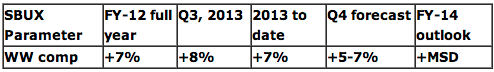

On July 25, 2013, Starbucks (SBUX) delivered a Q3 double beat and stellar worldwide comparable sales (comps) of +8% (+9% in the U.S.)

Some analysts were concerned about the SBUX Q4 forecast of a mid-single digit comp. The high comps were said to be a kind of spike. SBUX explained that mid single-digit comps were likely in Q4.

CEO Howard Schultz explained that it would be irresponsible for SBUX to forecast high comps if it believed they were not attainable and that SBUX business trends were very solid.

He sharply concluded:

Now having said that, our expectations of ourselves that we are going to deliver a healthy comp growth in Q4 that our investors will be proud of. Let's get off the comp number, because it's not the issue, issue is we are building a great extraordinary endeavoring company and the comps are going to follow that.

Were the sell-side analysts right to be concerned about Starbucks' comp "slowing up?" See the below Starbucks comps chart.

My opinion: perhaps. Of course, the beginning of comps deceleration is an important investor signal and will first be seen on quarterly or monthly comps reporting. Only McDonald's (MCD) reports monthly comps.

But there are other more important questions.

In the retail and restaurant space, comp sales from year to year are given way too much emphasis in reporting and analysis. It becomes the headline bumper sticker. The metric, which strips out newly opened or closed stores that are "immature," is a proxy for business cadence and optempo momentum, and sometimes a proxy for profit flow through.

But the analytical problem is the year-to-year comp is only so meaningful. What happened last year - the base for the comp - could have been impacted by many factors such as weather, calendar shift, competitive and marketing calendar shifts and so forth. It's certainly possible to have a great 10-year, five-year or two-year comp trend, but to have a flat or modest current quarter comp calculation.

In the future, we urge investors of all sorts - and analysts - to ask more meaningful questions about the comp trend.

After getting the comp results, and a customer traffic and average ticket breakout, here are 10 more meaningful questions:

1. Did the comp achieved meet your internal budget?

2. What is the comp on a two-year basis, a five-year basis?

3. What tradeoffs to get this comp?

4. What's the comp on a rolling 12 month or rolling two-year basis?

5. How much profit flows through to the store level from this comp?

6. How much is the flow through on a percentage of incremental sales basis?

7. What is the standard, or theoretical profit flow through?

8. Is the incremental flow through attained via higher cost percentage leverage?

9. How much does incremental store level profit flow through to the corporate bottom line?

10. How does this comp affect variable compensation payout accruals?

One question to consider is whether this is a monthly period, or how many weeks were included in this comp and the prior period? The hugely symbolic and massive market cap McDonald's for instance, is still reporting on a traditional monthly basis, which makes for calendar noise, which we discussed previously on SA.

In the restaurant space, there is an inordinate amount of short-term action to maximize the comp.

Better investor and sell-side questions will enable the company to explain its rationale, and send truer & better picture to the market.

When you need an authority on understanding public franchisors, connect with me on LinkedIn - or just give me a call.