Every franchisor, big or small, has a franchise development department. In some cases it is a department of one that may be manned by a passionate (and quite frequently strange and eccentric) founder. In other cases, it may be a massive "bullpen" of franchise salespeople whose entire function in life is to sell, sell, sell--which, by the way, is common in larger franchising organizations. Regardless of the size of the franchisor, the franchise development department exists for one purpose: to sell franchises.

Franchise salespeople are often among the friendliest and most fun-loving people you'll ever meet.

With a smile in their voice and a twinkle in their eye, they will quickly and easily make you feel like the smart, sexy, savvy businessperson you know you are, and before you know it you'll be singing their praises from the rooftops.

While I'm certainly not implying that there is anything wrong with this process, make no mistake: Franchise development people love you because you represent a big, fat commission check and because they're under tremendous pressure to sell--particularly in the case of a new franchise concept or offering.

But, how much money will you make buying a franchise? And why aren't those nice & friendly salesmen telling you?

Please also note that a reluctance on the part of a franchisor to share performance data does not necessarily mean that the franchisor has something to hide or that the franchisor's model doesn't work.

In reality, it has more to do with the fact that franchisors must be very careful about the claims they make with regard to franchisee performance. In the not too distant past, it was not uncommon for franchise development people to make comments such as, "Unfortunately, I am prohibited by law from providing any financial information"; however, this has since changed based on the amended Federal Trade Commission (FTC) Franchise Rule, which was approved on January 22, 2007 and became mandatory on July 1, 2008.

In a nutshell, the FTC now specifically requires franchisors to state in Item 19 of the FDD that they can provide financial information, but have chosen not to. The specific language can be found later on in this chapter in the detailed description of the 23 mandated Items includ-ed in the FDD.

When I went through this process as a franchise candidate myself, I distinctly remember thinking, "Man, if I could just get my hands on a friggin' profit and loss [P&L] statement or some basic numbers, I could figure out if I can make any money!"

Don't fret--all is not lost. By reviewing each of the 23 items in the FDD carefully, you can piece together a fairly accurate framework of your basic expenses. In addition, by making a number of follow-up calls to existing franchisees, you should be able to fill in any blanks. You see, franchisees aren't prohibited from

sharing detailed financial information because they're considered to be unbiased parties.

Here's the real secret: Make those due diligence calls!

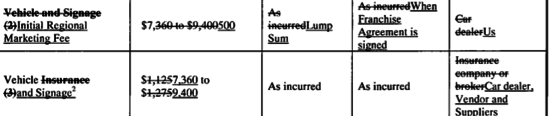

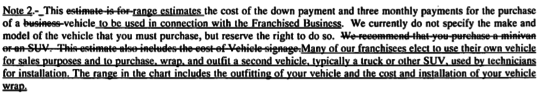

There simply is no substitute for contacting a broad cross-section of existing franchisees and asking the tough questions, so DO NOT skip this step. You'll also want to pay close attention to Item 7 in the FDD, which details the costs of getting into the business, aka the initial investment.

Do all of these things correctly and voila--you'll have a nice, reasonably accurate pro forma!

For the 5 Most Fascinating Stories in Franchising, a weekly report, click here & sign up.