I overheard an interesting conversation about Item 7s, how much it costs to buy a franchise, and the estimated working capital required.

A lawyer explained that "it was a rule that only 3 months of working capital should be shown on the item 7"

This made no sense to me. It is fine if your franchise system is going to ramp up under 3 months, but what if you have bought a system which is expected to take 12 - 18 months to ramp up? Like a child care system?

Why would a franchisor want to mislead the the prospective purchaser by miscalculating working capital? It won't help either party.

Mike Webster tells me that the 3 month "rule" is misunderstood. It really works like this. If the franchisor doesn't have an item 19, then they cannot have an accurate estimate of working capital, how much you need to break even, because this estimate is a financial performance representation. So, if you don't have an item 19, you cannot have an hidden FPR in your item 7.

This makes sense. But, I looked at some item 7's to see how misleading adherence to the "3 month rule" might be. I looked at Man in Van Franchises, because a big component of the cost is going to be the cost of the vehicle or vehicles.

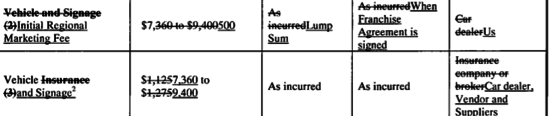

Here is what 101 Mobility's Item 7, from 2013, reveals about the cost of buying a vehicle.

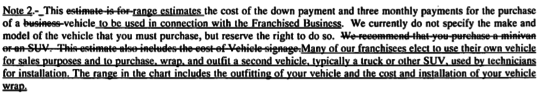

First, the cost of a vehicle is estimated at $7,360 to $9,400, including any shrink wrap for signage.

Well, that sounds a like a great deal! The franchisor must have an excellent vendor program to pull this off.

Well, no. We have to read the fine print.

We see the "3 month rule" being misused. Knowing the true cost of the vehicle is not going to allow you to make an accurate estimate of your break-even.

Could this just be the way the industry reports the cost of the vehicle in the item 7?

No, I am reliably informed by Jim Norton, Chief Operating Officer at Amramp, a competitor to 101 Mobility that:

"Amramp indicates $$23,950 to $42,500 for the purchase of a vehicle. So, at first glance a potential franchisee would see far less investment for 101 Mobility than for Amramp.

But, what should I expect when the 101 Mobility management team had no franchising experience or industry (healthcare experience) when they started the franchise?"

Jim is right, I think.

In my view, we need better Item 7s and better Item 19s, so that prospect purchasers can get an accurate picture of their expected return on invested cash. Adherence to the "3 month rule" produces dumb Item 7s, which cannot be relied upon.

For the 5 Most Fascinating Stories in Franchising, a weekly report, click here & sign up.