Remember - "Bring out Your Dead?

Well, you might be killing your leads too early, too.

In the early 1990s, I was in charge of US development for a top QSR franchise. At that time we relied on targeted marketing by DMA (Designated Market Area), trade shows and the display advertising to attract attention to our franchise offering.

Ours leads came in by telephone, brochures & applications were mailed and the follow up was telephone and FAX machine.

-

Created a well crafted an inviting sales letter to re-attract attention.

Used the best and fasted technology available - A FAX machine.Asked our dead lead one question - "Would you like to reactivate your franchise application?"Gave them one thing to do to restart the process - Simply fax back this letter and we will get you back on track to developing your first restaurant".

Used the best and fasted technology available - A FAX machine.Asked our dead lead one question - "Would you like to reactivate your franchise application?"Gave them one thing to do to restart the process - Simply fax back this letter and we will get you back on track to developing your first restaurant".

The program worked great!We revived dead leads and sold more franchises.For the 5 Most Fascinating Stories in Franchising, a weekly report, click here & sign up.

With today's announcement that Google Wallet would be preinstalled in Verizon Wireless, AT&T and T-Mobile USA, it is worthwhile to review this and other changes from the franchise owners' point of view.

My Business Model is Obsolete, in the February 25, 2013 issue of Fortune Magazine by Geoff Colvin describes how an increasing pace of innovation is having a significant effect on the business models of institutions that have been in existence for decades.

Unlike the larger and better known corporations identified in this article, my focus is on how smaller organizations are affected by these same changes.

Without the financial resources of larger and more profitable organizations, smaller businesses are at greater risk of disappearing in a shorter period of time.

Smaller businesses are being forced to adapt to these changes in the pace of innovation and their core business models -how they earn profits- are been strained.

1.Payment Acceptance Systems

Business transactions used to be simpler when paid in cash. Then there was the convenience of cheques. Today we have credit and debit cards, often with reward programs, and Paypal. The sad reality is that most businesses probably do not even know the cost of accepting these varied payment systems.

With these conveniences come costly equipment and acceptance fees. An entirely new middleman has emerged to support noncash transactions in the name of convenience.

Let us not forget, however, that this is an added cost to business. The business cannot always pass on these costs due to the competitive environment which results in reduced profit. Then there are the costs of technology that must be absorbed.

Business accepts these charges as a cost of doing business but many fail to give proper consideration to the implications of taking on these costs - maintenance, support and replacement - to the overall profitability (and sometimes viability) of the business.

The overall result of just these two changes to the business model is twofold. Business owners need to know more about technology and marketing than ever before. They must also charge more for what they offer or accept reduced income. This puts the small business owner, who lacks the knowledge and resources to properly invest in technology or experiment with alternative marketing vehicles, at a disadvantage.

2. Marketing

At one time marketing by smaller businesses was generally limited to Yellow Pages, local newspaper and/or magazine advertising, and/or direct mail. Today the reality of marketing is quite different.

- Yellow Pages are no longer a primary advertising vehicle.

- With the advent of cellular networks, phone numbers are no longer centralized so a single telephone directory no longer exists.

- Add in access to online directories and the value of Yellow Pages advertising is now questionable.

The collapse of virtually all print media in place of Internet options requires businesses to seek out alternate ways to promote their offerings. It also requires a greater level of knowledge into marketing and technology which typically does not exist within smaller businesses. Into the void comes a range of Internet vehicles that include Internet web sites, online advertising, social media and blogs.

These marketing vehicles lack any form of reliable or verifiable results on which to evaluate success yet they seem to be the only alternative for the moment. Businesses feel they must have a presence in these areas to remain viable.

The amount of time and money spent on these marketing vehicles is a significant change in business model typically not considered by businesses using the traditional cost-benefit analysis.

In fact, many promoters of these new age vehicles argue (incorrectly, in my opinion) that traditional measurement systems do not reflect the value inherent in these investments. This is not to suggest that online marketing is not effective when done properly. Only to beware of the high tech snake oil salesman promoting unproven methods without a means of measuring results.

For the 5 Most Fascinating Stories in Franchising, a weekly report, click here & sign up.

There's no question that experienced workers in their trade want the ability to run their own business and take their skills in a new direction. Being able to run your own business means you're in charge of what direction your company goes in and you get to make all the calls.

Who gets hired, what equipment is used, where you're located: it's all up to you. You get to set your own hours and go at your own pace, meaning everything is up to you, which is both a blessing and a burden.

You have full responsibility over whether your company succeeds or fails, meaning you have to put quite a bit of work into your company if you want to be successful in the long run, you need to mange every aspect of your business in such a way that you can truly be successful. This involves making sure your finances are completely in order all of the time.

That's where financial services come into play, but getting these services and being able to afford them can be another matter entirely. All businesses need bookkeeping and accounting to keep track of their finances and allocate any and all funds you have accordingly.

However, hiring these services is a full salary's worth that you may not be able to afford. Many business owners will try for the alternative of doing their own books, only to find that a full-time job along with something as demanding as running a business will hurt your business more than help it.

Companies need a way to get their financial services handled without issues, but how can they do so effectively?

Why you should Outsource your Bookkeeping

There are countless reasons to seek out the alternative of hiring an outsourced bookkeeping business, mainly through the benefits of getting financial services taken care of for you without you overspending.

1. Remote bookkeeping is also extremely convenient for you because you don't have to deal with the clutter of paperwork or having all of your information scattered about; everything is organized and managed for you to easily access. The team of outsourced bookkeepers handles all of your information, completes financial services for you, and places the resultant data on a secure, remote server.

That server is very easily accessible for the business owner, as they get choice of how secure they want access to their data to be. They can restrict access to a work computer, or get access via their smart phone, tablet, laptop, or even give other employees access pending a password or other form of security.

However you choose to secure access to the data, you still get 24/7 access to all of your data, organized and very convenient to access. There are countless other reasons why you should outsource your bookkeeping, like the variety of services offered to you.

You don't have to worry about paying for bookkeeping, accounting, and payroll workers; instead, you can choose get all of the services your business needs from remote bookkeeping. Outsourced bookkeeping offers you a huge variety of services, from getting your bills paid for you and getting financial reports sent to you to CPA services, bankruptcy services, payroll services, and reconciliations completed.

Everything and anything your business needs financially can be done, so you can just pick your services and how you want to access the data and the rest is done by the remote bookkeeping company.

2. Behind the Scenes with Outsourcing your Bookkeeping

Outsourced bookkeeping businesses make sure that their hires are as efficient and competent as possible to ensure that your precious financial data is handled accordingly. Potential hires that are considered must have some previous experience in the field, whether they've done some bookkeeping or accounting for a business, and must have a fairly clean record.

All potential employees are vetted and undergo a background check for any discrepancies, and they all go through multiple interviews before being hired. To fully ensure the security of your data and let employees know how serious their job is, all new hires sign a three-page non-disclosure policy stating that they will be held accountable for anything that goes wrong as far as them handling your data.

Whether they're new hires or experienced workers, all employees work together on tasks for clients to make the process much faster and more efficient. Plus, the server they use is highly secure and has countermeasures designed to keep your information safe no matter what happens.

Of course, remote bookkeeping companies work to make sure their servers are as efficient and airtight as possible, following state cyber security laws. Still, it doesn't hurt to have a backup like a cyber insurance policy or an offsite backup of your data just in case anything goes wrong.

There are many reasons why you should outsource your bookkeeping, but many business owners worry about security of their vital data in the hands of a server or in the hands of employees. However, remote bookkeeping businesses strive to cover every potential issue, building a secure server with countermeasures as well as only hiring the best possible workers.

3. Financial Reasons as to why you should Outsource your Bookkeeping

There are countless reasons why you should outsource your bookkeeping, but it always boils down to how much money it costs versus what you have. It doesn't matter how great a service is; if you cannot afford the service then you cannot hire them.

However, it's a surprise to find out that not only is remote bookkeeping inexpensive, but it means you save tens of thousands of dollars versus your alternatives!

Hiring in house bookkeepers or accountants means a salary of at least $35,000 annually with some in the $50,000 range, meaning you're paying almost six figures to get these services.

However, remote bookkeeping will not cost more than $20,000 a year, and that's every possible service offered by the outsourced bookkeeping business. Just bookkeeping costs $300 a month or $3,600 a year, ten times less than what in-house bookkeepers charge!

It's very easy to see why you should outsource your bookkeeping, as you get all of the advantages of a good service with no downsides and at an affordable rate. To learn more about why you should outsource your bookkeeping through companies like Remote Quality Bookkeeping™ of Massachusetts, click here.

The post Three Reasons why you should Outsource your Bookkeeping appeared first on Cloud Bookkeeping Services|Remote Quality Bookkeeping.

This could be your first day looking at franchises or considering a franchise distribution model for your business.

And if you went searching around the internet you will find all of these statistics and cliches in a variety of iterations.

Do you use any of these? Because Franchise insiders don't.

# 1 - US Department of Commerce Study shows 97% of Franchises vs. a 50% failure rate for independent businesses

Not so - The US Department of Commerce did not make this conclusion. Call and ask them. Bureaucrats tend to keep records they are proud of.

#2 - The median gross annual income, before taxes, of franchisees was in the $75,000 to $124,000 range, with over 30% of franchisees earning over $150,000 per year.

Not true and foolish - Median can't be a range. It is the exact midpoint of a range. It's impossible to support this assertion. Because you can't make a range a median.

#3 - US Small Business Administration study conducted from 1978 to 1998, which found that 62% of non franchised businesses closed within the first 6 years of their existence due to failure, bankruptcy, etc.

Unverifiable and likely not true - If you go to SBA.gov you can't find this information. You can find a lot of franchising people touting this as true.

#4 Owning a franchise allows you to go into business for yourself, but not by yourself.

It's trite - Franchisees are independent business owners and all of the owner's obligations are solely theirs. It's more like for franchisees and franchisors that - we are all in this together separately. When you succeed your franchisor will be happy to rejoice in the shared success. If you fail at franchising you will be an orphan and all alone in your failure.

# 5 Franchising is like a marriage.

No it's not like that at all - Marriages are supposed to be until death do you two part. Franchises are for specific term of years. You and your spouse make mutual decisions about what you'll do in your married life. In franchising your brand activities are prescribed by the franchisor. A marriage is between two people. If franchising was like a marriage then a franchisor would be a polygamist with multiple partners.

If you're using these 5 foolish franchise cliches you should stop. And if you hear someone use one of these cliches, turn around and run away.

For the 5 Most Fascinating Stories in Franchising, a weekly report, click here & sign up.

Last July 2014, Bloomberg Businessweek had a detailed cover story about Burger King's (NYSE:BKW) leadership.

It's not much of a useful analytical piece. The piece did not move the market, the Bloomberg editorial standard. Deep analytics must not sell anymore in our time-starved span of attention. The piece is Wall Street personality and issue focused.

Franchised Restaurant companies require a lot more investor due diligence, on both the equity and bond investor side, and on the franchisee side. And I want to talk about that.

First, franchisors don't release their franchisee financials results other than same store sales. 100% franchisors like DineEquity (NYSE:DIN), Burger King and Tim Hortons (NYSE:THI) don't release a single franchise operations number.

Popeyes (NASDAQ:PLKI) alone of the publicly traded group releases franchisee EBITDAR - EBITDA less rent.

Some limited clues may be possible from the 10Q/10K statements and the franchisors' Franchise Disclosure Document that details unit opens/closes.

The 10Qs/10Ks don't detail why units open or close, but the FDD broadly classifies closings into categories.

The same store sales metric is more visible.

But to focus in isolation as Businessweek tried (Burger King's same store sales exceeded McDonald's) is flawed: a .5% same store sales gain on a $2.7 million sales base yields a much more healthy picture than 2.0% on $1.0M store AUV base.

Actually, both comps and unit opens/closings need to be examined together, it's very possible to open a lot of stores but realize negative same store sales trends (Five Guys, Smashburger are best recent examples, experiencing both conditions).

Positive same store sales are nice, but are they profitable sales (might not be if discounting is involved) and are they high enough (restaurants need about 2% growth per year typically to cover inflation).

Bad debt expense, the value of franchise royalties not paid to the franchisor and eventually aged and reported, is also a poor, lagging metric. Once bad debt expense is posted, it's really late in the business cycle, the franchise model problem is very intense, the horse is out of the barn.

Franchisees don't talk much - they are afraid to and told not to, and are constrained from communicating via franchise agreements. More research and due diligence is needed. Consider the 3G Capital and Fortress experience, their astoundingly bad 2012 Quiznos investment ($350 million investor group loss and counting).

Getting franchisee EBITDA is great (it is possible, but you have to dig and hire the right people) but it's only half of the story. Restaurants are capital expenditure (CAPEX) intense and some measure of after tax, after debt service, after loan amortization economic gain or loss number is needed.

As usual, business analysis is not what you read on the cuff - it's not what you expect, it's what you inspect.

For the 5 Most Fascinating Stories in Franchising, a weekly report, click here & sign up.

When you're buying a franchise you probably need money - most buyers do - and numerous lenders are lining up, especially at franchise expos, to be of service. One option that buyers often overlook is leasing, and it's worth your time to check out the possibilities.

If you're investing in a franchise that includes equipment, such as a POS system, or ovens and appliances for the kitchen, or if you need a truck, such as a van, you may be better off leasing than borrowing. Leasing equipment is the equivalent of "renting" the equipment, which means that you won't take money from your working capital to buy the equipment.

With a lease, you get to use the equipment and pay monthly, and at the end of the lease you can acquire the equipment, or upgrade it and roll the package into another lease.

Here are eight reasons why you should consider a lease when you start a franchise:

1. Hold on to your working capital.

Cash on hand is a huge advantage.

2. Claim a tax benefit.

Section 179 of the U.S. Internal Revenue Service Code allows you to write off a percentage of a monthly lease payment.

3. FICO requirements are usually lower for leasing.

There's less risk with a lease so credit rating requirements may be lower.

4. There are no prepayment penalties.

If it turns out you've got extra cash on hand, pay off the lease without a penalty.

5. You can choose the term.

24 to 60 months. This helps you keep the payment amount in line with your cash flow.

6. If you're expanding your business by opening a second unit, you may be able to use the first business to guarantee the lease and not have to sign a personal guarantee.

7. Securing a lease may be faster than securing a loan.

Especially, if you're leasing an equipment package or a vehicle that's recommended by a franchisor. Leasing companies like franchise deals.

8. Closing costs are minimal.

Almost always less than $500.

There are few disadvantages to a lease.

Of course, you still need to provide personal financial information and provide a variety of documents to the lender, but this is all the easier when you're buying a franchise. Savvy franchisors develop relationships with leasing companies to expedite franchise sales and development.

For the 5 Most Fascinating Stories in Franchising, a weekly report, click here & sign up.

You'll find more information about franchise financing in my Amazon best-seller: 12 Amazing Franchise Opportunities for 2015. Chapter 2 is titled Funding Your Franchise Acquisition.

As social media usage continues to soar, you should establish a social media policy, if you haven't yet. Such a policy communicates to employees your expectations on the use of social media sites, such as Facebook, Twitter, YouTube, etc., as they relate to your business. If you already have a policy, good for you!

Now take a little time to review it to make sure it's legally compliant, especially in light of guidance from the National Labor Relations Board (NLRB.) Even if you are not a union shop you need to take NLRB guidance and rulings seriously. Why? Read on.

The Acting General Counsel of the NLRB has just issued a report on employers' social media policies for the third time in less than a year. The report serves as guidance for employers as they craft and revise their social media policies.

In a nutshell, the NLRB has frequently determined that such polices are unlawful due to being overly broad, i.e. too restrictive in terms of an employee's right to engage in protected concerted activity in accordance with Section 7 of the National Labor Relations Act (NLRA.)

Such protection covers an employee's right, without fear of retaliation, to discuss their pay, benefits and other working conditions.

Section 7 says: "Employees shall have the right to self-organization, to form, join, or assist labor organizations, to bargain collectively through representatives of their own choosing and to engage in other concerted activities for the purpose of collective bargaining or other mutual aid and protection, and shall also have the right to refrain from any and all such activities."

It's important to realize that Section 7 protection applies to union and non-union members alike; so even if your organization is not unionized, employees' rights to engage in concerted activity are protected. Your social media policy should not restrict that right. Further, you should understand that the use of social media, such as Facebook postings, for engaging fellow employees in conversation is considered by the NLRB to constitute protected concerted activity if the discussion involves pay, benefits or other aspects of working conditions. The protected discussion may well be mixed in with language that you or others at your organization find objectionable, such as disparaging remarks about supervisors or profanity. Although possibly offensive, it is nonetheless still protected.

Among the many policy excerpts addressed in the report, here are three to help give you an idea of where the NLRB is coming from. The excerpts are in quotation marks and italics with the NLRB's explanation immediately following in bold:

1. "Don't comment on any legal matters, including pending litigation or dispute."

NLRB: We found that the prohibition on employees' commenting on any legal matters is unlawful because it specifically restricts employees from discussing the protected subject of potential claims against the Employer.2. "Think carefully about 'friending' co-workers . . . on external social media sites. Communications with coworkers on such sites that would be inappropriate in the workplace are also inappropriate online, and what you say in your personal social media channels could become a concern in the workplace."

NLRB: The provision of the Employer's social media policy instructing employees to "[t]hink carefully about 'friending' co-workers" is unlawfully overbroad because it would discourage communications among co-workers, and thus it necessarily interferes with Section 7 activity. Moreover, there is no limiting language clarifying for employees that it does not restrict Section 7 activity.3. "If you enjoy blogging or using online social networking sites such as Facebook and YouTube, (otherwise known as Consumer Generated Media, or CGM) please note that there are guidelines to follow if you plan to mention [Employer] or your employment with [Employer] in these online vehicles. . .

Don't release confidential guest, team member or company information. . . ."

NLRB: We found this section of the handbook to be unlawful. Its instruction that employees not "release confidential guest, team member or company information" would reasonably be interpreted as prohibiting employees from discussing and disclosing information regarding their own conditions of employment, as well as the conditions of employment of employees other than themselves-activities that are clearly protected by Section 7. The Board has long recognized that employees have a right to discuss wages and conditions of employment with third parties as well as each other and that rules prohibiting the communication of confidential information without exempting Section 7 activity inhibit this right because employees would reasonably interpret such prohibitions to include information concerning terms and conditions of employment.

Companies can get themselves into big trouble when they fire someone based solely on a social media posting that violates their social media policy. Of course, termination may be warranted when postings portend violence or constitute bullying, harassment, racial slurs or defamation. But when the employee addresses working conditions, you need to tread lightly. Getting qualified legal advice is usually a good idea when considering an adverse action; when related to the possibility of protected activity, it's a must!

For the 5 Most Fascinating Stories in Franchising, a weekly report, click here & sign up.

Most franchise territories are created by some "defined" geography.

Most franchise territories are created by some "defined" geography such as a group of Zip codes, a ring dimension or a described area.

Since all political geographic boundaries are readily available including block groups, Zip codes, census tracts, counties, states, designated market areas, and Metropolitan Statistical Area-Core Based Statistical Area, these are mapped and viewed within a global information system (GIS) and are a great foundation for the beginning step in defining territories.

GIS tools allow the franchisor to draw or create the territory in digital format.

For some franchisors, this may be enough, having a digital database of existing territories. There may not be a need to understand the demographics of the area, just be able to see it on a map. This allows them to print a hard copy of the maps to include in the franchisee agreement, be able to identify potential overlap issues with new territories, and to map out potential future territories.

Counting the Customers

Some franchisees choose to enhance their mapping capabilities by including geo-demographics, both consumer and business related. Adding demographic data to the geography (block groups, counties, DMAs) dramatically enhances the ability to identify or "target" groups of desired customers. The franchisor may know that their targeted customer base is a household with a certain level of average income.

Using the mapping-demographics, every block group in the United States can be found and mapped that meets this criteria. The process of creating the franchisee boundary will now include a count of potential customers. Having these counts leads to the development of defendable, equitable territories.

For those who may not know their true customer profile, mapping tools can include geocoding (assign a latitude-longitude coordinate based upon an address) that places the customer on the map.

Once the customers are on the map, attaching their location with the corresponding demographics of their block group to create a customer demographic profile is easily accomplished. By mapping your best customers and developing a "target" profile, you can go find these targets anywhere in the United States and develop intelligent franchisee territory searches.

Some franchisors are business-to-business rather than consumer oriented.

The same process applies, but by using a different set of geo-demographic data. Business population counts are available by North American Industry Classification System/StandardIndustrial Classification codes by their address or summarized at any geographic level (block group, Zip, county). Either way, this data can be viewed as information on a map.

If a franchisor targets a specific business population, this targeted group can be mapped and territories developed based upon desired levels of business counts and potential.

Understanding and documenting the potential customer base of a franchisee territory will also benefit the franchisor by allowing them to effectively maximize the potential number of territories in a given market area.

The Goldilocks Problem

Franchisors wouldn't want to "give away" too much territory or on the other hand not provide an adequate customer base.

By understanding the demographic customer potential and using a defined minimum criterion for these customer levels, one can map the optimal number of territories per market assuring that each is sufficient with the potential customer base.

When you need help in creating territories for your franchise, please contact us at:

IntelleVue LLC 11102 East 75th Place Tulsa, OK 74133 Longitude: -95.853451 Latitude: 36.054777

Contact: Jeff Davis 918.250.5561 [email protected]

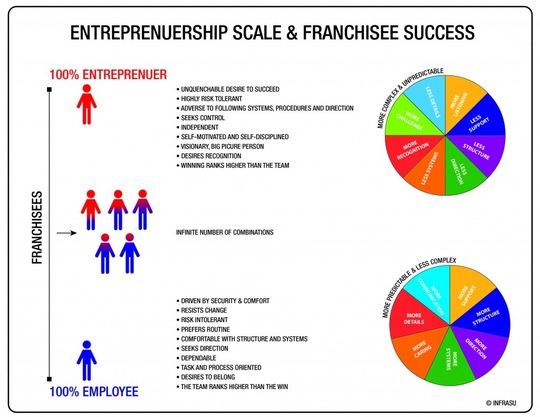

Since the late 1970s franchising professionals have debated whether or not franchisees are entrepreneurs.

The debate still goes on; some claim franchisees are just employees who buy themselves a job, while others claim franchisees are just entrepreneurs who choose to buy a business instead of building one. Some people base their argument on the literal definition of the term "entrepreneur" while others go further and take into consideration its connotations.

You may say that it all boils down to semantics, so who cares, right? Well, all franchisors should care. This is not a philosophical or academic question; it's a strategic and operational one.

The term "Entrepreneurship" is not restrictive and unyielding; instead it's fluid and flexible. In franchising, we must look at this term not as an absolute, but more as a scale, not as the literal definition, but more as the complex concept it captures. And, the success of your franchisees, as well as their ramp-up and satisfaction, depends on how well you understand what the Entrepreneurship Scale means to your system.

Franchisees, like all people, are complex beings--each one holds a different combination of personality traits, experiences, expertise, learning styles, preferences, strengths, weaknesses, beliefs systems, and habits that make them unique. To hold the perspective that all franchisees are entrepreneurs or that no franchisees are entrepreneurs is equally dangerous.

Both premises are oversimplifications that can take a franchisor in a totally wrong direction. Instead, consider that every franchisee falls on a different position on the Entrepreneurship Scale.

Thus their success greatly depends on how well you define and mold your business model, the franchise sales process, the training and support programs and the tools you incorporate in your business so as to address these differences. If you don't, successful results will remain a game of luck instead of one of skill. It's just that simple!

Although franchise success starts with a valid business model, the success of individual franchisees begins with a clear definition of that model as well as of your culture, and furthermore hinges on your proficiency at granting franchises to those people who better match your company. For example, franchisees who are closer to employees on the Entrepreneurship Scale tend to get better results in a company that has a highly supportive culture and a more structured model with stricter controls, clearer benchmarks, and systems.

On the other hand, those closer to the entrepreneur end of the scale will be more productive in less restrictive systems. So, if tight controls are important to you, a person closer to the ultimate employee will be a better match for your company.

The irony and challenge of franchising is that most franchisors search for individuals whose traits are closer to those held by the ultimate entrepreneur. Let's face it, most of us prefer to deal with people who are self-motivated and totally committed to success. These people move faster through the sales process and are quicker to make a decision. Yet, this type of individual is by nature more independent. Think about it, the people who are more likely to invest in your system are the same people who will be most prone to resist the system in which they invest. On the other hand, those people who tend to be better at following your system are less inclined to choose business ownership, and thus to invest in your franchise offering.

Although the success of individual franchisees starts with a good a match, it doesn't end there. No matter how hard we try or how many tools we use to benchmark and select franchisees, there is simply no way to ensure a perfect match every time. After all, we are dealing with people and the reactions of the most predictable of human beings can't be fully anticipated at all times and under all conditions.

This means that franchisees are always going to be a mix, some closer to our ideal combination and some farther away from it. Therefore the success of every single franchisee ultimately rests on how well you adapt your system, training, communications, and support to each individual so as to empower him or her to follow your system as closely as possible.

The ultimate paradox of franchising is that in order to get the consistency and uniformity inherent in franchising, we must use tailor-made training and support systems.

Franchisees who are closer to the ultimate employee end of the scale will require more support, more caring, more direction, and more coaching and communication in order for them to be able to absorb the information and apply it. On the other hand, franchisees who are closer to the ultimate entrepreneur will need less direction, more listening, less structure, and if you want to keep them from deviating from your system, you have to keep a closer eye on them since they will have a greater tendency to do their own thing which can damage your brand and also cause them to fail.

So, does the debate about whether franchisees are entrepreneurs or employees matter? You bet it does! Success in franchising is crafted, not something that just happens by pounding franchisees to follow the system. Understanding the nature of franchisees and how they learn is a crucial step in designing franchising systems that engender success.

The post Are Franchisees Entrepreneurs or Employees? Why Should You Care? appeared first on InFraSu.

For the 5 Most Fascinating Stories in Franchising, a weekly report, click here & sign up.

"He uses statistics as a drunken man uses lamp-posts... for support rather than illumination." - Andrew Lang (1844-1912)

"According to a recent Gallup poll of 994 Franchise owners - 94% of them felt that there franchise business was successful."

Almost 4 years ago, I did some research on one of the more frustrating franchise statistics repeatedly quoted is average income. Nothing much has changed, so I updated it for today. Especially in light of the claim that 94% of franchise operators 'felt' that there business was successful.

Inevitably, this average income of a franchise owner always suggests that the typical franchisee earns $100,000+ per year.

To cite one example, the USA Franchisee Statistics page on www.franchiseseek.com states that

"In 2008 .... over 30% of franchisees earn over $149,000 per year." I recently read a press release citing a similar figure for 2009.

Such a figure falls into the category: "too good to believe".

In a country where the average income is under $50,000 a year and an unemployment rate in range of 10% to 20% range, this figure just doesn't pass the smell test. If we are in a recession, as I believe we are, is it possible that franchised business operations are a safe haven offering a guaranteed substantial income during difficult economic times? Or any economic times?

FranchiseFacts explored this issue in detail as part of its National Franchisee Survey, 2009-2010.

Our survey asked respondents to report if their business was profitable and, if profitable, their profitability over the most recent calendar year (2009).

Our preliminary findings then were that only 3% of respondents earned more than $100,000 over the past calendar year and only 15% claimed to earn in excess of $50,000 a year.

This is quite a contrast to the $149,000 figure cited above. At the other extreme, 61% of respondents state that their business is not profitable!

To be clear, none of this is suggestive of problems in the franchise industry.

The economy has ended an overheated phase where too many people paid far too much for businesses. They financed their businesses rather than starting slow and building through natural growth. Overly optimistic revenue projections were used to justify high operational expenses. These businesses, and their owners, now are saddled with financial obligations that cannot be paid out of current revenues. Consolidations and closures are inevitable.

For the 5 Most Fascinating Stories in Franchising, a weekly report, click here & sign up.

The bottom line for any company is the money: after all, you're in the business to make as much money as possible, and your company can't keep running if you're not at least breaking even. Businesses deal with quite a few different expenses, from paying for their employees to owning a building to acquiring equipment and stock and paying any other taxes and such that are necessary.

It's tough to make enough of a profit to cover all of your expenses, and you want to be able to make enough of a profit to put money into improving your business as well. Equipment needs to be upgraded, more employees need to be hired while others need a raise, stock needs to be increased and improved, and more, but that all requires money as well.

Your business is dealing with finances on a daily basis, spending or earning, paying off bills or receiving checks or determining what to spend when, and that's why financial services are so important for a business. With the right services, business owners can easily get all of their financial information organized and determine how to spend money appropriately at any given time.

With these services, you will know at any given time how much money your business currently has, and you can easily see all of the different trends of spending and earning your business goes through as well. All of that data is used to help you determine when your business should be spending and when it should be cutting back, as well as helping your company make the right decisions in the long run.

Affordable Bookkeeping

Running a business can be incredibly challenging, and having the best possible financial services to help you can be extremely beneficial; however, paying for these services can be another matter entirely, especially considering the implications of spending all of that money on those services.

You already have so many different expenses, and paying full salaries for financial services can be tough to deal with, especially when your business is still fairly new. Bookkeeping involves keeping track of all of your business's finances, which is a very complex and involved task, and affording your bookkeeping can be difficult enough.

Along with accounting, affording your bookkeeping can be incredibly challenging to deal with when it comes to your business's finances. Accounting takes all of that bookkeeping data and uses it to help you make the right decisions for your business financially, helping you spend all of your money on the necessaries in your business along with determining where you can allocate any of your remaining funds.

Accounting can help you determine whether you should be cutting back and budgeting or you can spend more money on improving your business, but you can't get accounting without good bookkeeping. If you are having trouble affording your bookkeeping, you may think a better alternative arises through doing your own bookkeeping, but it's not very viable.

Many business owners believe they have no choice and end up doing their own bookkeeping while running their business, only to run into problems by focusing too much on one task or another. Falling behind on bookkeeping can be bad enough as your business needs that data to be financially efficient, but what if you aren't focused enough on running your business.

You need to be at the helm of your business taking it in the direction you want, and you can't do that while you're simultaneously running a business. You need a better way to go about affording your bookkeeping for your business.

What Remote Bookkeeping does for You

Outsourcing your bookkeeping can be considered one of the best choices for a business, as you can get the financial services your company needs at a reasonable rate and there are countless other benefits to remote bookkeeping as well. Outsourced bookkeeping services means you're affording your bookkeeping and not having to worry about any other issues financially.

Outsourced bookkeeping is simple: you get your pick of financial services, bookkeeping and more, and the remote bookkeeping business completes everything for you remotely and electronically. All of your data is easy to access and extremely secure on high speed, well-running servers used by the outsourced bookkeeping business.

The server used is very safe, following cyber security laws to the letter and using resources like cloud to store and transfer data effectively. There are also countermeasures in place that allow remote bookkeeping businesses to completely ensure that no matter what, your data is as safe as possible, like a cyber insurance policy.

Offsite backups are also used to ensure that your data is secure virtually and physically, backing up your data on a data center and server that are both separate from the original.

Outsourced Bookkeeping

Outsourced bookkeeping businesses also offer a huge variety of services so you can get any and all of the financial services your business needs for a fraction of the price, making it easy to go about affording your bookkeeping.

You can get CPA (certified public accountant) services, like getting your reconciliations completed and checked, getting preparation for your taxes every year, getting your bills paid for you, and more. You can get financial reports sent to you; get irregularities in your bank account flagged, getting bankruptcy services, getting audit/forensic accounting, and more, all making life easier for your business.

It's easy to see how you can afford your bookkeeping; in fact, compared to in house bookkeepers and CPA's, you save tens of thousands of dollars on a yearly basis! In house bookkeepers can cost up to $43,000 a year, and CPA's and other accountants normally cost even more than that, meaning it costs you almost six figures to get just bookkeeping and accounting.

With remote bookkeeping, you can get bookkeeping, accounting, payroll services, and any other services your business needs at a low rate of $19,500 a year, saving you a huge amount of money.

The low price of remote bookkeeping is $3,600 a year, so it's easy to see how affording your bookkeeping can be easily accomplished through remote bookkeeping. To learn more about outsourcing your bookkeeping through companies like Remote Quality Bookkeeping™, click here.

The post How affording your Bookkeeping can be Easy appeared first on Cloud Bookkeeping Services|Remote Quality Bookkeeping.

For the 5 Most Fascinating Stories in Franchising, a weekly report, click here & sign up.

Recently I wrote about What To Do Before Buying A Franchise and I suggested a couple of questions that you could ask yourself before deciding if franchising, as well as business ownership, made sense for you.

I pointed out that it takes skills to operate a business or a franchise and I also said that franchisors will teach franchisees the skills needed to succeed in business -- of course, that's relative to the franchisor and the situation. Remember that not all franchisors are created equal; some do a better job than others when it comes to training and other operational issues.

The Must-Have Skill

But then I said there's one skill that can't be taught. In fact, this skill will make or break your success in franchising. Without this skill you do not have much chance of succeeding in franchising and, in fact, without this skill you should not invest in any franchise.

What's the skill?

The ability to follow direction!

Sounds simple, doesn't it? But not everyone possesses that skill.

Is THAT A Skill?

In fact, some people would argue that that's not a skill. Call it what you want (it's a skill!) if you don't have it, you're not cut out for franchising.

If you're a regular reader of this blog, or you've read my books, or you've heard me speak about franchising at a public forum or over the airwaves, you know that I've described franchising as a series of systems.

It's All About Systems

Systems lead to success in business and especially in franchising. There's a system for marketing. A system for sales. A system for operations. If a franchisor doesn't have these systems, do not invest in that franchise!

Even if the franchisor has the systems, no matter how good they are, if you don't have the skill of following direction, do not invest in that franchise, or any franchise!

Franchisor May Say "No"

If you do lack the skill, hopefully a franchisor will discover it and not accept you as a franchisee -- but, once again, not all franchisors are created equal. Some need the money that comes from selling franchises, so they may let you slip by and hope for the best.

If you cannot follow direction (or you just don't want to), how do you expect to succeed in a franchise? If you're the type of person who wants to reinvent the wheel, or you need to ask Why? when you're told to do something, franchising isn't for you. Franchisors know that -- now you do, too.

For the 5 Most Fascinating Stories in Franchising, a weekly report, click here & sign up.