I overheard an interesting conversation about Item 7s, how much it costs to buy a franchise, and the estimated working capital required.

A lawyer explained that "it was a rule that only 3 months of working capital should be shown on the item 7"

This made no sense to me. It is fine if your franchise system is going to ramp up under 3 months, but what if you have bought a system which is expected to take 12 - 18 months to ramp up? Like a child care system?

Why would a franchisor want to mislead the the prospective purchaser by miscalculating working capital? It won't help either party.

Mike Webster tells me that the 3 month "rule" is misunderstood. It really works like this. If the franchisor doesn't have an item 19, then they cannot have an accurate estimate of working capital, how much you need to break even, because this estimate is a financial performance representation. So, if you don't have an item 19, you cannot have an hidden FPR in your item 7.

This makes sense. But, I looked at some item 7's to see how misleading adherence to the "3 month rule" might be. I looked at Man in Van Franchises, because a big component of the cost is going to be the cost of the vehicle or vehicles.

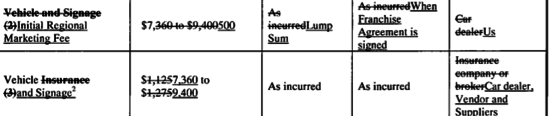

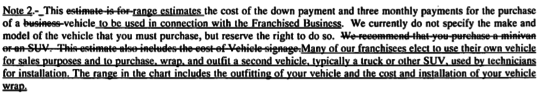

Here is what 101 Mobility's Item 7, from 2013, reveals about the cost of buying a vehicle.

First, the cost of a vehicle is estimated at $7,360 to $9,400, including any shrink wrap for signage.

Well, that sounds a like a great deal! The franchisor must have an excellent vendor program to pull this off.

Well, no. We have to read the fine print.

We see the "3 month rule" being misused. Knowing the true cost of the vehicle is not going to allow you to make an accurate estimate of your break-even.

Could this just be the way the industry reports the cost of the vehicle in the item 7?

No, I am reliably informed by Jim Norton, Chief Operating Officer at Amramp, a competitor to 101 Mobility that:

"Amramp indicates $$23,950 to $42,500 for the purchase of a vehicle. So, at first glance a potential franchisee would see far less investment for 101 Mobility than for Amramp.

But, what should I expect when the 101 Mobility management team had no franchising experience or industry (healthcare experience) when they started the franchise?"

Jim is right, I think.

In my view, we need better Item 7s and better Item 19s, so that prospect purchasers can get an accurate picture of their expected return on invested cash. Adherence to the "3 month rule" produces dumb Item 7s, which cannot be relied upon.

For the 5 Most Fascinating Stories in Franchising, a weekly report, click here & sign up.

As we see a move to more franchisors creating more bankable item 19s, we should see better item 7s, also.

From a franchisor's sales and recruitment perspective having a realistic Item 7 investment schedule and a fully detailed Item 19 Financial Performance Representation - FPR it's a competitive advantage over those franchise concepts that don't or play fast & loose with their numbers.

What I find misleading are your assessments of 101's activities. They are clearly following the guidelines published by the FTC, which provides for presenting vehicles as "purchased or leased". Furthermore, the title of Item 7 is "Your Estimated Initial Investment", not your estimated "Total" investment. Any consumer that cannot ascertain the information provided by 101 should not be buying a franchise. It is clear that AmRamp requires the franchisee to purchase a vehicle as part of their initial investment estimate, 101 Mobility does not, nothing misleading here, just different choices. I'm sure that Mike Isakson, 101's franchise consultant presented all the options to them and they chose the one that most clearly aligned with their goals. That is the essence of being a franchisor, choosing to present your offer in the way you deem appropriate within the FTC guidelines. And, in fact, 101 makes a significant Item 19 disclosure to support their offer. Finally, the goal of the FDD is to spur the consumer on to do their own research, not provide them with an "all cases" list of assumptions. I do not find the 101 Mobility FDD presentation of Item 7 is not misleading.

Ben writes -

"What I find misleading are your assessments of 101's activities."

Well don't you think 101 Mobility could have a better and more revelatory Item 7 to help franchise buyers?

Ben writes -

"I'm sure that Mike Isakson, 101's franchise consultant presented all the options to them and they chose the one that most clearly aligned with their goals."

I don't know Mike Isakson. He's probably a very nice guy. And we could take your word for this but how could you possibly know?

Ben writes -

"Finally, the goal of the FDD is to spur the consumer on to do their own research"

No it's not. It is supposed to be the most reliable information franchise buyers receive. And that's the intent of the FTC Franchise Rule to disclose before a lawful sale is made. Which is why the FTC requires franchisors to do it. The FDD is the central documentation of a franchise buyers research and for comparison to other franchises. Finally I could be wrong but I don't think you mean to call franchise buyers "consumers" or do you?

Hi Joe,

I think that the 101 Mobility Item 7 is relevant to their business model and how they want to portray their franchise offer. It's not a black or white issue, but one that each franchisor has the right to choose. The FTC rule isn't a box your franchise has to fit in, just guidelines for disclosing your offer, whatever it may be.

Mike Isakson, former Chair of the IFA and COO of Service Master is a very qualified guide for any franchisor. I know Mike and I know the 101 Mobility executive team.

The FTC rule is simply a starting point for anyone seeking to buy a franchise: "The Franchise Rule gives prospective purchasers of franchises the material information they need in order to weigh the risks and benefits of such an investment." And yes, I consider the FTC rule on franchising a consumer protection policy to ensure consumers have access to material information when considering a the purchase of a franchise.

Ben writes -

"And yes, I consider the FTC rule on franchising a consumer protection policy to ensure consumers have access to material information when considering a the purchase of a franchise."

Franchise agreements and Franchise Disclosure Documents are purposefully clear that they are in fact not consumer agreements but commercial contracts for business parties.

Ben writes -

"Mike Isakson, former Chair of the IFA and COO of Service Master is a very qualified guide for any franchisor. I know Mike and I know the 101 Mobility executive team."

Mike sounds like great guy you might want to suggest to him improvements to their Item 7. A guy like you describe would appreciate it, don't you think?

Ben writes -

"I think that the 101 Mobility Item 7 is relevant to their business model and how they want to portray their franchise offer."

Don't know what you mean here? Here's what I think; 101 Mobility should want to have an Item 7 that helps its franchise buyers have a clear measure of the investment and requisite capital required for them to succeed before they buy.

Joe, I don't know if you are purposefully intending to disparage franchise companies and leaders in franchising by your comments but if so, well done. Your lack of depth in understanding the franchise model and the FTC rule highlights the mounting troubles in the sector. Just because you worked "in" franchising doesn't mean you "know" franchising. There is actually a significant body of research that support this complex and dynamic model (actual evidence-based research). I see no value to the sector by your opinions on how a franchisor should portray their offer, especially when you don't know the franchisor.

Ben writes -

"There is actually a significant body of research that support this complex and dynamic model (actual evidence-based research). I see no value to the sector by your opinions on how a franchisor should portray their offer, especially when you don't know the franchisor."

Well Ben happy to have you provide citations to the work relevant to FTC Disclosure and Item 7s. Post them on this thread.

Ben writes -

"Your lack of depth in understanding the franchise model and the FTC rule highlights the mounting troubles in the sector. Just because you worked "in" franchising doesn't mean you "know" franchising."

Opinions they do vary.

Ben writes -

"I don't know if you are purposefully intending to disparage franchise companies and leaders in franchising by your comments but if so, well done."

Don't think that suggesting 101 Mobility look at improving their FDD's Item 7 rises to your claim. But who am I to say?

You have told me the purpose of your site is "intelligent conversations on franchising", but this is not one of them. Insinuating that 101 Mobility, their legal and business consultants are "dumb", that they are knowingly "misused the 3 month rule" is unsubstantiated arrogance on your part. The research on the franchise model sets the table for a healthy understanding of the FTC rule on franchising and the role of the franchisor in choosing their offer. That appears to be a meal you have chosen to skip.

You have told me the purpose of your site is "intelligent conversations on franchising", but this is not one of them. Insinuating that 101 Mobility, their legal and business consultants are "dumb", that they are knowingly "misused the 3 month rule" is unsubstantiated arrogance on your part. The research on the franchise model sets the table for a healthy understanding of the FTC rule on franchising and the role of the franchisor in choosing their offer. That appears to be a meal you have chosen to skip.

Ben writes -

"You have told me the purpose of your site is "intelligent conversations on franchising", but this is not one of them. Insinuating that 101 Mobility, their legal and business consultants are "dumb", that they are knowingly "misused the 3 month rule" is unsubstantiated arrogance on your part. The research on the franchise model sets the table for a healthy understanding of the FTC rule on franchising and the role of the franchisor in choosing their offer. That appears to be a meal you have chosen to skip."

Don't be silly Ben. Misquoting & mischaracterizing doesn't advance reasoned dialogue.

My reasonable and legitimate points are really very simple. 101 mobility should look at improving their Item 7 (they don't have to if they don't want to). Franchisors should have realistic and transparent investment estimates. How can you be against that?

Joe, your words speak for themselves...no quoting necessary.

No, 101 Mobility should not make any changes to their Item 7 based on your opinions. It is their offer and it is theirs to make whether you or anyone feel it should be "improved". It is up to the prospective buyer to discern whether they accept it or not. Franchising is a self-governed business model, and as such it is up to each franchisor to define and describe their model as they deem appropriate within the confines of the law(s). Or are you suggesting that franchising needs to be legislated, and if so that you are the appropriate legislator worthy of determining a "good" offer from a "bad" offer?

There is nothing in their offer that lacks transparency or is unrealistic that I can see, but that is my opinion. The franchise candidate is the only real judge. The "reasonable and legitimate" point here is that franchisors offers differ and consumers should evaluate them carefully to understand them relative to the other offers available.

Be writes -

"The franchise candidate is the only real judge."

Most prospective franchise buyers have no experience with FDDs and are ill-equipped to know from Adam the quality of an Item 7 they're reviewing.

Ben writes -

"The "reasonable and legitimate" point here is that franchisors offers differ and consumers should evaluate them carefully to understand them relative to the other offers available."

Again franchise buyers are not consumers. If you are going to charge people to take your class you should get this right for the sake of your students. Franchisors should make it clear what their investment entails & requires in their Item 7 and not make people hunt for the information or look for it outside of the FDD. Is that really too much to ask?

The reason students, including some of the leading franchise executives in the country, pay for my course is because it is evidence-based, not opinionated rantings. Case in point:

The FTC has prepared "Buying a Franchise: A Consumer Guide". Furthermore, "The Federal Trade Commission, the nation’s consumer protection agency, has prepared this booklet to explain how to shop for a franchise opportunity, the obligations of a franchise owner, and questions to ask before you invest." You might not consider the buyer of a franchise a consumer but the FTC, and credible franchise professionals do.

Sorry Joe, I can't endorse your site as a credible source of franchise information. It is sorely needed. Take care.

Ben writes -

"The FTC has prepared "Buying a Franchise: A Consumer Guide". Furthermore, "The Federal Trade Commission, the nation’s consumer protection agency, has prepared this booklet to explain how to shop for a franchise opportunity, the obligations of a franchise owner, and questions to ask before you invest." You might not consider the buyer of a franchise a consumer but the FTC, and credible franchise professionals do.

Sorry Joe, I can't endorse your site as a credible source of franchise information. It is sorely needed. Take care."

Sorry Ben Franchise-Info didn't request your endorsement. We'll have to endeavor to persevere without it. And when FDDs & franchise agreements start calling franchisees "consumers" and when you get franchise attorneys to call their work product 'consumer agreements' you can let everyone in franchising know right here.

Not sure why you're being so hostile in this debate it is really unbecoming. Is that really what you want to do?

Please remove me from your site. Thank you.

The issue here is relatively simple.

If a franchisor requires a franchise owner to own a certain piece of equipment, then should the item 7 reflect:

a) the full of cost the of the equipment or;

b) 3, 6 months, or some other period, of leasing payments, should the equipment be financed.

Since Item 7 is intended to reflect that costs of ownership, the answer is a). The method of financing the required elements of the franchise does not need to part of the disclosure document.

Commenting on this thread is probably dangerous to anyone's mental state and ego. I don't happen to know any of the companies mentioned or the consultant that was referred to but here is what i use as a guide in all FDD d matters but specifically Item 7.

Rule number one is very simple. What information will help the franchisee be more successful.

There is no rule number two.

I recommend to my clients thatt he cost of equipment be fully disclosed. Most of the attorneys I work with, and I work with probably 6-8 across the country at any one time, agree with me and most will allow the Item 7 to not only be footnoted concerning the cost of equipment but noted that leasing is recommended and to see the working capital line and footnotes.

Does everyone take my advice? No they don't, but we usually part along the way over this and other issues that they don't take advice on.

In my very simple approach anything that might cause the franchisee to fail should be not only disclosed but be part of the qualification process. The push to sell franchises instead of awarding franchises is not a long term solution. If the franchisee is successful generally the relationship stays good other things being equal. Why would you want to put your company in a position to face litigation or arbitration when it is simple to just be honest?

In the working capital line most clients just put in the first 3 months of lease payment and it is footnoted as such. However I have recommended in certain cases that the first year of working capital be put in the FDD, does it possibly hurt sales? Possibly but I can't prove that. Usually it just becomes something that disqualifies certain prospects and prevents a failure.

I guess I am probably in the minority but I wake up in the middle of the night if I think I see a client sell a franchise to someone they should not have sold to. But then I think that my 38 years of being a franchisee, franchisor, COO, CFO,CEO, President and Chairman of the Board and consultant of franchise companies has given me a true understanding of franchising. But of course I am open to other people's opinions.