Whenever there is turmoil in the world, the most capable people look for someplace else to go where they and their families and their assets can be protected and nurtured. Historically, the United States is always high on everyone's list when it comes to selecting a new home. We get the cream of the society when uncertainty compels exodus. We get the intellectuals, the professionals and the best of the business people.

That makes me extremely proud. I love it that the United States enjoys the respect of foreign nationals in the context of sanctuary. I also derive enormous personal enjoyment at the diversity that exists here in Houston. That diversity is the direct result of a world in chaos.

I can go into stores and hear fifty languages in fifteen minutes, as well as enjoy the food, music and other cultural richness of the people who are now my neighbors - literally my neighbors. To me that is a blessing.

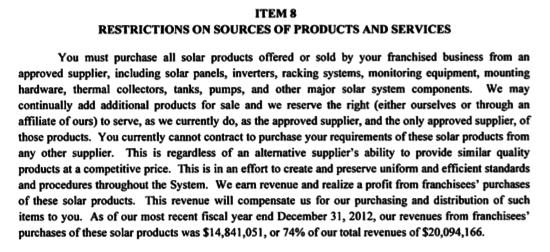

Since so much of what I do involves vetting small business investment opportunities for potential business buyers, I am in a position to observe pernicious patterns of nefarious dealings, especially by certain franchise companies.

I started to see this back in the 1970s, when it was possible for someone from another country to get fast tracked to a Green Card and to US citizenship if they invested in a business here. Unscrupulous franchise companies deliberately marketed franchise offerings to potential immigrants with malignant intentions.

The malignancy of the intentions took two main forms. First was the aggressive misrepresentation of the likelihood for success if the immigrants invested. These included every classic form of falsehood that almost everyone now knows about. Everything positive was overstated, and everything potentially recognizable as being a negative aspect of the investment was either denied or greatly understated and dismissed.

Secondly, there were a number of franchise companies that were offering real investment opportunities that were qualitatively excellent, but the agreements were written so that once the immigrant franchisee achieved success, it was easy for the franchisor to find incidents that could be claimed to be breaches of the agreement on the part of the franchisee that allowed the franchisor to take the business away for little or no money simply by terminating the franchise.

These were usually accompanied by threats that any resistance would result in the franchisee being reported to the immigration authorities as undesirables who engaged in dishonesty, and that they and their families could be deported, losing everything. I represented many of these people, and while some were so wealthy and sophisticated that they were hard to assault, many who were also wealthy by then current standards could also be frightened by threats to assault their standing to remain in the USA.

I saw this with sufficient frequency to recognize that some franchise companies made it a point to target immigrants. Immigrants had money. Many immigrants didn't understand how the American legal system works. Immigrants could more easily be frightened and intimidated.

I am seeing this again in epidemic proportions. The sharks are again thriving in immigrant rich target environments. Immigrants know less than any other category of potential franchise investors how to vet these so-called opportunities. They are, therefore, amongst the most defenseless and easy prey. While fraud is fraud everywhere, the "styles" of fraud are somewhat different here. Fraud is most effective when subtle.

One of the first due diligence issues to note in approaching one of these deals is the nationality/cultural affinity of the existing franchisee population, and also whether the franchisor's principals are from the same culture as the majority of the franchisees. The notion that people are less likely cheat their own kind is utter stupidity.

This cultural or national affinity profile is a huge red flag. It makes the traditional steps of franchise investment vetting much less reliable. Immigrants are much more fearful of telling any stranger anything that is not positive. They are accustomed to being enticed into betraying signs of disloyalty. Whenever someone is apparently trying to seek unflattering information, or check out the truthfulness of statements made, they instantly and instinctively smell a rat/sense a trap, and they clam up.

Talking to immigrant franchisees as part of the due diligence in this kind of franchisee population is almost a waste of time. You have to have a sense of what sections of the FDD, when read in light of that franchisor's marketing and sales brochures and sales pitch on discovery day, are changed in their significance by the cultural affinity of the franchisee group. What it does most urgently is change the mix between what you do with what you can see and what you have to go and find that simply isn't there amongst the readily available information sources.

If you are not of the same culture/nationality as the majority of the franchisees, your risks go even higher, because you are really much more thought of as "fair game". These franchisees wouldn't come to the aid of each other in any crisis, and they certainly wouldn't bestir themselves for the benefit of some outsider.

This xenophobia obtains in so many cultures that it is a more extreme issue in vetting a potential franchise investment when your client is an immigrant and when your client is an American Anglo Saxon thinking of becoming a franchisee in a system heavily populated and possibly also owned by foreign nationals. That they may have become American citizens has no weight whatsoever in this context.

If you are afraid of being thought politically incorrect and shy away from being harshly cynical in this kind of situation, you simply are not ready for prime time. Here you have to call the shots as they are in reality, not as you might think of doing at some church social with the bishop present. If people are offended by this harsh insight, that's just too bad. The job here is to properly vet the investment risks, not to be fearful of giving offense. In fact, you can expect the franchisor to accuse you of being a racist pig.

And if they do, then you know you have just hit a home run and that you should strongly advise against investing in any business deal with any such people. That is so because the answer to these criticisms is to be forthcoming with facts that are subject to corroboration to refute the doubt, rather than to call the challenger a racist.

Immigrants have a higher risk in investing in franchises in America (or anywhere else for that matter). They have pressure points of vulnerability that citizens of long standing do not have. Moreover, their perception of their vulnerability is much more acute. And they don't know how to/ are afraid to be directly challenging to what they are told by franchise companies. They are more easily swayed into believing by the bare number of franchisees, and, in many such cultures, they also believe that what will happen is really out of their hands anyway. That they were successful business people in their former homeland also makes them believe that they have staying power when confronted with difficulty.

But they simply don't have better staying power when they are fleeced, and they go through bankruptcy just like everyone else when they have been cleaned out by thieves.

When you represent an immigrant investor, the due diligence must be far more acutely incisive than due diligence in any normal situation. The acuity begins with the obligation to begin to educate your client about how the franchise world works. The client won't want to take this tutorial seriously, believing that anything that isn't transaction processing to get the deal closed is just a lawyer's way to job the file and make more money.

Americans aren't the only ones who distrust lawyers. The educational process is easier if you have actually been involved in situation of abuse and can provide actual case history type information. It will be important that you keep his regular lawyer in the loop, as that lawyer is probably of the same culture and has more personal credibility with the client than you do.

You need him to vouch for you in this new relationship. Keep also in mind that the better you treat this lawyer, the more immigrant business you are likely to get, as immigration issues are probably more of a specialty for him.

You will be able to assign less homework to the immigrant client than you normally would to a potential franchise investor who is not an immigrant. You will have to do more of the leg work yourself. If you are lucky and the client has children in college in America, you can bet they are highly computer literate and they can be a big help in homework assignments. They will also be gaining respect in the eyes of their parent by pitching in, and that means a lot more in most other cultures than it does in ours. The quality of their work will probably be superb with competent guidance from you.

In dealing with immigrants, it will be extremely helpful if you can find a way not to charge them for saying hello. If they/their lawyer can feel that they can come to you with questions without being charged for every phone call, a better job will be done. Showing respect for their culture goes a lot farther in international professional relationships. In other words, there are sensibilities that are called for in representing immigrants that we don't normally think about when we are representing Americans.

How you go about telling an immigrant that a franchisor representative that comes from his country/district/city/village and speaks to him in his native dialect is trying to fleece him requires some delicacy. They all have relatives back home, and the salesmanship here includes calling back home to learn about the investor's family, friends and associates, and then using that information to suggest that there are relationships back home that should be a basis of special trust by the investor in the bona fides of the franchisor.

You must be sensitive enough to take the initiative to ask specifically about conversations that seemed casual to your client at the time, but that were part of the "scheme" by a crooked franchisor.

The manner in which immigrant investors think about compliance with the rules and regulations that will touch their interests as they operate their future business is also an area of concern. The "education" provided by the crooked franchisor on this subject in the sales pitch must be accounted for, as it is done in a manner - always oral and always later denied - that suggests the presence of many opportunities for revenue that will be "off the books".

Those extraneous revenue opportunities are almost never available, and if the franchisor catches the franchisee operating extraneous business that is not reported, that will be an opportunity to terminate the franchise and take over a business should the business succeed.

Having a franchisee take the start up risk, establish the business, and then taking the business away for very little money is just as frequently part of the scam as the fraudulent inducement to invest in a franchise that has little chance for success.

This planned takeover aspect of selling franchises to immigrants is not usually given as much serious concern when vetting a franchise investment for an American client. It should be, but it isn't.

Your immigrant franchise investor client has to be vetted a bit differently also. Vetting your client for investment suitability is always important, but in the context of someone who has lived in another place where the rules, customs and expectations may be quite different, it takes on added significance. While you have to do it without giving offense, you really ought to put your client through a "discussion exam" in which he tells you about how things have been done in his life up to now and you counsel him about what differences have to be expected and about how to adjust to those differences.

For example, there is far more information exchange in business relationships here, especially in franchising, and the information is rather formalized compared to most other places. The attitudes about information exchanges are frequently very different where your client comes from, and he has to be made aware that a casual attitude toward information exchanges can cost him his business in a typical American franchised business. That is only one of many examples of the education you need to provide for the immigrant client that you wouldn't give as much attention to for someone who has lived here all his life.

I have seen some real nightmares that have arisen out of just a different attitude about information reliability - entire very successful businesses lost. If the business is being purchased as an up and running business rather than a start up, what the current business owner told the potential buyer will be absolutely outrageous compared to anything you will ever see in a UFOC or franchise sales brochure. If the seller is also an immigrant, you can bet that the discourse between the seller and buyer is right out of some street bizarre scenario.

Although I can't prove it, I am sure in my own mind that the franchisees who sell their franchised businesses commit the most egregious frauds of all. A franchise resale transaction is a minefield of deception.

The scope of this article is about representing people who are not born and raised in America when they are thinking of investing in a franchise. It is by no means intended to be a tutorial about how to do due diligence from a broader perspective. There are several other articles on this web site dealing with franchise investment fraud and how to approach it.

Even in their totality they are not encyclopedic in the subject of due diligence. You simply can't cover every possible scam tactic, as the fertile mind of the shyster franchisor keeps coming up with new tricks. Nuances on old tricks are counted here as new tricks. So much in vetting for investment fraud is only in the guts of the person doing the vetting, what he brings to the table based upon the multiplicity of schemes that he has been exposed to in his career.

But these articles are intended to assist general business lawyers to do a better job for their franchise investor clients. When I see them - after it's too late - I always ask whether they went to a lawyer, and they almost always say yes - and then go into a rant about how incompetently the job was done. That is the problem I am working on when I publish these tutorials.

If you are not a lawyer, but someone thinking of buying a franchise, direct your lawyer to this site to read those articles. As it is not politically correct to point out the fraudulent practices in the franchise industry, your lawyer won't find another place to get an education about that subject. Be advised, however, that reading articles about how to vet franchise transactions is not really a responsible substitute for experience.

For the 5 Most Fascinating Stories in Franchising, a weekly report, click here & sign up.