Recently in Site Selection Category

Location brings information together

Although the success of Culver's stems a great deal from the delicious food it serves, the company also relies on Esri ArcGIS Business Analyst software and data to ensure the locations its new franchisees are selecting will be successful. Using Business Analyst, new sites can be easily compared and contrasted by analyzing the demographics of existing restaurants, then pinpointing new areas that are similar.

Owners of successful franchises, like Culvers, have relied on GIS technology to discern markets for many years. The software provides tools that help organize information by using location as the common identifier for data. By understanding where franchises, the competition, and customers are located, franchisors can make informed decisions, improve communication, and share their knowledge with others.

"We chose Esri because they have the best information available for what we need to know," says Dave O'Brien, real estate manager at Culver's. "Using ArcGIS Business Analyst, we are able to easily compare and contrast new sites by analyzing the demographics of our existing restaurants and then pinpointing new areas that are similar."

O'Brien uses a combination of software for an in-depth view of the market at analysts' desks as well as a providing an easy way for anyone in the company to incorporate the information they find into the tools they need to do business. ArcGIS Business Analyst, including the segmentation module, provides in-depth customer analytics.

The Business Analyst Segmentation Module provides block group level geography, consumer survey data from Mediamark Reaserch Inc. and an intuitive interface so the analysts can accurately estimate demand and market potential for potential new franchisees.

Business Analyst Online is used for creating boardroom-quality maps and easy-to-understand reports that are used by the franchise partners. "We are a family company, and this is apparent in all our daily efforts," stresses O'Brien. "We want our franchise partners to succeed. Without them-the local owners and operators in their own communities and hometowns-we would not exist."

Selecting the Choice Sites

Even with an extensive menu, every food item at Culver's is made fresh to order throughout the day.

With almost 500 restaurants that stretch from Wisconsin's heartland east to South Carolina into Texas and west to Utah, existing franchise partners and franchise candidates are continually looking at possible new sites.

"The best way to determine a good site versus a bad site-besides understanding its access to guests, how to place signage, how good visibility is, and the location's prominence in a particular market-is almost certainly going to be a comparable store analysis," says O'Brien.

Whether by existing franchise partners or new franchise candidates, new sites are always being scrutinized for potential. "Working with franchisees requires a lot of time; we're either on the phone discussing locations or viewing prospective sites in person," explains O'Brien.

He goes on to add that ArcGIS Business Analyst helps everyone focus on trade areas that are more appealing before going out to visit prospective restaurant locations, helping to decrease the time it takes to narrow down choices.

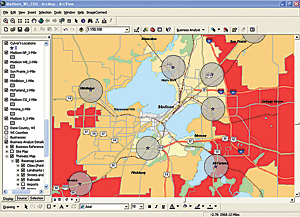

Culver's analysts define areas being serviced by existing restaurants by creating locations on a map of their restaurants and using tools within ArcGIS Business Analyst to delineate market area boundaries around sets of customers. Next, Culver's uses the ArcGIS Business Analyst Segmentation Module to mine valuable customer profiling information.

The Segmentation Module consists of Esri's Community Tapestry data extension, which classifies U.S. neighborhoods into 65 segments based on their socioeconomic and demographic composition. Operating on the theory that people with similar tastes, lifestyles, and behaviors seek others with the same tastes-"like seeks like"-these behaviors can be measured and predicted.

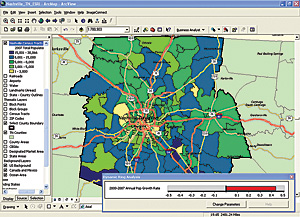

The ArcGIS Analyst Segmentation Module has intuitive wizards that guide the analyst to answer questions about customers such as, Where are other neighborhoods that look like neighborhoods we are currently in that tend to have higher sales volumes? What do they buy? How can I reach them? and Where can I find more like them?

Using these spatial analysis tools, Culver's is able to segment the demographics of a restaurant location and find new areas that have similar attributes.

ArcGIS Business Analyst allows Culver's to define areas being serviced by existing restaurants. The software extension does this by creating locations on a map of the restaurants and defining market area boundaries around sets of customers, in this case one-mile rings.

To quickly share this information with corporate managers and new franchisees, the Culver's Real Estate and Franchise Development team uses Business Analyst Online. Business Analyst Online is a Web-based solution that applies GIS technology to extensive demographic, consumer spending, and business data to deliver on-demand analysis and presentation-ready reports and maps. Reports and maps are easy and convenient to use, with more than 50 templates readily available for the Culver's analysts to use for presentations to their board members and potential franchisees.

"We want to give our franchise partners the support they deserve," says O'Brien. "GIS technology gives them the ability to maximize their potential at Culver's."

Today, GIS is seen as a strategic business solution that helps businesses continue to grow. The company is expanding into the state of Florida, a new area for development. "GIS is a tool to help us make even better decisions as we continue to expand," says O'Brien. "GIS doesn't replace anything we have now, including people. Instead, the software has become a necessary tool that complements our existing business process."

The Culver's Culture

Intuitive wizards in ArcGIS Business Analyst make it easy to answer questions about market areas, in this case finding the census tracts with the highest population growth in order to decide where to open a new restaurant.

The first Culver's restaurant opened in 1984. Co-founders Craig Culver and his wife, Lea, oversee almost 500 restaurants in 20 states through Culver Franchising System, Inc. Culver's attributes the success of its franchise restaurants to the owner/operator concept and the understanding that their business, as much as they'd like to say is about the food - it's really about people.

Franchise partners and team members make sure everyone who comes to Culver's feels welcomed. This resonates even today each time a team member holds open a door, or checks in tableside to find out how the meal is.

Culver's guests order from a cashier or drive-through, but the restaurant goes a step further by bussing tables and bringing around fresh coffee refills. Culver's has won many accolades including recognition as one of 25 high-performing franchises in the country by the Wall Street Journal.

Franchise partners operate their restaurants full-time. Before they can open the door to a new restaurant, each franchisee must complete an intense 16-week training program where they learn, hands on, the business of operating a restaurant.

Founded in 1984 in Sauk City, Wisconsin, Culver's is a growing franchise. The fast casual restaurant specializes in frozen custard and hamburgers called the ButterBurger®.

Culver's is a growing fast casual restaurant that just opened it's 473rd location in December. The restaurant's founders Craig Culver and his wife Lea look for franchise partners willing to work side-by-side to create restaurants that ensure every guest leaves happy. Culver's works hard to help its franchise partners choose great locations to ensure they are successful.

Today, the Culver's oversee franchised restaurants in 20 states through Culver Franchising System, Inc.

First opened in 1984, Culver's specializes in Frozen Custard, a premium ice cream, and the ButterBurger, a juicy hamburger so named because of its lightly toasted and buttered bun. Without a holding pan in sight, the restaurant cooks everything to order, including making the namesake frozen custard, fresh on the premises throughout the day.

For the 5 Most Fascinating Stories in Franchising, a weekly report, click here & sign up.

A Good Franchise in a Poor Location will become a Poor Business!

One of the most effective strategies to conducting site selection is not by looking for the proverbial needle in a haystack, but instead, by using the process of elimination.

The number one reason for a franchisee's failure or poor performance is due to a poor location. A poor location ultimately results from poor site selection. How else can you explain that identical stores from the same chain or franchise system will vary as much as 200% in sales volumes? Of course you will need to factor in store size, marketing budgets, management and so on; however, these are all secondary to the importance of location, in my opinion.

Essentially, there are three types of franchise businesses: profitable, break-even and go-broke. A truly profitable franchise location will make money and the business will appreciate in value. A break-even franchise location will pay the owner a small salary and pay the rent but not much more. The go-broke location that comes to my mind lasted less than three months from opening to closing for one unfortunate tenant. Despite my warnings that this was a go-broke location, the business owners poured in $80,000 into their store setup and couldn't pay their rent by the second month of operation. Usually, a go-broke location will not only steal your capital but also put you into personal bankruptcy - after you have maxxed out your credit.

If you thought that franchise site selection was all about location - location - location, you're right ... intellectually. However, when first-time tenants with limited leasing experience are involved in the site selection process, good old common sense often goes out the window. Consider for a moment that site selection involves both science (with part research and part timing) and good intuition (part luck). Franchise tenants, typically, will mistakenly rely on either a landlord's real estate agent or their franchisor (without a dedicated in-house real estate team) to lead them through the process.

In my book, Negotiate Your Franchise Commercial Lease or Renewal, I have dedicated an entire chapter to site selection. Here are just a few relevant tips from the expert:

1) Allow enough time so that you're not making decisions under pressure. Typically, for a new franchise business, you should start the site selection process six months or more in advance of when you want to open. If you find a prime location, usually the landlord will hold it for you for a few months. However, if the process takes longer, you may need several months to finalize the Offer to Lease, review the formal lease documents and/or build out the store.

2) Don't let a realtor show you space all over town. Franchise tenants often fail to realize that realtors/agents/brokers typically work for landlords who pay them a commission on lease deals signed and closed. When one agent shows you another agent's listings, this will effectively create commission-splitting between the property's listing agent and the leasing agent. This will also undermine your negotiating power since the landlord's real estate agent will know how you feel about every location. A realtor may be very helpful in pointing out a location you were unaware of, but remember who they are working for. While their advice may be sincere, it may be sincerely wrong.

3) Make your leasing inquiry by calling the "For Lease" number on the property sign. This way, you will meet and negotiate with the listing agent directly. Tour prospective sites in order from worst to best based on curb appeal. This way, you will become more confident, ask better questions and be more in control of the leasing process.

4) Don't telegraph your intentions by giving buying signals. Ask the leasing representative to e-mail you preliminary information before you agree to view the space. When viewing, stifle the urge to think out loud; subtle comments to a partner/spouse and overheard by the leasing representative can work against you. If you're asked how much you have budgeted for rental payments, remain vague. Not every question asked deserves an answer - not yet, anyway.

If you find yourself weighing a better location at a higher rent versus a lesser location at a lower rent, my advice is to go for the first option. When consulting to franchise tenants and doing site selection, my job isn't to find the cheapest location, it is to select a site that will help the franchise tenant maximize his/her sales.

Also remember that landlords sometimes prefer to lease their worst space(s) first and save the best space(s) for last. Usually, the individual unit or location you lease within a shopping centre or strip mall is more important that the mall itself - or at least equally important. Know that lease rates within a building can vary by 200% depending on unit desirability, walk or drive-by traffic flow, space shape, quality of neighbouring tenants, anchor tenants and your operating status as an independent or a national chain name. While you don't always get what you pay for in leasing commercial space, you normally don't get more than you pay for either.

Note that if you already own a franchise business but are considering relocating when your current lease expires, start your site selection at least nine months ahead. If you cannot get a satisfactory lease renewal, you will need this time to select alternative sites and negotiate a new lease elsewhere.

Franchise tenants need to know there is a great deal more involved with the site selection process than just what is explained here ... these pointers are just a few tips of the iceberg.

For the 5 Most Fascinating Stories in Franchising, a weekly report, click here & sign up.

With the constantly evolving atmosphere of the business world, understanding the particular nuances of brick-and-mortar stores is imperative to establishing an image within consumer market any size.

This is where Geo-analytics (also known as location analytics) becomes an effective way to optimize a business' location. Geo-analytics equips businesses with the tools and knowledge to plant and grow effectively.

Before deciding to invest in a geo-analysis for a business, you may want to ask what makes geo-analytics so beneficial. To help understand how Geo-analytics could be a "game changer", here are a few important points:

- Information is key to building a new location for your business, and a geo-analysis of your immediate area allows you to see numerical and graphical representations of what you need to know.

- Geo-analysis supplies detailed information about spending patterns, consumer needs and wants, and other information about the demographics in your desired area.

- The shifting web-based consumer market can seem like a threat to many physical stores, but geo-analysis gives you a visual of how to create an environment to communicate with your locations demographics.

- With the knowledge about your specific location, you can make important and educated decisions about implementing a new business model.

Consumers seek businesses that seem to understand them and their needs, and having the proper information about the location in which you plan to build a business is key.

Whether you're building a franchise or starting up a business from scratch, knowing exactly what the community around you needs can give you an edge over your competition.

The post How Geo-analytics can Improve Your Business appeared first on Predict and Prevent Business Failure.

For the 5 Most Fascinating Stories in Franchising, a weekly report, click here & sign up.

Any manager or employee involved in outside sales knows the incredible joy of getting their territory right.

It is simply tremendous to walk in the door of a prospective customer and know that your referrals are good, there are 30 more customers waiting for you down the street, and you have all the territory information you need to make a good pitch, from approach to close.

The right territory mapping software puts your sales team in the right spot at the right time, so that these golden opportunities are maximized.

Headache Inducers

On the other hand, every outdoor salesperson has the experience under their belt of that one time they accidentally followed on the back of another team member from their company: territory gone wrong.

Customers hate it, and sales people leave the approach at best feeling like grinning idiots, at worse, they are chased off the premises by irate customers who feel cheated.

The problem is not your employees, your management or your customers!

The problem is your territory mapping system.

In many sales territories, you have to divide up territories in high-traffic, highly populated areas where little more than a street will divide one high-performing sales rep from another.

Headache Reduction in 4 Steps

- Real Time Updates - Whether you are trying to close out a sales territory for a deadline, make room for incoming sales reps, or just adjust your system for market changes, you have to change assigned territories. It is part of the job. The right territory mapping software will do this automatically, preventing the data loss from sleepy eyed sales reps having to scan a list of prospects for the day and make their own maps.

- Integrate Data - Your sales team needs information to contact your customers, your customers need information to see the value in what you are offering. With so much information available online via governmental and social media websites, good territory mapping software will automatically include relevant and current demographic data.

- Manage Long Term Territories - For businesses setting up franchises, or seeking to establish long-term sales reps, the ability to virtually experiment with your territories is absolutely a prerequisite for establishing a territory. You can start with protected territories, knowing that the area you chose was large enough for growth.

- Reduce Stress Through Sharing - Any outdoor sales rep knows the experience of snipping images from their sales software into a presentation or document and then trying to show that to a reticent prospect. Modern software systems reduce the need for cutting, copying and pasting. Simply share a link to the relevant data and your prospect can pull it up on their own phone/tablet/computer.

Although the business of communicating to prospects will always have interpersonal issues involved, ensure that your sales team has the least amount of headaches possible with the right territory mapping software.

The post 4 Ways a Good Territory Mapping Software Prevents Headaches appeared first on Predict and Prevent Business Failure.

For the 5 Most Fascinating Stories in Franchising, a weekly report, click here & sign up.

In Alabama, the Coca-Cola Company has just expanded the franchise territory of Coca-Cola Bottling Company United (CCBCU) to include seven new cities.

The new contract means the franchise area of CCBCU more than doubles in size.

It's almost certain, however, that the local CCBCU customers will probably see no change in their day-to-day operations, despite the exponential growth of the soft drink supplier.

Coca-Cola has long been known for their exceptional products and their even more outstanding customer service. It has built its reputation on ensuring the local beverage purveyors receive product on a timely basis, ready to sell, and easy to track. Their advertising over the years has indelibly connected their corporate face to "doing good" in local and global communities.

So how will CCBCU manage to maintain their relationships with existing customers while expanding into such an extensive territory? Presumably, technology will facilitate not just the transition, but provide the foundation for a smooth, painless shift to the (much) larger corporate footprint. Proprietary franchise management software will direct their next steps, based on analysis of their new territory data.

A franchise offers significant benefits as a small business. The products/services are already developed; the processes of start-up and launch have been streamlined, and the artwork, imagery and labeling development has already been proven effective. Managing the business effectively comes down to knowing the territory and the target customer base.

Smart franchise owners elect to leave the product maintenance to their franchisor, in order to focus on building a strong relationship with their territorial customer base. The success of those local customers is vital to the success of the franchise, so identifying, tracking and modifying the data within that franchise territory is integral to the business success.

This comprehension of the base market is almost certainly why Coca-Cola has remained at the top of the franchiser list for so long - they respect and maintain a strong connection and quick responsiveness to the business of their local customers.

Regardless of the size of a franchise territory, proprietary software can contribute to business strategy by collecting, analyzing and strategizing franchise territory data.

Gaining this information assures franchise owners that they are responding appropriately and productively to their local market, as well as building a strong future for themselves.

The post Tracking the Market Within Your Franchise Territory appeared first on Predict and Prevent Business Failure.

For the 5 Most Fascinating Stories in Franchising, a weekly report, click here & sign up.

Much of the modern economy focuses on data, information and social networking, but in retail, the age old adage "location, location, location" still fits. For retail technology, the goal of any advanced data, information or social networking is to find and engage the perfect market, and in a physical retail space your location defines your target market.

Why Location Still Matters

Many people interested in starting a franchise retail store are interested and invested in modern business systems, and want to know why the old adage is still applied to modern businesses. It is simple, a retail franchise must interact with customers, find them and bring them into a place where they can purchase products.

Although much is made of online retail (a very profitable business), the online retail space is not limited by location, so a small start-up is either going to be part and parcel of one of the billion dollar enterprises already in the retail space (Amazon, Ebay, Etsy) or trying to compete against them.

The great opportunity of a physical location is the fact that it is physical. When you are operating a store in a location, there is no one else in that space. Traffic is limited by your location, which means you have a custom-made niche already set up for your business, the moment you open your doors.

Demographics

The right retail technology gives you the ability to choose location based upon up-to date demographics through the use of heat mapping in territory creation. Understanding the demographics of the location where your business will locate is essential to remaining in business and creating profits. If the people passing your door are not interested or able to buy your product, or if they just aren't there at all, you will not have profit.

The most important decision for building your business is to have the right customers for the product you are selling, and good retail mapping technology gives you the tools to locate and choose your target demographic before ever setting up shop, increasing your chance to make profit because you have invested customers.

For the 5 Most Fascinating Stories in Franchising, a weekly report, click here & sign up.

In this video Candace Couture, director of franchise admissions at Planet Fitness, discusses her role in selling franchises and new franchise locations, and to approve new franchise locations for existing franchisees looking to open up new locations.

Planet Fitness has 536 locations currently; and is looking to open over 100 more this year. Right now they operate in 47 states right now. Candace has to tell whether or not an area is going to work demographically before a franchise location can be sold, so she uses the SCOUT software to run comprehensive demographic analysis, looking mainly at population in an area of 1-3-5 mile radius.

She also looks at highly Hispanic markets because they have worked very well for the company, so they look at race and ethnicity. Planet Fitness typically works well in a median level income market so they are making sure that the income levels aren't so high that the area wouldn't make sense.

SCOUT also interfaces with the Planet Fitness billing software which is very important because with the company's expansion across the country they are starting to go into markets and open up locations closer to each other so want to make sure they are not cannibalizing on each other.

And with the ability to interface with the Planet Fitness billing software, an employee can basically click on a star on the map of any location and populate the map with all Planet Fitness members so it's crucial for the company to have that data.

For the 5 Most Fascinating Stories in Franchising, a weekly report, click here & sign up.

Market share is your piece of the pie. It is important to investment banks, your partner, your sales team and your growth. But what is that pie and how do you calculate your slice?

Although market share is likely the single most important marketing metric, there is no generally accepted best method for calculating it.

There are however three common ways to measure it:

- Dollars or Revenue collected: The owner of Coffee & Tea, a boutique coffee shop, is located in central Manhattan where people spent $10 million dollars at cafe's last year. Coffee & Tea made $1 million dollars during that time. They have 10% market share. (1,000,000/10,000,000 = 0.10).

- Customers served: High-End Remodeling, Inc. has a trade area that covers 10 square miles around their office. They serve the well-to-do housing market. That area includes 100,000 housing units but only 10% are homes that are worth more than $1 million dollars. That means 10,000 housing units are potential customers to High-End Remodeling. The company currently does remodeling for 1,500 homes in that area giving them a 15% market share. (1,500/10,000 = 0.15)

- Volume or Unit sales: Westside Auto Dealership determines that there we're 50,000 cars sold last year in their market. Of those, Westside Auto sold 8,000 cars giving them a 16% market share. (8,000/50,000 = 0.16)

In the U.S. you can get data on the size of the entire pie by looking at the US Census FactFinder. Here you can find the dollars spent for your product or service, by geography, by year.

Depending on what data is available to you, use any, or all of these methods to determine your piece of the pie.

What other methods do you use to calculate your market share?

For the 5 Most Fascinating Stories in Franchising, a weekly report, click here & sign up.

People, such as investors, are especially interested in your business plan for growth, and your retail sales forecast is a big part of what they take into consideration.

It should show your projected monthly sales for the next year and by year for the next two-to-five years.

That doesn't mean you have to get your sales forecast perfect; it is always part past data, part common sense, part research, and part guessing.

These 3 tips will help point you in the right direction to having a reasonable sales forecast.

- Project unit sales. Whether you are selling a product or service, start by forecasting your unit sales per month. It is easier to forecast by breaking things down to component parts. For example, a product-oriented business will show number of units, such as packs of notepads or number of cars sold. Don't think this doesn't apply to you because you have a service-oriented business. You can still apply this principle by breaking your forecast down, such as how a lawyer bills by the hour. Remember to take peak buying seasons into consideration; an accountant may forecast an increase in billable hours every year at tax time, while a florist may see a rise in the sale of roses around Valentine's Day.

- Use past data. Recent sales data can be your best tool to forecasting the future. Statistical analysis, for example, will help you spot trends that you can apply to predict the future. Past data is also useful when forecasting sales of a new product. It is easier to make an educated guess on these sales when you can use an analysis of an existing product. Are you launching a new software product? Base your forecast on the sales of a similar software product.

- Project prices. After you developed your forecast that projected unit sales monthly for 12 months and then annually, you need to project your prices. This area is another where your research and analysis of past data will pay off. Use it to help you guess future pricing and any fluctuations you notice as a trend.

Forecasting your retail sales isn't as difficult as it first seems. If you have any questions or need help with your sales forecast, contact us.

For the 5 Most Fascinating Stories in Franchising, a weekly report, click here & sign up.

Microsoft has discontinued MapPoint starting this year, which was used as a territory mapping software.

This left many users with an urgent need to replace it.

However, the big question here is, what exactly does a business, like a franchise, need in a mapping package?

The Biggest Feature Needed Isn't A Map

The biggest features that I hear are needed in mapping software are: something they can use quickly, get decisions fast, have cloud ability to collaborate with other team members and ultimately to the franchisee. Microsoft taught us that creating something that only works on a PC no longer works.

Benefits of a Map

Selling Franchises

Of all the bells and whistles that Microsoft offered, the one that is most important is whatever allows the franchisee a means to make decisions faster for buying into what the franchisor is selling.

Saving Time

The main "pain point" from franchisors depends on what you're using mapping for. Such as this post relating to Microsoft going away is one big example. As many franchisors have told me, "Franchise territories are the most important things to our company." The feature for territory mapping needs to handle decades of old territories mixed with new territories and edits. In can be incredibly time-consuming for a retailer to manage all of this.

Few Extra Things Needed

Franchisees also have a need related to territory mapping. They want a starter package from mapping suppliers.

Not an expensive product and they definitely do not want a product that they need to purchase a full subscription to use the product.

They need minor demographics, simple site management and one or two territories. Low friction to usage is again a highly desirable feature...meaning "non-technical users".

Uploading a list is still important. Usually any locations of existing or proposed sites.

Routing for franchisors is also desired to generate sales leads.

Again, all for ultimately selling to a potential franchisee.

Lastly, sex appeal. It helps to make it shiny and new.

Summary of Top Desired Mapping Options From Franchisors

Features

- Quick to use, they don't need to spend all day on it.

- Easy to use so anyone in the company can use it.

- Collaborative with decision makers, perhaps even the franchisees themselves.

- Allows multiple users on the same plan.

- Demographics, of course, how detailed depends upon its use, but usually not very detailed.

- Sexy product that looks cutting edge.

Benefits

- Sell franchisees.

- Allow franchisees to have faith in the franchisors.

- Provide strong communication between the franchisor and franchisee.

- Builds trust between the franchisor and franchisee.

- Allow franchisees to expand and grow.

- Sexy product that is cutting edge helps to sell franchisees, shows one's being in touch with the times.

- Sell franchisees (so important I had to list it twice).

So to sell, sell, sell is the main benefit.

Save time, time, time is the second benefit.

The map is just the means to the end.

For the 5 Most Fascinating Stories in Franchising, a weekly report, click here & sign up.

Pet services have been the fastest growing product segment for the Pet Stores industry over the past five years.* Pet services include full service grooming, haircuts, baths, toenail trimming and tooth.

As the demand climbs and the need to fulfill customer demand grows, a feisty mobile pet grooming business, Aussie Pet Mobile Canada, who was voted #1 in Pet Services category by Entrepreneur Magazine in 2012, came looking for a territory answer.

Why they came to us?

They came to us looking for a better way to manage territories for their mobile franchisee's. They wanted to talk to a person who could listen and strive to fill the need they had. They were frustrated with the current solutions which required a dedicated computer running Microsoft.

What they needed?

1. They wanted to build territories for their franchisee's from any computer.

2. They wanted a way to share and collaborate this information with their franchisee's live.

3. They wanted to add their own list of data to visualize what was important.

4. They wanted something with flexible pricing options and they wanted it to be used for all their franchisee's.

(More information on what Franchisor's have recently been looking for can be found here; What Benefits and Features Franchisor's are looking for)

What we did for them?

We built them a system that is based in the cloud. A true software as a service option that can be run from anywhere and shared with anyone.

For collaborating, they can now have a franchisee watch live as both parties collaborate on the territory definition. They can give the franchisee edit rights and they can build what they think is a rough draft.

We gave them a "master" territory project that could prevent encroachment automatically. We gave them the ability to share each individual territory to its prospective owner.

For sharing, each project can be shared internally or externally with view/edit rights so they had control on who gets do do what.

Does it pay for itself?

A thousand times over in just time alone. The goal was to have a central repository of all their existing and potential territories, something that they can share instantly vs taking screen shots and emailing them.

This is a dynamic system so as time goes by, the franchisee can grow into more territories if needed and see what is available in the surrounding area and make decisions quicker.

It gives that sex appeal that you're using the latest cutting edge tools to your franchisee's. There are easier solutions, but these don't give the answers they needed, aren't collaborative, only run on PC's or roughly on the web, don't update with new data automatically and are overly complicated.

Is there something you need for a better territory solution?

For the 5 Most Fascinating Stories in Franchising, a weekly report, click here & sign up.

* SOURCE: WWW.IBISWORLD.COM/2014

Why is Defining Territories so Brutal?

Building territories is an undertaking that is part science, part art, and mostly psychology. It's typically a collaboration between two parties whose interests are not necessarily aligned to the same goal, but they have to meet in the middle. Defining territories is similar to signing a prenuptial agreement because it involves a lot of passion and stress, yet requires a delicate balance to place the right restrictions on the one you love. Both parties pursue their own interests, but ultimately they want the relationship to work out and last a long time.

Let's look at the issues around a franchisor-to-franchisee relationship.

The franchisor wants to create the smallest territory possible for the franchisee. If the territory is too large, the franchisor may lose lots of potential customers, lots of potential revenue, and open the doors to a competitor capitalizing on what the franchisee can't fulfill, especially when contracts can last a decade. If the franchisor makes the territory too small, they can pinch a franchisee's potential income, or worse, put them out of business. When a franchisee can't make a decent living it's bad PR, looks bad on the franchisor's books, and makes it harder to entice more potential franchisees to join the company.

The franchisee, on the other hand, usually wants the largest territory possible because they truly believe they can sell to and support a customer base of that size. If the franchisee gets too much, they may potentially take on too many customers and fail to take care of the ones they have. Or, the franchisee might have to pass on new customers leaving the market ripe for a competitor takeover. Failure by success, so to speak. If the franchisee gets too little, they may go broke and may need to extend their boundaries. The franchisee may be angry with the franchisor for misleading them or they might feel cheated. None of these situations are good.

Take these four steps to lessen the difficulties associated with defining territories.There are several key issues to consider when defining territories. We'll give a quick summary and go into more detail on each item in separate posts.

1. Understand the demographic and trade area needs of your business model.

Each business has a unique demographic profile for their existing customer base. Doing a simple exit survey can put a physical location to a customer as well as provide insights into customer characteristic (e.g., gender, age, race) without being intrusive in the process. Even an online business has great location data. Match this data to the demographics that the customers live in and search for correlations against sales. It sounds complicated, but it's easier than you think and highly beneficial for finding out who your customers really are. This step also serves up a huge bonus for defining your territory.

2. Determine the minimum performance requirements relevant to the business.

Based on pro-formas, gut feelings, analogous stores, each business has a minimum performance requirement that must be met.

3. Decide on what rights, if any, a franchisee has for marketing and providing services outside their territory.

This can include a temporary territory assignment agreement. It is especially useful for allowing a franchisee the ability to cover a new market while the franchisor brings on new franchisees to the area.

Keep the territory structure simple.

It is easy to slip and overcomplicate the territory structure, which may lead to confusion by both parties, lost prospects, or drawn out negotiations while competition blankets the market place.

Defining territories is brutal, but with a little forethought and planning, both parties can be transparent and negotiate their "prenuptial" agreement in a calm and loving manner.

What examples do you have about creating territories?

For the 5 Most Fascinating Stories in Franchising, a weekly report, click here & sign up.

Most franchise territories are created by some "defined" geography.

Most franchise territories are created by some "defined" geography such as a group of Zip codes, a ring dimension or a described area.

Since all political geographic boundaries are readily available including block groups, Zip codes, census tracts, counties, states, designated market areas, and Metropolitan Statistical Area-Core Based Statistical Area, these are mapped and viewed within a global information system (GIS) and are a great foundation for the beginning step in defining territories.

GIS tools allow the franchisor to draw or create the territory in digital format.

For some franchisors, this may be enough, having a digital database of existing territories. There may not be a need to understand the demographics of the area, just be able to see it on a map. This allows them to print a hard copy of the maps to include in the franchisee agreement, be able to identify potential overlap issues with new territories, and to map out potential future territories.

Counting the Customers

Some franchisees choose to enhance their mapping capabilities by including geo-demographics, both consumer and business related. Adding demographic data to the geography (block groups, counties, DMAs) dramatically enhances the ability to identify or "target" groups of desired customers. The franchisor may know that their targeted customer base is a household with a certain level of average income.

Using the mapping-demographics, every block group in the United States can be found and mapped that meets this criteria. The process of creating the franchisee boundary will now include a count of potential customers. Having these counts leads to the development of defendable, equitable territories.

For those who may not know their true customer profile, mapping tools can include geocoding (assign a latitude-longitude coordinate based upon an address) that places the customer on the map.

Once the customers are on the map, attaching their location with the corresponding demographics of their block group to create a customer demographic profile is easily accomplished. By mapping your best customers and developing a "target" profile, you can go find these targets anywhere in the United States and develop intelligent franchisee territory searches.

Some franchisors are business-to-business rather than consumer oriented.

The same process applies, but by using a different set of geo-demographic data. Business population counts are available by North American Industry Classification System/StandardIndustrial Classification codes by their address or summarized at any geographic level (block group, Zip, county). Either way, this data can be viewed as information on a map.

If a franchisor targets a specific business population, this targeted group can be mapped and territories developed based upon desired levels of business counts and potential.

Understanding and documenting the potential customer base of a franchisee territory will also benefit the franchisor by allowing them to effectively maximize the potential number of territories in a given market area.

The Goldilocks Problem

Franchisors wouldn't want to "give away" too much territory or on the other hand not provide an adequate customer base.

By understanding the demographic customer potential and using a defined minimum criterion for these customer levels, one can map the optimal number of territories per market assuring that each is sufficient with the potential customer base.

When you need help in creating territories for your franchise, please contact us at:

IntelleVue LLC 11102 East 75th Place Tulsa, OK 74133 Longitude: -95.853451 Latitude: 36.054777

Contact: Jeff Davis 918.250.5561 [email protected]

Pet services have been the fastest growing product segment for the Pet Stores industry over the past five years. Pet services include full service grooming, haircuts, baths, toenail trimming and tooth.

As the demand climbs and the need to fulfill customer demand grows, a feisty mobile pet grooming business, Aussie Pet Mobile Canada, who was voted #1 in Pet Services category by Entrepreneur Magazine in 2012, came looking for a territory answer.

Why they came to us?

They came to us looking for a better way to manage territories for their mobile franchisee's. They wanted to talk to a person who could listen and strive to fill the need they had. They were frustrated with the current solutions which required a dedicated computer running Microsoft.

What they needed?

They wanted to build territories for their franchise operators from any computer. They wanted a way to share and collaborate this information with their franchisee's live.

They wanted to add their own list of data to visualize what was important.

They wanted something with flexible pricing options and they wanted it to be used for all their franchisee's.

What we did for them?

We built them a system that is based in the cloud. A true software as a service option that can be run from anywhere and shared with anyone.

For collaborating, they can now have a franchisee watch live as both parties collaborate on the territory definition. They can give the franchisee edit rights and they can build what they think is a rough draft.

We gave them a "master" territory project that could prevent encroachment automatically. We gave them the ability to share each individual territory to its prospective owner.

For sharing, each project can be shared internally or externally with view/edit rights so they had control on who gets to do what.

Does it pay for itself?

A thousand times over in just time alone. The goal was to have a central repository of all their existing and potential territories, something that they can share instantly vs taking screen shots and emailing them.

This is a dynamic system so as time goes by, the franchisee can grow into more territories if needed and see what is available in the surrounding area and make decisions quicker.

It gives that sex appeal that you are using the latest cutting edge tools to your franchisee's. There are easier solutions, but these don't give the answers they needed, aren't collaborative, only run on PC's or roughly on the web, don't update with new data automatically and are overly complicated.

Is there something you need for a better territory solution?

Connect with me on LinkedIn, then. Let's talk about what you need.

For the 5 Most Fascinating Stories in Franchising, a weekly report, click here & sign up.

The biggest feature I hear from franchise owners about mapping is: something they can use quickly, get decisions fast and have it be on the cloud for collaboration with team members and ultimately to the franchisee.

The main benefit of all that is to allow the franchisee a means to make decisions faster to buy into what the franchisor is selling.

The main "pain point" from franchisor's, depends on what your using mapping for.

Many franchisor's have told me, "Franchise territories are the most important thing to our company". The feature for territory mapping has to handle decades of old territories mixed with new ones and edits. It can be incredibly time consuming for a retailer to manage all this.

Franchisee's also have a need related to this topic. They want a starter package from mapping suppliers. Not an expensive one and one they definitely don't want to buy a full subscription too. They need minor demographics, simple site management and one or two territories. Low friction to usage is again a highly desired feature...meaning "non-technical users".

Uploading a list is still important. Usually locations of existing sites or proposed.

Routing for frachisor's is also desired but more for sales gen leads. Again, all for ultimately selling to a potential franchisee.

Lastly 'sex' appeal. It helps to make it shiny and new.

Summary of top desired mapping options from Franchisor's:

Features:

* Quick to use, they don't need to spend all day on it.

* Easy to use, so anyone in the company can use it.

* Collaborative with decisions makers, perhaps franchisee's themselves.

* Allow multiple users on the same plan

* Demographics of course, how detailed is dependent on its use, but usually not much

* Sexy product that looks cutting edge

Benefits:

* Sell franchisee's

* Allow franchisee's to have faith in the franchisor.

* Strong communication between franchisor and franchisee

* Build trust between franchisor and franchisee

* Allow franchisee's to expand and grow

* Sexy product helps sell franchisee's, shows one's being in touch with the times

* Sell franchisee's (so important I had to list it twice)

So Sell, Sell, Sell is the main benefit.

Save Time, Time, Time is the second benefit.

The map is just the means to the ends

My last article ("Site Selection Basics") focused on the importance of distinguishing between your trade area (geography, demographics, mixed uses) and site attributes (such as type of shopping center, access, parking and co-tenancy).

How do you develop your customer profile so that you locate your business in a trade area with a significant number of your customers?

If you're buying a franchise, you'll be given the customer profile so that you can target the right trade area as well as the most desirable site characteristics for that type of franchise.

There are franchises that focus on attracting customers during particular day parts. For example, fast-casual restaurants that cater to customers in early morning and during lunch will recommend locating in trade areas with a nice mix of residential and employment centers.

They will recommend picking sites that are perceived as convenient by the target customer, such as being within a short distance (due to time constraints such as a limited lunch hour), good access and sufficient parking.

Some uses are "mass market" businesses. By definition, a mass market business is one where the majority of people in the trade area are potential customers, such as fast food establishments or florists.

And while some demographic segments might provide more customers than others, these businesses depend on being in areas with a lot of activity to bring customers to their door. Here the trade area demographics might be less important than the quality and number of competitors and the particular site location characteristics.

A franchisor will (or should) provide you with both a customer/demographic profile as well as recommended trade areas, types of shopping centers that are better for the franchise, recommended site characteristics and space requirements (size, dimensions of the space, required utilities, etc).

If you're buying into a franchise that has other national competitors (and most do), go online and research what the competition is recommending with regard to trade area and site requirements. It's often listed under "real estate" or "submit a site" sections on their website.

Compare it to what you're being told by your franchisor and ask questions if the requirements differ. A franchisor should be able to explain differences, and this will be a good double check on the quality of the franchise concept.

Franchisors will often have a few franchisees (likely the most successful and happy franchisees in the system) that they refer to prospective franchisees as examples of the business operation, location and potential.

It's good to spend time looking at a few of the higher volume locations for a variety of reasons:

(1) Talking to an experienced franchisee who's willing to discuss the pros and cons of their business is always worthwhile

(2) It will give you an opportunity to review their trade area and site characteristics so you can see how it conforms (or differs) from the franchisor's recommendations

(3) You can then take what you learned and apply it to your target trade areas.

It's good to visit at least one average store and one poor performing store so you can see what those look like as well. Sometimes you'll notice weak operations (spend some time observing, on different days and at different times), or you might observe problems with the site (such as limited parking) or other issues with their trade areas. This will be time well spent.

If your franchisor doesn't provide trade area, site and space checklists, develop them for yourself using the information from the franchisor as well as other tips you've learned from the competition.

When looking at different locations, it's easy to get confused so making notes and using a checklist will allow you to keep track of your observations so you can review them later.

And it goes without saying that reviewing the sites of your potential competitors is critical. Be honest with yourself regarding their strengths and note their weaknesses. This will help you to position you franchise business for success.

GIS helps Culver's do better comparable store analysis by allowing staff members to focus on the most appealing trade areas. |

Selecting the Choice Sites

Using ArcGIS Business Analyst, Culver's is able to easily compare and contrast new sites by analyzing the demographics of existing restaurants, then pinpointing new areas that are similar. |

"We want to give our franchise partners the support they deserve," says O'Brien. "GIS technology gives them the ability to maximize their potential at Culver's."

"We want to give our franchise partners the support they deserve," says O'Brien. "GIS technology gives them the ability to maximize their potential at Culver's."

Image via Wikipedia

"Location, Location, Location" is the oft-repeated mantra meant to emphasize the importance of the right site to the success of any retail business.

But what are the key factors for you to understand with regards to your location choice?

The three most important real estate-related drivers for any type of retail business are:

(1) the size and quality of the trade area served;

(2) number and quality of your competition and;

(3) the type of shopping center and other site-related qualities.

A common mistake is to ignore the distinction between a trade area and a site within that trade area. A trade area is the market area that will be served by your business. The trade area has geographic boundaries and consists of a mix of uses (home, work, shopping, entertainment and public facilities).

Tip: a good mix of uses tends to provide higher sales potential mainly because there's activity in the trade area for most of the day and 7 days a week. The demographic profile of the residents of the trade area is critical, too.

The demographic profile should match your customer profile (if you're a franchisee, your franchisor should tell you the target customer profile in detail). A large population base is good only if there are a lot of your customers.

The precise size of a trade area is determined by community affiliation, travel and shopping patterns, and natural and man-made barriers.

Think of the difference between the trade area and your site in this way: the trade area is the market area you hope to tap, and your site is the location in that trade area that will determine how much of that trade area you'll reasonably be able to serve.

Your type of business and the location of competitors are key elements that determine your reach into the trade area.

For example, a dry cleaner is largely a convenience business, and there tends to be a lot of competitors. Unless you offer particularly unique services or your competitors are poor operators, you'll be cut off by other similar businesses that are more convenient to customers in the trade area. You should seek to "out-position" your competition, so pick a site that's defensible, both now and in the future.

Your trade area reach is also determined by the type and location of the shopping center your chose (neighborhood, community, power center) as well as the center's site characteristics (such as sufficient parking, ease of access and signage).

A traditional grocery store in a suburban area tends to pull 2-3 miles, and the other tenants in those centers tend to be convenience tenants that also have limited reach.

If there are tenants that have a larger draw, such as specialty grocers or other "big box" tenants, you'll have the opportunity to draw from 5 miles or more into the trade area. That's why it's important to locate with co-tenants that will serve as generators for your business.

All things equal, you'll want to be in a strong shopping center with co-tenants that provide generators for your business. But remember that no matter how strong the shopping center and your space within that center may be, you will always have an uphill battle if you're "fighting the market".

I've seen stores with even poor site characteristics do strong sales, and this was largely attributable to the strength of the trade area for that tenant.

Make sure you'll be serving the right trade area before focusing on any specific site. A strong location in the right trade area makes a winning combination.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=076ad5ec-4059-4a41-a6b1-055653516330)