●listening to what your audience is saying; and

●responding in a positive way.

1. Take Advantage of $500,000 Section 179 Deduction for New or Used Assets

For tax years beginning in 2013, the maximum Section 179 deduction for eligible new or used assets other than heavy SUVs is a much larger $500,000.

For instance, the larger $500,000 limit applies to Section 179 deductions for things like new or used machinery and office furniture, computer equipment, and purchased software.

As explained earlier, the up-to-$500,000 Section 179 deduction privilege is also available for new and used heavy long-bed pickups and new or used heavy vans.

Warning: Watch out if your business is expected to have a tax loss for the year (or close) before considering a Section 179 deduction. The reason: You cannot claim a Section 179 write-off that would create or increase an overall business tax loss. Contact your tax adviser if you think this might be an issue for your operation.

2. Benefit from Bonus Depreciation for Other New Assets

Your business can claim 50 percent first-year bonus depreciation for qualifying newequipment and software that is placed in service by December 31, 2013. Used assets do not qualify. For example, this tax break is available for new computer systems, purchased software, machinery and office furniture.

There is no business taxable income limitation on bonus depreciation deductions. That means 50 percent bonus depreciation deductions can be used to create or increase a net operating loss (NOL) for your business's 2013 tax year. You can then carry back the NOL to 2012 and/or 2011 and collect a refund of some or all taxes paid in one or both those years. Contact your tax adviser for details on the interaction between asset additions and NOLs.

Deadline: The December 31 placed-in-service deadline for assets eligible for 50 percent first-year bonus depreciation applies whether your business tax year is based on the calendar year or not. So time is growing short if you want to take advantage.

-

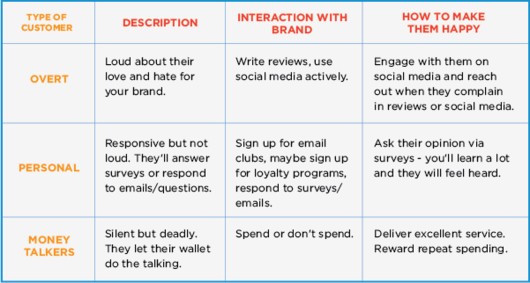

The Overt customers are the ones that post on social media, tell their friends where to go and are generally "the loudest". They want to feel appreciated when they share love for your brand.The Personal customers are the ones who will communicate with your brand when you reach out to them. They tend to be the most engaged email subscribers, enroll in loyalty programs, answer surveys and claim promotions.The Money Talkers let their wallet give all the feedback they need.The key to identifying who customers are and what they want is collecting data on them. You can start collecting data immediately:

- Send a feedback survey via email to your email subscribers

- Invite people to try a new menu item

- Run a promotion for your social media fans only

More data = better segments.As you collect more customer contact information and additional data on who these people are, you will start to see some trends and consistencies - these will comprise your customer segments.It's easy to fall down a rabbit hole and make arbitrary segments so, when you get to creating your segments, it's important to think about the drivers of your business first.For casual dining businesses, increased online engagement increases the average frequency of visits. You should create segments that help you understand how to engage that segment to do what will drive your business.Segments for casual dining restaurants that can encouraged to come more frequently might be:- Facebook Fan + has spent money in-store before

- Filled out a survey + on email list

- Enrolled in loyalty program + social media follower + has been to website in the past month + filled out a survey

There are nearly unlimited different segments you can create and maintain, the key is starting somewhere and tailoring as you go. Once you create segments, you can send targeted and custom messaging that relates to what that segment cares about. They will appreciate the tailored messaging and you will benefit from them coming and giving you more of their business.

There are nearly unlimited different segments you can create and maintain, the key is starting somewhere and tailoring as you go. Once you create segments, you can send targeted and custom messaging that relates to what that segment cares about. They will appreciate the tailored messaging and you will benefit from them coming and giving you more of their business. To see how Privy can help you create and maintain segments, click here.

To see how Privy can help you create and maintain segments, click here.

To see how On The Spot Systems can help you collect in-store surveys and apply them to your segments, click here.

It's not too late. You can still take steps to significantly reduce your 2013 business income tax bill.Tip #1: Buy a Heavy SUV, Pickup, or Van before Year's End.While buying a big SUV, pickup, or van for your business may not be seen as politically correct because of the gas the vehicles use, the fact is they are useful if you need to haul people, equipment and materials around. They also have major tax advantages.

To see how On The Spot Systems can help you collect in-store surveys and apply them to your segments, click here.

It's not too late. You can still take steps to significantly reduce your 2013 business income tax bill.Tip #1: Buy a Heavy SUV, Pickup, or Van before Year's End.While buying a big SUV, pickup, or van for your business may not be seen as politically correct because of the gas the vehicles use, the fact is they are useful if you need to haul people, equipment and materials around. They also have major tax advantages.- Thanks to the Section 179 deduction privilege, you can immediately write off up to $25,000 of the cost of a new or used heavy SUV that is placed in service by the end of your business tax year beginning in 2013 and used over 50 percent for business.

- For a heavy long-bed pickup (one with a cargo area that is at least six feet in interior length), the $25,000 Section 179 deduction limit does not apply. Instead, the "regular" Section 179 deduction limit of up to $500,000 applies, as explained later in this article. The same is true for a heavy van that has no seating behind the driver's seat and no body section protruding more than 30 inches ahead of the leading edge of the windshield.

- Thanks to the 50 percent first-year bonus depreciation privilege (more on that later), you can write off half of the business-use portion of the cost of a new (not used) "heavy" SUV, pickup, or van that is placed in service by December 31, 2013 and used more than 50 percent for business.

- After taking advantage of the preceding two breaks, you can follow the "regular" depreciation rules to deduct whatever is left of the business portion of the vehicle's cost over six years, starting with 2013.

To cash in on this favorable tax treatment, you must buy a "heavy" vehicle -- one with a manufacturer's gross vehicle weight rating (GVWR) above 6,000 pounds. First-year depreciation deductions for lighter SUVs, light trucks, light vans, and passenger cars, are much less. You can usually find a vehicle's weight rating on a label on the inside edge of the driver side door where the hinges meet the frame.Example 1: Your business uses the calendar year for tax purposes. You buy a llnew $65,000 Cadillac Escalade and use it 100 percent for business between now and December 31. On your 2013 business tax return or form, you can write off $25,000 of the cost thanks to a Section 179 deduction. Then, you can use the 50 percent first-year bonus depreciation break to write off another $20,000 (half the remaining cost of $40,000 after subtracting the Section 179 deduction).Finally, you can follow the regular depreciation rules to depreciate the remaining cost of $20,000 (the amount left after subtracting the Section 179 deduction and the 50 percent bonus depreciation deduction), which will generally result in a $4,000 deduction for 2013 (20 percent times $20,000). Overall, your first-year depreciation write-offs amount to $49,000 ($25,000 plus $20,000 plus $4,000), which represents a whopping 75.4 percent of the vehicle's cost.In contrast, if you spend the same $65,000 on a new sedan that you use 100 percent for business between now and year end, your 2013 depreciation write-off will be only $11,160.Example 2: You operate a calendar year business for tax purposes. You buy a used $40,000 Cadillac Escalade and use it 100 percent for business between now and December 31. With a Section 179 deduction on your 2013 business tax return or form, you can write off $25,000. Then, you can generally deduct another $3,000 under the normal depreciation rules [20 percent times ($40,000 minus $25,000) equals $3,000]. Your first-year depreciation deductions add up to $28,000 ($25,000 plus $3,000). In contrast, if you spend the same $40,000 on a used light SUV or a used regular passenger car, your maximum 2013 depreciation write-off will be only $3,160.Example 3: For tax purposes, your business uses the calendar year. You buy a used Dodge Ram heavy long-bed pickup for $35,000 and use it 100 percent for business between now and year end. On your 2013 business tax return or form, you can write off the entire $35,000 thanks to the Section 179 deduction, assuming you have no problem with the business income limitation rule explained later. (The $25,000 Section 179 deduction limit that applies to heavy SUVs doesn't apply to heavy long-bed pickups.) In contrast, if you spend $35,000 on a used light pickup, your maximum 2013 depreciation write-off will be only $3,360.Parts 2 and 3 to come next week ...If you want to chat about your year end planning, connect with me on and LinkedIn and let's see what you can do for you.The best exit strategy is one that has unfolded over the course of years. It is never too early to begin an exit strategy. You should have had one on the day you signed your franchise agreement.In addition, you should review your goals annually. Part of the review should focus on your exit timing. If you think now is the time to exit then you must honestly ask yourself how motivated you really are to sell. Like any big project, you will need to devote time, money and effort to do it properly.Most small business owners, however, worry more about building their business than selling it and never plan their exit. Be assured, it's never too late to develop a plan.After making the decision that now is the time to exit you need to accomplish three critical things before placing your business on the market.1. Discuss Your Exits with Your Franchisor.First, you should discuss with your franchisor what your plans are. All franchise relationships eventually come to an end. You are not the first and won't be the last franchisee to exit your system.You have used the franchise system, brand, and people to build your business. Don't be afraid to use them to exit. They have a

critical interest in a successful transition. Use them to help you close the deal.2. Gather your Documentation.Second, you need to gather documentation and clean up any inconsistencies, errors or omissions in your paperwork. The list is extensive and you can never have too much documentation.Buyers will take lack of documentation or documentation they have to fight to get as a sign of trouble and it will break down the trust between you. Not only will it potentially affect your value, it will cause unnecessary delays.In a small business transaction the trust between the buyer and seller is critical. Without trust the deal will not happen. The way you can build trust is by having all the documents readily available for any buyer who is serious about making an offer.You need to tell a story to the buyer, and that story has to be validated by documentation.3. Look for Financing Options for the Buyer.Finally, you should see what if any financing will be available for a buyer. This should be done before you even list your business for sale. Talk to your business broker, attorney or accountant to get some recommendations on financing sources to pre‐qualify your business.Not only will this make it easier to sell the business, it will be a great reality check on your price. If the price can't support financing, then maybe you shouldn't sell until the business grows into the price you want.Buyers of small businesses always have to make a leap of faith, similar to the leap you made when you got into the business. You need to convince the buyer why this transaction makes sense.If you are really ready to sell, have prepared a well organized and thorough package, and have pre‐qualified your business for financing, you will have a better chance of selling your business on your own terms.When you are ready to think about selling your franchise, connect with me on LinkedIn and give me a call.While HR mistakes, thankfully, usually are not fatal, they can create serious consequences for an franchise owner.Here are seven common mistakes that are easy to avoid while creating a lawful and more satisfying workplace for your employees:- Hiring someone as an independent contractor who should really be classified as your employee. Tread carefully when hiring workers because the IRS, US Department of Labor and many states are teaming up and scrutinizing employers more closely than ever. If you control how someone does the work, as opposed to merely the results, the person is likely your employee. If you provide the tools and equipment, the person is likely your employee. If the person is doing work that is intrinsic to your business, the person is likely your employee. If you re-hire someone "as a consultant" to perform the same work they use to do for you as an employee, the person is, once again, your employee.

- Changing or creating a policy but not communicating it properly. What is the point of having a policy if those it affects don't know about it? It sounds silly but sometimes the crucial communication piece gets neglected or is incomplete. The best policies provide clear guidance and information and help employees and managers alike by communicating expectations across the organization. Trying to enforce a policy that an employee didn't know about won't hold up in court. Expecting supervisors to enforce policies they don't fully understand is counter-productive. Train all supervisors and all employees about all of your policies.

- Allowing bad behavior because someone is your star consultant or best salesperson. If you let anyone get away with bad behavior, that behavior will escalate and you'll soon have a morale problem on your hands or the bad behavior may spread among others. Promptly discuss the problem with the person and explain that it must change. Sometimes a person does not realize the effect he or she has on others so pointing it out may be enough to put a stop to it. If not, you'll need to explore stronger measures and consider whether it's really worth the additional problems to keep this person on staff.

- Hoping employee complaints will go away if you ignore them. Employee complaints, whether regarding safety, sexual harassment or assertions of discrimination don't just resolve themselves. Take all complaints seriously, investigate promptly, and take appropriate action, if warranted. Be sure that your efforts to correct any problems do not make working conditions worse for the complainant. That could quickly escalate the problem and subject you to a claim of retaliation.

- Not being honest about employee performance. It can be difficult for supervisors to deliver bad news but letting employees believe they are doing a good job when they aren't is all too common. This lack of honesty denies the person the opportunity to improve and puts the organization in a tenuous legal position should it decide to terminate the employment. Train your supervisors and hold them accountable for giving honest coaching and feedback to employees.

- Classifying a job as exempt based on its title. Small companies often provide lofty titles but whether a position can be considered exempt or non-exempt from Fair Labor Standards Act (FLSA) minimum wage and overtime protections depends upon its duties, never on its title. Be prepared to justify your classification of every exempt position based on one or more of the US Department of Labor's (DOL) Exempt Duties Tests (in addition to meeting minimum salary requirements.)

- Failing to pay non-exempt staff for unauthorized overtime. Pre-authorized or not, any work that you have suffered or permitted must be paid and an overtime premium applies to hours that exceed 40 in a work week. You may discipline the employee for working overtime without pre-authorization if that is your policy, of course, but that does not absolve you of your payment obligations.

It is much easier to prevent mistakes than to correct them.

The demands of HR legal compliance in an increasingly complex business environment can sometimes seem daunting. But take the small amount of extra time and effort to prevent basic HR mistakes so you can spend more time inspiring your staff and growing your business. Now that's a good idea at any time!When you need an HR legal compliance program that just works, connect with me on LinkedIn.For the 5 Most Fascinating Stories in Franchising, a weekly report, click here & sign up.