and more.

Over the past 20+ years Canada has put in place the infrastructure and tax incentives to support its model for health insurance coverage. With utilization of the Internet to provide education, control and administration tools for Health Spending Accounts, Canada is in a position to deal with the pending cost containment of health care expenditures. This is partially done by utilizing the Internet to help reduce administrative costs that have become a part of the management of services that Canadians utilize for covering their individual health care needs.

Perry Shoom is Vice President of Marketing for PreAxia Health Care Payment Systems, Inc. He can be reached via e-mail at [email protected]. For more information on Health Spending Accounts, visit www.PreAxia.com/HSAforBusiness.

Interest in Health Spending Accounts is growing for some fundamental and basic reasons. Today's reality is that governments in Canada and the United States are working to balance their budgets by reducing expenses.

Another reality is that health care expenditures take up a significant portion of government budgets and must be reduced if governments are to be successful in their efforts.

While this funding for services is declining, demand for health care is not likely to subside.

Who will pay for the services that are needed?

In this first of two parts, we explain the basics of Health Spending Accounts. Part two of this article details the services covered.

1. What is Health Spending Account?

Health Spending Accounts are the government's way of helping Canadians pay for their medical expenditures. (Similar devices are available in the US.)

A Health Spending Account is a special bank account administered by a third party. This account can replace or complement other employee benefits.

Employers deposit funds into the account on behalf of their employees. Employees have access to these funds for reimbursement of health care expenditures.

These accounts are available to businesses of all sizes including self-employed individuals where the employer and employee may be the same individual.

Health Spending Accounts are suitable for businesses of ALL sizes.

These accounts must be used solely for reimbursement of medical expenses. Individual business owners channelling their medical expenses through a HSA can save thousands of dollars per year.

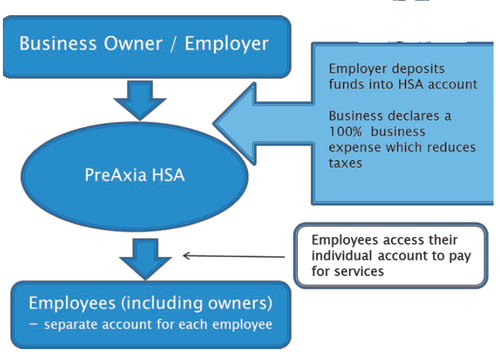

2. How does the HSA work? Here is a simple picture.

3. How does the HSA save Money?

This is a bit tricky, but Canada Revenue Agency provides a tax benefit to employers and employees who utilize HSAs for reimbursement of medical expenses.

Insurance agents and health care advocates say many business owners and self employed remain unaware how to fund their health insurance properly

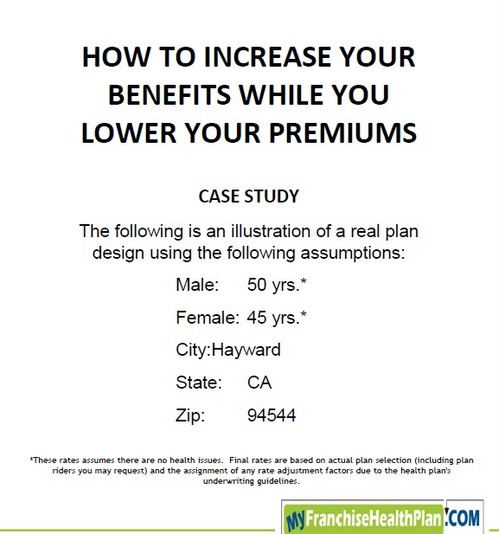

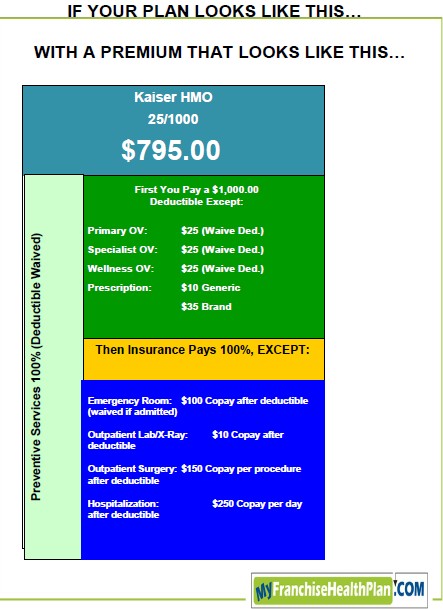

Consider this standard HMO plan, with a low deductible of $1000.00, but an unaffordable monthly rate of $795.00.

(Click on the image to enlarge it.)

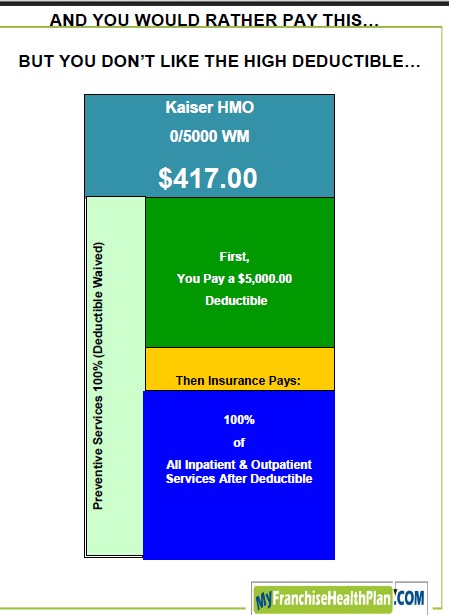

But $800 is just is too much to pay a month. What you really want is something like this, and cut your monthly payments in half.

Now, you have a monthly payment that you can afford of $400.00 but that high deductible may prove an even harder nut to crack.

Is there a combination of plans which would lower the monthly payments, but not increase the deductible?

Yes.

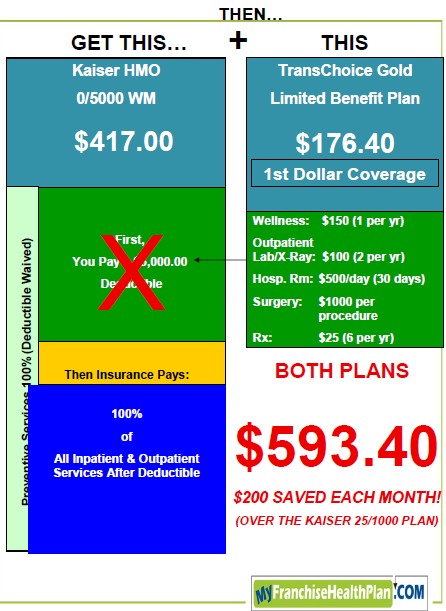

The answer is that with some limited benefit plans you can bundle them to create a new HMO to create monthly rate, lower than $900, but higher than $400 and "not have to worry" about the high deductible.

For example, using the Trans Choice Gold limited benefit program, you can construct the following HMO.

(Click on image to enlarge it.)

By paying a small premium to the limited medical benefit program and bundling it with a major medical plan, you can fund most of the deductible with insurance dollars instead of your own dollars.

Assuming that all the other requirements are met, this plan would get the health care tax credit - where the limited benefits program by itself would not.

Great way to lower your monthly payments, increase your benefits, and access the health care tax credit.

(This is the second in a 7 part series about Health Insurance Myths, for the first Myth on Prescription Plans, click here.)

For years, individuals and families that couldn’t afford a standard Medical Insurance Plan had a ‘limited’ program available to them and were not considered ‘insurance’. These programs were generally sparse and covered only a handful of needs.

Today’s Limited Liability Medical Programs still do not meet the standards of ‘medical insurance’, but they are more robust and a great alternative to taking care of the basic medical needs that an individual or family may have in any given year.

These programs do not have an enrollment date, a participation requirement and are guaranteed issue. They are portable and generally offer first dollar reimbursements. These plans can be extremely affordable.

Individuals who are fortunate enough to be able to afford standard ‘health insurance’ or are able to acquire insurance through an employer’s benefit plan, may still consider looking into purchasing a Limited Liability Program and raising their current deductible in order to limit ‘out of pocket’ expenses. These can work very well with Health Savings Accounts.

There are also a number of very creative options that can come with these programs including a 24/7 telephone option to speak to a physician. This is great for traveling, midnight concerns and situations that are practically self-diagnosable. These programs also frequently come with some very basic eye and dental benefits.

Solution 2: To limit your your out of pocket expense consider managing them with a Drug Discount card which contains other savings.

To Print out Immediately your Free Prescription Drug Discount Card, Click Here Now. (Please limit yourself to (2) cards, thanks.)

- Myth 1 - My Insurance Plan provides me with the best pricing for prescription drugs.

Most Insurance Plans provide adequate coverage for prescription drugs, but many of them use a 90 day mail in orders for maintenance medications.

Some Plans have negotiated discount pricing with the Pharmacies, and they make their money, if they can convince you to participate in the mail order option.

Some Insurance Plans today still offer a ‘fixed’ co-pay amount for each prescription filled.

The co-pay could be $5, $10 $20 or higher. However not all pharmaceuticals cost what the co-pay amount is. If you are not careful, you could be paying a fixed cost of $15 for a prescription that only retails for $3.

If you have health insurance that provides for prescription drug coverage, chances are that the pharmacy or pharmacies you visit keep your information on file in a computer.

Solution 1: Check your prescription costs effortlessly.

Acquire a prescription ‘discount’ card and ask your pharmacist to keep that information on file as well. When you go to fill a prescription, simply ask the pharmacist to check the cost against both programs and go with the least expensive option.

It costs you little or nothing to have multiple options for the pricing of your medications.

To Print out Immediately your Free Prescription Drug Discount Card, Click Here Now. (Please limit yourself to (2) cards, thanks.)