-

Franchise concepts with Item 19 FPRs insufficient to estimate cash flow are ruled out.ROIC calculations within the range of 3 to 5 years franchise investment payback are ruled in.There are over 3000 franchises offered for sale in the United States.Only 40% or less of franchisors include the optional Item 19 FPR in their FDD.And the as competition increases in franchising more franchisors are including an Item 19 FPR or improving the quality and depth of financial disclosure they provideSmart and savvy franchise buyers see little reason to spend time on potential franchise investments with franchisors who cannot or will not provide financial performance evidence proving that their franchise is investment grade.If you are a franchisor without an Item 19, you are at a real competitive disadvantage.So, give me a call to chat how we can help you with your Item 19.Print leads were different from internet leads.It used to be that a print lead would phone you after seeing your print ad.While on the phone with the prospective purchaser, you had to qualify them financially.You also had to separate pretenders from the contenders. In restaurant franchising, the pretenders would often want to know if we would come and "look at their site". "Well, not until we are in the site selection phase - which happens after you sign the franchise agreement."

Prospects were easier to qualify because they phoned you.

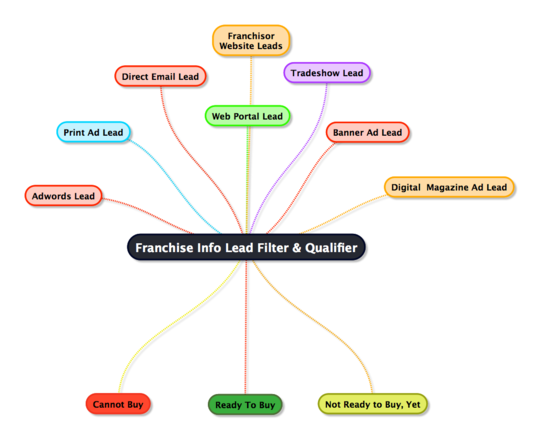

But over the last ten or eleven years, internet leads have replaced print leads.Qualifying leads has grown exponentially harder for two reasons:

1. There many more internet leads.2. It is very hard to get the internet lead on the phone.I have spent many years reviewing a franchise sales programs - from the time when all the leads were print to now, when most of the leads are digital.I have always found the same thing.Leads can be sorted or segmented into three groups: Cannot Buy, Ready to Buy & Not Ready to Buy, Yet.Internet leads are much harder to segment because it takes so much time to get in contact with the lead.We have developed some ad hoc systems to handle this problem, but we weren't really happy with this solutions performed.For example, telephone verification was either too costly or they did not sort the groups properly.Early in 2013, we started experimenting with an entirely new system - one that relied upon some sophisticated autoresponder rules.We can classify a lead into: cannot buy, ready to buy, or not ready to buy, yet based on how the lead would respond to our messaging sequence.Best of all, it was a great combination of human verification & autoresponder technology.We are confident that we can help you sort out your franchise lead problems.So, give me a call to chat about your franchise lead problems.Nobody with any common sense will believe that having a tattoo helps you manage your franchise owners.It is a silly idea.But, here is what is not silly:Asking your franchise owners to get a "tattoo".What are they willing to commit to?Here is Barry Nalebuff giving a great example of a commitment device- Get a Tattoo, for me.For the 5 Most Fascinating Stories in Franchising, a weekly report, click here & sign up.

If you've ever trained a puppy, you learned how to negotiate. SIT! Good boy. Here's a treat. That's negotiation.We negotiate with our KIDS every day. "If /when you finish your veggies, you can have the ice cream." That's negotiation.And what about our spouses? "Honey, if I go out to the paint store and pick up the paint, will you paint the kitchen?" That's negotiation.Point being while negotiation is thought of as a SALES SKILL, it really is an everyday life skill we use a lot more than we realize.There are some areas that are non-negotiable. For example, try getting a discount at a department store. Unless it's on sale, the price is the price. In some industries, negotiation is the norm - real estate for example.What about a car? It's a known fact there's a window sticker price and the price that you pay; a negotiated price.That's an 'up front' negotiation. It's expected. And sometimes it doesn't go well. One side won't budge or won't negotiate to your satisfaction, so someone loses. Usually both parties.

One side won't budge or won't negotiate to your satisfaction, so someone loses. Usually both parties.

For negotiation to be successful, both parties need to feel good at the conclusion.

But if you're in sales, price cutting can be a daily negotiation.

Tips to make you better at negotiating:1. Never, ever discount the price right off the bat. Often a price cut will get the salesperson more excited than the prospect. You may think going in with a lower price will make the prospect grateful and give you an easy 'go' right away. It usually won't. If they take your offer of the lower price, that indicates they might have taken it at the rate card price which is where you SHOULD be quoting from to start with.2. When you talk price be strong and confident. A weak or hesitant delivery makes the salesperson sound soft. Then the price sounds soft and thereby invites a lower offer.3. Delay giving concessions until the end of the conversation. A concession given too early is just a 'giveaway.' Save it for closing the sale by saying, "That's an interesting idea. Let's come back to that a bit later."4. When there is a request for a price concession, have a nice way to reject it. Just because they have dealt with other weak salespeople doesn't mean you need to be that way. We can use a very effective, "I wish we could; however, that's not an option we have" technique. Or you can say, "Since you only have $4,000 and the project is $5,500, we can work to remove a few parts of the package."5. Never underestimate your strength in a negotiating situation. Some prospects assume a salesperson is in the position of weakness. If you fall for that, that will weaken your resolve and soften your backbone. Understand this: If the prospect is bargaining with you or even discussing the proposal with you, that's an indicator of interest; a buying sign. Their actions are telling you without saying it outright you have something they need or want.6. When do negotiations begin? When you say hello. Negotiations, in general, are ongoing all day long at work and at home. And it's often a subtle thing. Recognizing you're constantly involved in negotiation gives you an advantage. Be aware that life itself is a series of negotiating situations. You often are negotiating without realizing it.7. Avoid goodwill conceding. (Thank you Gavin Kennedy - Everything is Negotiable for this concept.) The principle of "goodwill conceding" is this: The salesperson thinks that if they are nice and give a price concession to the other side, the other side will reciprocate with a concession back to you. In other words, they'll buy.Nice idea. Only it backfires with a professional buyer. What they do is take what you offer and try to get more. (After all you're giving things away.)8. When you give - GET. When you do give a price concession, use the 'if/then' technique so that you get something in return. "Mr. Jones, if I can get you the widgets at that price, is you able to give me the go-ahead today (or can we do business today)?" or "Mr. Jones, if I can give you that price, can I get a referral from you?"There are dozens of other "gets" when you give. Salespeople don't mind giving when they are getting something in return. But perhaps the most important reason to take something back when you give a concession is this: It puts a 'price' on your concession. No longer are concession requests free. By asking for something in return, it keeps you from getting additional requests for concessions.9. Why is it important to be a good negotiator? Because a bad negotiator leaks dollars and reduces the all important profit to the company. Profit is what's needed to run a company. No profit, no company.Now, one closes suggestion: Whenever you can, substitute the word 'investment' for the word price. In most cases, the prospect is making an investment, and a good one at that.For the 5 Most Fascinating Stories in Franchising, a weekly report, click here & sign up.

Nancy Friedman is a featured speaker at franchise, association and corporate meetings. She has appeared on OPRAH, Today Show, CNN, FOX News, Good Morning America, CBS This Morning & many others. Nancy is the author of 8 books on sales and customer service and is the spokesperson in the popular DVD customer service training programs. For a demo of Nancy call 314-291-1012 or visit www.nancyfriedman.com.

Overview:-

Activists shouldn't have been surprised by the Red Lobster sale to private equity.Darden missed opportunities over time.

- Some Red Lobster levers for improvement exist.

To any close observer of the ongoing Darden (DRI) conflict as it has unfolded with its opponent activists Barington, and Starboard since late 2013, a Red Lobster sale to private equity was not a shocking outcome.

Consider:Private equity has dry powder--unallocated funds-- available that it must put to use to earn a fee. Golden Gate had owned three restaurant brands and continues to own one, California Pizza Kitchen.Darden, which was in trouble since at least 2007 trying to hit a 15% EPS model with the mature Red Lobster and Olive Garden restaurant brands, bought a lot of restaurant concepts at high price in 2008-2013, and wound up with a lot of debt. As the rate of casual dining traffic decline fell after the Great Recession, (Darden noted the casual dining overall space traffic fell 18% versus the peak) and core earnings fell, it had both dividends and buyback demands going up at the same time. A true cash flow squeeze resulted.Darden had remodeled the entire Red Lobster chain by 2013 and needed to get some money out of its investment. (Why it remodeled Red Lobster first versus Olive Garden is a fascinating question.)Red Lobster had underlying real estate that could be levered to lower the effective Golden Gate purchase price.The question, is what now to do with Red Lobster? What are the "Lobster Levers"?On the positive side, the brand ratings are not weak. It ranks roughly in the middle of the pack via the 2014 Brand Keys Customer Loyalty index but near the top of the 2013 Q4 Goldman Sachs Brand Equity Survey. The downside is there are no other national seafood players to steal market share from. Bonefish (Bloomin Brands) (BLMN) is just growing and Joe's (Ignite Restaurant Group) (IRG) has built its own crab niche.It's not going to work its way out of trouble with more $10 television advertising that it has been pounding way with this week. It's going to have rent to pay. Darden has noted Red Lobster's customer base indexes older and lower income than the most desirable casual dining peers; it's got 706 units in an overbuilt US restaurant space. Keeping the same units and doing the same thing won't solve anything.But what it can do is the following:Close some units. Now that it is private and protected from the intense investment community focus on every metric, it can examine its store base. Note that American Realty executed sale leasebacks on 500 of the 706 units. A number of units were excluded for a reason, some were leased, some undesirable to do so.Red Lobster reached its unit count peak in the US in 1996, at 729 units. It then closed 75 stores over the next four years, to arrive at 654 units in 2000, to then slowly grow again until 2013. The natural US unit cap seems to be much smaller than 700. A privately held company can work this.With a rather low 9% reported adjusted brand EBITDA, the law of large numbers is there must be a number of units that are in the lower profit quadrant that upon closure, could result in positive cannibalization, and will improve the overall brand average profile.Test and rebrand. Maybe because it was part of the central heritage of Darden, other than remodeling or wood grilling, there has been no real new concept ideation for years. A self serve Red Lobster lunch platform and Red Lobster/Olive Garden combo stores were tested recently and were a total waste of time and money. Such poor quality tests are indicated of a big concept ideation problem. Too much seafood on the menu and a very low level of alcohol sales are indicative of the problems.Work international. All of its peers are. Darden just began a brief foray into ex-Canada international and franchising in 2013. As late as 2013! Missing the international opportunity was a great strategic flaw. The US is filled up with restaurants. Can't Red Lobster work internationally, somewhere?Work franchising, joint and limited partnerships. Darden's problems with franchising went all the way back to a failed franchised venture in the 1970s. Franchising is difficult, well funded and capitalized franchisees have to be found. Darden said they didn't have the expertise. But it can be found. A new management mindset embracing franchising has to be developed. It can work in casual/fine dining: Ruth Chris (RUTH) has had 50% of its stores franchised to solid players forever, and Cheesecake Factory (CAKE) is working franchising and joint venture partnerships to get its international growth jump started. The Cheesecake founder, restaurant operator, David Overton "got it", but not Darden.Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.During the heart of the 2008 economic downturn I was the manager of the Franchisee Assistance Program for a large sandwich restaurant chain.My job was to work with distressed franchisees to help them put together a plan to save/fix their businesses.Unfortunately most people reached out to our team when it was already to late: they often had accumulated a lot of debt and their weekly sales could not support their costs.Our options to help our franchisees were limited and to their dismay we were unable to give franchisees cash or reductions in fees to help them solve their issues.The following are some take always from that time and my interactions with our franchisees:-

Know when to say when:

-

Don't wait until you have already lost a lot of money to try and turn it around. If you start to notice a downward trend take proactive measures immediately.Often times people would reach out to our program as a last resort when it should have been their first call. As a franchisee you should know and avail yourself of all the support that your franchisor offers.If you are going to buy a franchise and make that kind of investment; you need to push yourself to achieve great success but also set an amount you can afford to lose. If you hit that loss amount then you need to take action and close your business. You are responsible to yourself and your family; don't let your business go from a calculated risk to a financially devastating life event.I was constantly amazed talking to people who were thousands of dollars in debt, had given up on their business, but were not doing anything to shut it down or fix it. They were business zombies going through life accruing more debt every month with no end in sight.Franchisees cannot abdicate their responsibility for their success to the franchisor:

-

You are the business owner and financially responsible for your it's success or failure.

-

It is your name on the lease and the loans.It is your credit rating that will be hurt if you default on your obligations.It will be you that is paying off this mistake for years to come if you don't make this work.The franchisor is responsible to give you a system and a model to run a business and to help you help yourself.

-

Help you help yourself is one of the core concepts of franchising. Here is a business in a box, now you focus on execution.I can't tell you how many people I spoke to, that spent all of their energy focused on how their franchisor had: lied, cheated, and manipulated them, instead of taking some action to solve their problems. It is hard to look in the mirror and and accept that you aren't doing well but it doesn't change the fact that you aren't doing well and something needs to change.Here is an an example of abdicating responsibility; I would ask distressed franchisees what marketing they were doing and they would site their ad fund contribution.

-

Those of you in a franchise system know that very few companies can do national advertising every single month. If you are lucky they have several events a year.National advertising is a big plus of becoming a franchise owner, being able to pool your money with all of the other franchisees to get more exposure is a big appeal of franchising but that can't be your only marketing.Local store marketing is a bigger factor in individual location success than national advertising.If you don't want to local store market then don't own a franchise.Don't buy a franchise in an industry that you don't have any experience or access to experience in:

-

Everyone thinks that they will just hire a manager. That is fine until the manager quits or gets fired and then for some period of time you are running your business.If you are interested in owning a restaurant; before you buy the franchise you should go work in a similar restaurant for 6 months to a year to learn on someone else's dime.I was constantly surprised when I would talk to franchisees that weren't restaurant people who were surprised at how hard running a restaurant was.When times are tight cut the right costs:

-

If your business is really slow and you are having a hard time breaking even or you are loosing money, you need to cut the right costs.

-

Don't cut:

-

Bookkeeper - that was an expense that most people would cut first because their bookkeeper was giving the franchisee bad news. You need to know your businesses finances.Cleaning service - unless you are willing to clean your restaurant as well and as frequently as your cleaning service don't cut them. Dirty restrooms are the fastest way to sabotage your current business.Local marketing efforts - don't cut them completely, you can change them if they aren't working.Costs to reduce:

-

Ask your landlord for a temporary rent reduction or some relief. The property managers will want to see your plan for growing your business and a reasonable time frame for execution.Manage your variable costs tighter, specifically food and paper cost. Conduct more inventories and do your best to forecast your needs on a weekly basis trying to reduce waste and excessive stock.Labor: take a pay cut if you are paying yourself. Manage your shift labor tighter - cut people when it gets slow or better yet use those labor dollars to do more work. Send your employees out to coupon cars or drop off catering menus at local businesses. No one should ever be standing around when they are on the clock.There is so much that goes into running a successful franchise business.These points were based on my personal experience working with our franchisees and they may not be applicable to your situation. I hope they were helpful to you. If you have any questions, please feel free to email me through LinkedIn,If you are a restaurant owner or manager, my company has developed an operations and sanitation inspection tool named Mobile Inspector.I invite you to watch a short two minute video at http://mobileinspector.bizHere are the top cusotmer service solutions we teach, train, and practice to perfection at the Telephone Doctor.

-

Be a DOUBLE CHECKER.Learn to use those words. Everyone loves it when you double check something for them. Even if you're pretty sure the item is out of stock or the appointment is filled or there's no room available, it sounds so good to hear, "Let me double check that for you."

-

PRETEND IT'S YOUIf you're working with a customer, either on the phone or in person, and they need something, pretend it's you. What would you want to have happen? What would make you happy? What would make you satisfied? Here's a great place to remember the golden rule: "Do unto others as you would have them do unto you."

-

GET INVOLVEDLet your customer know you're on their team. If you're ringing up a purchase for someone, mention how nice their choice is. If you're helping someone with a trip of some sort get excited with them. When customers feel as though you're part of the package they love it.

-

STAY FOCUSEDEye contact is critical in delivering excellent customer service. Heads that turn on a spindle and look everywhere but at the customer get very few good marks in customer service. Eye contact shows you are listening. If you're on the phone, eye contact is definitely difficult. We can, however, learn to stay focused on the phone. Don't type unless it pertains to what you are doing. Don't read something while you're on the phone with a customer . . . STAY FOCUSED on the caller. We need to stay focused without eye contact.

-

DO SOMETHING EXTRA.There's usually always 'something' you can do for the customer that's extra. In most of the cases it won't even cost very much. Example: Keep a stock of penny lollipops for kids when they come into your store with the moms. Or a balloon. Or coloring books. Spend a few dollars if you have the budget for those "giveaways." Nail clippers . . . key chains . . . customers LOVE that something extra, oddly enough, even if they can't use it. The thought of getting something FREE is very special to the customer.

-

SHOW YOUR TEETH.(In Telephone Doctor language that means to smile.) There are many people who think they're smiling, but aren't. So Telephone Doctor's motto is: SHOW YOUR TEETH. Smiling is one of the best customer service techniques there is. It's so frustrating to walk into a store, or call some place and not see or hear a smile. (And, yes, you can hear a smile!)

-

ASK QUESTIONSA super way to offer superior customer service is to ASK QUESTIONS. Build on what the customer is talking about. Listen for one or two words that you can ask something about. Even a simple, "Tell me more," will work. Once the customer is talking, you will be able to help them much better.

-

USE COMPLETE SENTENCESOne word answers are semi-useless in customer service. And one word answers are definitely perceived as RUDE. "Yes," "no," and the like, tell the customer "I'm not really interested in you or what you need."

-

CAREMost people have what Telephone Doctor calls the CARE GENE. Some of us use it more than others. We just forget we have it. Learn to CARE what your customer's needs are. CARE what they are referring to. CARE about your customers and they will take CARE of you.

-

LAUGHTERLaughter will lighten the load. Everyone likes to laugh. Some even in the darkest moments. Take the time to laugh and enjoy your customers.Put any one of these Telephone Doctor customer service skills and techniques tips into action and watch what happens. They intertwine with each other and make customer service special. Use all ten and expect more business.Ask us about our instant customer service, team building, conflict resolution, leadership and communication training library.Anyone can talk about customer service, but only the Telephone Doctor can train your staff.When you need customer service training, get it from a training company.

Nancy Friedman, president of Telephone Doctor Customer Service Training, is a Keynote speaker at association conferences, franchise and corporate meetings.

You need her to inspire you to better customer service. She has inspired thousands to do better & she can help you too.

So, call Nancy at 314‑291‑1012 to book her for your next Keynote, or visit her on line at www.nancyfriedman.com.

The Franchise sales process has changed since I began over 20 years ago.Back when I started out, people interested in franchises used the telephone to inquire and request information.Because they saw our ads in the Wall Street Journal or some other important franchising magazine.We talked to them and sent our info packets out through the mail or UPS NextDay. The sales process had begun.But, today franchisors are building costly & elaborate franchise recruitment websites.

-

-

-

-

-

-

-

-

-

-

-

-

-

May 2014 Archives

Kudos once again go to Popeye's Louisiana Kitchen Inc. (PLKI) not only for a good Quarter One 2014 earnings results reported just last evening, but also for continuing the practice of being the only publicly traded restaurant franchisor that I'm aware of that reports its franchisees cash flow proxy number.

Popeye's reports franchisee EBITDAR--earnings before interest, taxes, depreciation and rent.

It's only a semi useful metric, as it misses rent and related expense, but also debt service and capital expenditures (CAPEX). Depreciation expense is an inperfect proxy for CAPEX.

In the first quarter of 2014, Popeyes franchisee community had an EBITDAR of 21.3%, compared to a 20.1% for the prior year. Franchisee same store sales were up 4.3%. Many more costs and expenses need to be subtracted to arrive at franchisee real economic gain, but at least it is some number.

Popeye's EBITDAR number is about 3.7% percentage points better than the GE Capital QSR survey sample published earlier this spring. Of course, you have to look at both dollars and percentages, per store to analyze fully.

Other franchisors do not want to talk about franchisee numbers. They don't have them, or the numbers are not good. Sometimes, franchisors are afraid and don't want to know them. But in any case, they should have them or should care.

Compare the Popeye's treatment to that of an article published by The Street's Laurie Kulikowski last week timed for Small Business Week.

Titled "Looking for an Investment-- Here are Eight of the Best Franchises". The Street collaborated with a franchise survey group that surveys franchisee satisfaction.

Not a single point of "return on investment" data or quantification was listed, despite that the survey had a "financial return satisfaction metric".

Satisfaction is nice, but what about making money? Not a useful article.

Sloppy staff work perhaps. But the franchisor should have the numbers. You manage what you measure.

Or, as my first boss in QSR operations drilled: "It's not what you expect, it's what you inspect."

Smart and savvy franchise buyers almost always ask for your Franchise Disclosure Document - FDD at the outset when they contact their target franchisors.

Or they get the FDD from another source before inquiring directly to a franchisor.

There are 23 Items in the FDD.

The franchise buyer initially is looking at Item 7 Estimated Initial Investment and Item 19 Financial Performance Representation - FPR of the franchise concepts they are vetting.

Item 7 Estimated Initial Investment gives the prospective franchise buyer a high & low range for the investment.

Item 19 FPRs or what prior to 2008 was called an Earnings Claim provides franchise concept financial performance information.

The franchisor must have a reasonable basis for their Item 19 FPR.

Item 19 FPRs come in a variety of formats and level of financial detail can range from a minimal gross sales representation to full blown profit and loss statements.

Great franchise buyers use the Items 7 and 19 combination to develop a basic return on invested cash - ROIC calculation.

This preliminary ROIC calculation helps rule in and rule out franchise concepts for further consideration.