Most of you and your associates probably received the first paycheck already in 2013. It is less than it was last time, right? How much less? Have you multiplied the "loss" by the number of payrolls in 2013?

Well, I just got off the phone with someone making $150,000 a year, gross. The first paycheck in 2013 is about $344 less than the last one in 2012 was. There are 26 payrolls in 2013, so it means losing thousands of dollars this year.

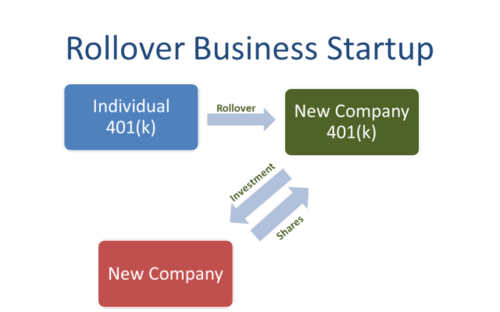

Why? Because the temporary Social Security tax cut (also referred to as payroll tax cut) will not be extended for 2013. Therefore, everyone will see the Social Security withholding increase from 4.2% back to 6.2%.

In a nutshell, what does it really mean to you, a solo or small business owner?

- If you are a solo or small business owner who also made "capital infusions" or "loans" to your company, you will have less to lend.

- You have to spend wiser.

- Since other people are getting less money on their paychecks as well, they will spend less - or at least look closer before they buy goods or services. It means you have to focus on what you do best and spend more time with current and future clients.

What may be some reasonable steps to consider in 2013 bringing change to the way you do business but in a good way! Take a close look at your time management. What percentage of your time generates revenue? What are those tasks you do that would not generate revenue? Can you take them away from your list by having someone else doing them?

Would you be able to generate revenue (do you have enough clients or customers) to do revenue-generating activities if you get some or most of that time back?

If your answer to the last question was "yes", than you are looking at "delegating" work.

What type of activities are those you could take off the list? Let me guess: mostly administrative ones.

How would it be the most beneficial to delegate such work? You certainly do not want to spend more on office space or computers. You can't increase your overhead costs further by hiring a part-time full-charge office manager with full benefits to take the tasks over. But you need these tasks to be done, in a professional matter, not to mention ad-hoc tasks.

What is the easiest and most beneficial way to go from here? I recommend a consulting firm offering full-scale back-office services virtually. So you do not need to hire anyone and do not need more space to be rented. You would have your own accountant taking care of the books, who can also do the taxes and process payroll, invoice clients and customers. If you have any additional ad-hoc tasks, HR related (job advertising, background checks, ect.,), web service assistance, just to mention a few, you just pick up the phone and it is taken care of.

What does it mean to you? You are gaining more time that you can charge to clients so more revenue is generated. You have spent significantly less than what additional earnings you made to make it happen - so it was worth doing it. You are less frustrated with business administration because you do not have to worry about it.

You just promoted yourself benefiting YOU and your Clients.

My name is Sylvia Pacher, and I am always here to assist you along the way to grow your business bigger, stronger, more competitive and profitable.