CITATION: Quizno's Canada Restaurant Corporation v. 2038724 Ontario Ltd., 2010 ONCA 466 |

DATE: 20100624 |

DOCKET: C51028 |

COURT OF APPEAL FOR ONTARIO |

Armstrong, Blair and Juriansz JJ.A. |

BETWEEN |

Quizno's Canada Restaurant Corporation, Quiz-Can LLC, The Quizno's Master LLC, Gordon Food Service, Inc. and GFS Canada Company Inc. |

Appellants (Defendants) |

and |

2038724 Ontario Ltd. and 2036250 Ontario Inc. |

Respondents (Plaintiffs) |

Proceedings under the Class Proceedings Act, 1992 |

J. D. Timothy Pinos, Geoffrey B. Shaw and Eunice Machado, for the appellant Quizno's Canada Restaurant Corporation, Quiz-Can LLC and The Quizno's Master LLC |

Katherine L. Kay and Mark E. Walli, for the appellant Gordon Food Service, Inc. and GFS Canada Company Inc. |

David Sterns, Allan D. J. Dick and Sam O. Hall, for the respondent 2038724 Ontario Ltd. and 2036250 Ontario Inc. |

Heard: January 27, 2010 |

On appeal from the Order of Justices K. Swinton, P. Hennessy and A. Karakatsanis of the Superior Court of Justice, sitting as the Divisional Court, dated April 27, 2009. |

ARMSTRONG J.A.:

INTRODUCTION

[1] Quizno's Canada Restaurant Corporation, Quiz-Can LLC, The Quizno's Master LLC (collectively "Quiznos"), Gordon Food Service, Inc. and GFS Canada Company Inc. (collectively "GFS") appeal from the order of the Divisional Court dated April 27, 2009, which conditionally certified the within action as a class proceeding.

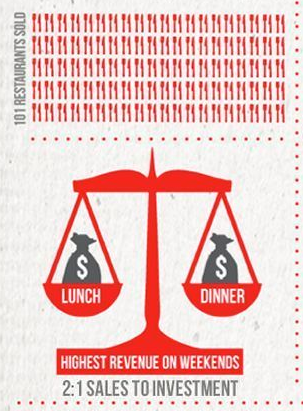

[2] Quiznos is the franchisor of a chain of some 427 fast food restaurants located across Canada. GFS is the distributor of food and other supplies to Quiznos restaurants. GFS operates through five affiliated companies, which distribute products to Quiznos restaurants through eight distribution centres across the country.

[3] The respondents are two former Quiznos franchisees in Ontario, who seek to represent a class of all Canadian Quiznos franchisees in business on or after May 12, 2006.

[4] The essence of the dispute between Quiznos and the franchisees is that the franchisees allege that they have been charged exorbitant prices for food and other supplies they purchase for use in their restaurants. Against GFS, it is alleged that they have engaged in a civil conspiracy with Quiznos in which they aided and abetted a price maintenance scheme.

[5] In the Superior Court, Perell J. dismissed the motion for an order certifying the action as a class proceeding. The Divisional Court reversed the motion court judge.

THE FACTS

[6] The Quiznos franchise system was established in the United States 25 years ago and commenced operation in Canada in 2001. The relationship between Quiznos and the franchisees is governed by a standard form franchise agreement.

[7] The Quiznos system requires the franchisees to offer common menu items made from uniform supplies. There is a common operating manual and common advertising. The franchisees may not sell at prices which exceed prices mandated by Quiznos. Franchisees pay royalties of 7 per cent on gross sales.

[8] The franchisees are required to purchase all equipment, products, services, supplies and materials from common sources or from sources with common ownership, which are designated by Quiznos. Quiznos has designated GFS to sell and distribute a full line of products including meats, produce, frozen foods, dairy goods, paper and cleaning chemicals to the franchisees in Ontario. Quiznos has designated four companies affiliated with GFS to sell and distribute supplies to franchisees in the rest of Canada.

[9] The franchisees allege that Quiznos, aided by GFS, has established a price maintenance scheme in which large sums of money are extracted from the franchisees from the sale of supplies. It is alleged that prices paid by the franchisees pursuant to this scheme are inflated and commercially unreasonable.

[10] As a result of the alleged price maintenance scheme, the franchisees further allege:

(a) They have been denied the ability to negotiate lower prices of supplies with the GFS defendants and other suppliers.

(b) They have been hindered, prevented or denied the opportunity to source identical supplies from other suppliers.

(c) They have been hindered, prevented or denied the opportunity to compete equitably with competitors whose prices are not unlawfully enhanced, fixed and maintained.

(d) They have experienced declining profitability, or are suffering losses, including unsustainable losses, which, if unabated, will result in irreparable harm including, inter alia, loss of total investment by some Class Members.

[11] The franchisees assert three causes of action:

(i) breach of the price maintenance provisions of the Competition Act, R.S.C. 1985, c. C-34;

(ii) conspiracy among the defendants (appellants) to fix prices; and

(iii) breach of contract

[12] Section 61(1)(a) of the Competition Act provides:

(1) No person who is engaged in the business of producing or supplying a product...shall, directly or indirectly...

(a) by agreement, threat, promise or any like means, attempt to influence upward, or to discourage the reduction of, the price at which any other person engaged in business in Canada supplies or offers to supply or advertises a product within Canada...

[13] The franchisees claim against the Quiznos defendants:

(a) compensation and damages in the amount of $75 million for conduct that is contrary to s. 61(1) of theCompetition Act;

(b) an interim, interlocutory and permanent injunction preventing Quiznos and GFS from engaging in the price maintenance scheme;

(c) $75 million for breach of contract including breach of the common law duty of good faith; and

(d) an amount equal to the full investigative costs of the plaintiffs and the plaintiff class, pursuant to s. 36 of theCompetition Act.

[14] The franchisees claim against Quiznos and GFS:

(a) damages in the amount of $75 million for civil con-spiracy;

(b) punitive, exemplary and/or aggravated damages in an amount to be determined by the court.

THE MOTION COURT DECISION

[15] There were two motions before the motion court: a motion by the franchisees to certify the action as a class proceeding pursuant to theClass Proceedings Act, 1992, S.O. 1992, c. 6 and a motion by Quiznos to stay the action. Only the certification motion is in issue in this appeal.

[16] Section 5(1) of the Class Proceedings Act provides:

5. (1) The Court shall certify a class proceeding on a motion under section 2, 3 or 4 if,

(a) the pleadings or the notice of application discloses a cause of action;

(b) there is an identifiable class of two or more persons that would be represented by the representative plaintiff or defendant;

(c) the claims or defences of the class members raise common issues;

(d) a class proceeding would be the preferable proce-dure for the resolution of the common issues; and

(e) there is a representative plaintiff or defendant who,

(i) would fairly and adequately represent the interests of the class,

(ii) has produced a plan for the proceeding that sets out a workable method of advancing the proceeding on behalf of the class and of notifying class members of the proceeding, and

(iii) does not have, on the common issues for the class, an interest in conflict with the interests of other class members.

[17] In respect of s. 5(1)(a) of the Class Proceedings Act the motion judge concluded that the statement of claim disclosed causes of action for breach of s. 61 of the Competition Act, breach of contract and civil conspiracy. The motion judge also found that "all persons, including firms and corporations, carrying on business in Canada under a Quiznos franchise agreement on or after May 12, 2006" with a slight alteration (the date for closure of the class membership) was an identifiable class as required by s. 5(1)(b) of the Class Proceedings Act.

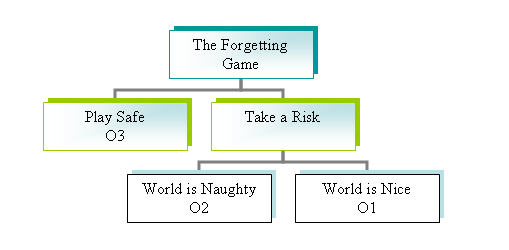

[18] The motion judge's refusal to certify this case as a class proceeding turned on his analysis of the proposed common issues pursuant to s. 5(1)(c) of the Class Proceedings Act. The franchisees proposed the following common issues before the motion judge:

(a) Have the Quiznos defendants, or any of them, engaged in conduct contrary to Section 61(1) of theCompetition Act?

(b) Have the defendants, or any of them, engaged in conduct that amounts to civil conspiracy?

(c) (Issue deferred)

(d) Have the Quiznos defendants, or any of them, engaged in conduct which constitutes a breach of their contractual obligations to the Class Members?

(e) Have the Class Members suffered loss or damage as a result of any of the conduct referred to in issues a, b, c, or d? If so, what is the appropriate measure or amount of such loss or damages?

(f) Should the court award an aggregate assessment of monetary relief on behalf of some or all class members? If so, what is the amount of the aggregate assessment and how should the class members share in the award?

(g) Should the defendants pay punitive, exemplary or aggravated damages to the Class Members? Should such damages be assessed in the aggregate? If so, what is the amount of such damages including pre- and post-judgment interest thereon?

(h) Are the Class Members entitled to recover from the Quiznos defendants the full costs of their investigations and the full costs of this proceeding, including contingent legal fees on a complete indemnity basis, under section 36(1) of the Competition Act?

[19] As is often the case in certification motions, the problem for the franchisees before the motion judge was the issue of damages. The appellants argued that because damages constitute an individual issue for each franchisee it was not appropriate to be treat them as a common issue.

[20] The franchisees tendered the evidence of an economist, Dr. Andy Baziliauskas, in respect of the damages issue. Dr. Baziliauskas testified that the quantum of the over-charge from the alleged price maintenance conspiracy could be calculated by taking the difference between the prices paid by the franchisees and the prices they would have paid but for the price maintenance conspiracy. The economist testified that actual prices would be available from the financial records of the parties and the "but for" prices could be taken from industry data. Thus, the difference between actual prices and "but for" prices could be applied on a class wide basis to prove damages.

[21] The appellants argued that actual prices would vary on a class wide basis because of a number of variables including: whether the supplies are purchased outside of the authorized distribution system, whether the franchisee qualifies for a rebate, individual credit terms, waste, employee theft and sharing among franchisees.

[22] The appellants also argued that "but for" prices would vary on a class wide basis because of circumstances particular to individual franchisees such as location, financial capacity and purchasing power.

[23] The appellants relied on their own expert economist, Dr. Roger Ware, who testified that the impact of the alleged price maintenance scheme would have to be assessed on an individual franchise and product by product basis across the country. The motion judge summarized the expert opinions as follows:

[112] Thus, relying on the critique of Dr. Ware, the Defendants disputed Dr. Baziliauskas' opinion that that (sic) there were three methodologies for extrapolating "but for" prices on a class-wide basis; namely: (1) by using "benchmark prices," which are prices paid for substantially similar products purchased by a comparator coalition of buyers where there is no price maintenance agreement between the franchisor and its distributor; (2) by using a "servicing fee" analysis, which is to take the difference between the sourcing and mark-ups charged under the distribution agreement under which GFS-Canada supplied goods and the fees charged by other franchisors in similar circumstances but where there is no price maintenance; and (3) by using a "before and after comparison," which is to compare the prices charged to the Quiznos franchises before and after the purported price maintenance began.

[113] I agree with the criticism of the Defendants that: (a) Dr. Baziliauskas has not shown that a comparator group of franchisees or a comparator franchisor can be identified; (b) he has not explained how it could be determined that a comparator group of franchisees was paying for product free of price maintenance by its franchisor; and (c) with respect to the before and after methodology, he has not shown that there was or that it could be determined that there was a time before price maintenance began. In my opinion, these omissions make his three methodologies conceptually unsound and not feasible to measure a class-wide impact of price maintenance.

[24] On the basis of the above, the motion judge concluded that it was not shown by the franchisees that their damages, if any, could be proven in the aggregate on a class wide basis.

[25] Having disposed of damages, the motion judge turned to the other common issues advanced by the franchisees in para. 115 of his reasons:

This conclusion removes proposed common issue (f) [aggregate assessment of damages] as a common issue and has the effect of an avalanche that buries the proposed common issues with an absence of commonality and a proliferation of individual issues. Thus, for instance, pro-posed common issues (a) and (b) above (namely: (a) Have the Quiznos Defendants, or any of them, engaged in conduct contrary to section 61(1) of the Competition Act? And (b) Have the Defendants, or any of them, engaged in conduct that amounts to civil conspiracy?) depend upon showing: individual instances of price maintenance; individual instances of suffering loss in the "but for" world in order to measure the impact of losses; and individual claims of damages for the tort of conspiracy. Similarly, proposed common issues (d), and (e) are individual not common issues. Proposed common issues (g) and (h) have commonality but, standing alone, they would not sufficiently advance the litigation to qualify as common issues.

[26] The franchisees relied on ss. 23(1) and 24(1) of the Class Proceedings Act, which they claimed assisted them in establishing a common issue in respect of damages. Sections 23(1) and 24(1) provide:

Statistical evidence

23.(1) For the purposes of determining issues relating to the amount or distribution of a monetary award under this Act, the court may admit as evidence statistical information that would not otherwise be admissible as evidence, including information derived from sampling, if the information was compiled in accordance with principles that are generally accepted by experts in the field of statistics.

Aggregate assessment of monetary relief

24. (1) The court may determine the aggregate or a part of a defendant's liability to class members and give judgment accordingly where,

(a) monetary relief is claimed on behalf of some or all class members;

(b) no questions of fact or law other than those relating to the assessment of monetary relief remain to be determined in order to establish the amount of the defendant's monetary liability; and

(c) the aggregate or a part of the defendant's liability to some or all class members can reasonably be determined without proof by individual class members.

[27] The motion judge found that neither section was of any help to the franchisees. He was of the view that s. 23(1) related to the distribution of damages and had nothing to do with the determination of the entitlement to damages. He further concluded that s. 24(1) "provides a method to assess the quantum of damages on a global or aggregate basis, but not the fact of damage".

[28] Following from the above analysis, the motion judge concluded that a class proceeding would not be the preferable procedure for the resolution of the proposed common issues as required by s. 5(1)(d) of the Class Proceedings Act.

[29] Finally, the motion judge concluded, in accordance with s. 5(1)(e) of the Class Proceedings Act, that the two named franchisees are satisfactory representative plaintiffs subject to the filing of a better litigation plan.

[30] In the result, the motion for certification was dismissed.

THE DIVISIONAL COURT DECISION

[31] Hennessy and Karakatsanis J.J., for the majority, would have allowed the appeal from the decision of the motion judge. Swinton J., in dissent, would have dismissed the appeal.

[32] The majority concluded that the motion judge erred in focusing solely on the damages issue and failed to consider the other proposed common issues. The majority said at paragraph 45 of their reasons:

In our view, whether one of the proposed common issues is overwhelmed or buried by the individual issues is part of the analysis for the preferable procedure criterion, but is not necessarily determinative of the common issues requirement. The remaining proposed common issues ought to have been analysed.

The majority stated further at para. 47 of their reasons:

We are satisfied that the motions judge erred in principle by focusing on proof of damages and failing to consider and identify other common issues. Even if the motions judge made no reversible error with respect to his assessment that the expert evidence provided no basis in fact to prove damages on a class wide basis, he erred in failing to consider whether there was some other basis in fact to find that breach of s. 61 of the Competition Act, breach of contract, and the existence of loss on a class wide basis were common issues.

[33] The majority proceeded to a detailed analysis of the proposed common issues, (a), (b), (d), (e) and (f). The majority concluded that these issues had a sufficient number of common elements to provide the basis for the certification of the class proceeding.

[34] The majority also concluded that the motion judge erred in finding that s. 24 of the Class Proceedings Act would not be available to determine aggregate damages at trial and he erred in finding that a class proceeding would not be the preferable procedure for the resolution of the common issues.

[35] The dissenting judge concluded that the motion judge came to the right result. In her overview of the case she said at paras. 155 and 156:

[155] I agree with the majority that a motions judge hearing a certification motion must ask whether there are any common issues, and then determine whether they are a substantial part of each class member's claims. In my view, that is what the motions judge did here, although his reasons might have been more detailed in order to illustrate his reasoning process more clearly.

[156] However, even if he erred in the way in which he approached the common issues as the majority finds, I see no basis to interfere with his conclusion that a class proceeding is not the preferable procedure. He applied the correct legal principles, made no palpable and overriding errors of fact, and exercised his discretion based on the pleadings and evidence before him. Therefore, I would dismiss the appeal.

THIS APPEAL

[36] The appellants raise the following grounds of appeal:

(i) The Divisional Court majority applied the wrong standard of review.

(ii) The majority erred in finding that s. 61(1) of the Competition Act is a common issue.

(iii) The majority erred in finding that the conspiracy claim is a common issue.

(iv) The majority erred in finding that the breach of contract claim is a common issue.

(v) The majority erred in finding that ss. 23 and 24 of the Class Proceedings Act can be used to determine the damages.

(vi) The majority erred in interfering with the motion judge's discretionary decision that a class action is not the preferable procedure for this case.

ANALYSIS

(i) The Standard of Review

[37] It is clear from the majority's reasons that they understood their role as an appellate court. The majority recognized that a decision of a motion judge on certification is entitled to considerable deference. See Anderson v. Wilson (1999), 44 O.R. (3d) 673 (C.A.) at 677 andCassano v. The Toronto Dominion Bank (2007), 87 O.R. (3d) 401 (C.A.). However, as stated by Winkler C.J.O. in Cassano at para 23, "[L]egal errors by the motion judge on matters central to a proper application of s. 5 of the CPA displace the deference usually owed to the certification motion decision..."

[38] The appellants submit that the Divisional Court majority erred in concluding that the motion judge failed to consider all the proposed common issues and then further erred in assuming original jurisdiction to decide those issues. I disagree. In my view, the majority correctly concluded that the focus of the motion judge's reasons was on the issue of damages, which he found overwhelmed the remaining proposed common issues. While he referred to the other issues in passing, there was effectively no independent analysis of those issues by the motion judge, which constitutes the kind of error that attracts the intervention of an appellate court.

(ii) The Competition Act Claim

[39] The relevant sections of the Competition Act are:

Section 36

(1) Any person who has suffered loss or damage as a result of

(a) conduct that is contrary to any provision of Part VI, or

(b) the failure of any person to comply with an order of the Tribunal or another court under this Act,

may, in any court of competent jurisdiction, sue for and recover from the person who engaged in the conduct or failed to comply with the order an amount equal to the loss or damage proved to have been suffered by him, together with any additional amount that the court may allow not exceeding the full cost to him of any investigation in connection with the matter and of proceedings under this section.

Section 61

(1) No person who is engaged in the business of producing or supplying a product, who extends credit by way of credit cards or is otherwise engaged in a business that relates to credit cards, or who has the exclusive rights and privileges conferred by a patent, trade-mark, copyright, registered industrial design or registered integrated circuit topography, shall, directly or indirectly,

(a) By agreement, threat, promise or any like means, attempt to influence upward, or to discourage the reduction of, the price at which any other person engaged in business in Canada supplies or offers to supply or advertises a product within Canada; or

(b) Refuse to supply a product to or otherwise discriminate against any other person engaged in business in Canada because of the low pricing policy of that other person.

I should note that s. 61 of the Competition Act was repealed on July 13, 2009.

[40] As indicated, the majority in the Divisional Court was critical of the motion judge for his focus on the problems associated with the proof of damages. The majority concluded that the appropriate common issue was the breach of s. 61(1) of the Competition Act and that such breach "may be approached in a number of ways".

[41] The majority's detailed analysis of s. 61(1) of the Competition Act issue is found at paras. 51 - 75 of their reasons. I find it unnecessary to repeat that analysis here.

[42] The Divisional Court correctly concluded that breach of s. 61(1) of the Competition Act does not require proof of loss or damage. Likewise it does not, as alleged by the appellants, require detailed analysis of the prices paid for each product by each franchisee and the prices each franchisee would have paid but for the alleged maintenance agreements. The section is aimed at attempts to maintain prices. Loss of profit or damages is not a constituent element.

[43] I accept the submission of the appellants that for the franchisees to succeed in their Competition Act claim, s. 61(1) must operate in combination with s. 36(1) of the act, which requires proof of loss or damage. That said, it does not detract from the conclusion that a breach of s. 61 is itself an appropriate common issue, which advances the litigation.

[44] I am in agreement with the majority's conclusions in the following paragraphs from their reasons for judgment:

[67] We agree with the appellants' submission that a 'top down' approach focusing on the arrangement between the franchisor, the distributor and the suppliers, and the nature and amounts of the sourcing fees and mark-ups, may allow the court to determine whether the mark-ups and sourcing fees resulted in maintaining prices contrary to s. 61(1). This may ultimately allow the court to determine whether s. 61(1) was breached without the need to establish what each individual franchisee, acting alone, would pay for each product from an alternate supplier.

[68] Whether or not evidence is available of prices before and after the distribution agreement or comparable industry practices need not be shown at the certification stage. The requirement that there be some basis in fact to support the common issues does not require the plaintiffs to indicate the evidence to be advanced at the certification stage, nor does it determine the admissibility of evidence.

[70] If the court is satisfied that the Quiznos respondents imposed sourcing fees and mark-ups by way of the distribution agreement in an attempt to influence upwards the prices paid by the appellant franchisees, and that the pricing scheme resulted in a breach of s. 61(1), a substantial ingredient of liability under s. 36 of the Competition Actcan be proven on a class wide basis. This will advance the claim of each member of the class, and avoids the duplication of the legal analysis involved in determining this question. Alternatively, a finding that the distribution agreement did not amount to price maintenance will resolve the litigation relating to both the Competition Act and the civil conspiracy claim.

[Emphasis in the original.]

[45] To the above, I would add that it is unnecessary at this stage to engage in the debate about the relative strengths and weaknesses of the expert evidence.

(iii) The Conspiracy Claim

[46] As already noted, apart from the claims for punitive and exemplary damages, the conspiracy claim is the only claim that includes GFS. The franchisees allege that price maintenance agreements pleaded in respect of the claim advanced under s. 61(1) and 36(1) of the Competition Actsupport a claim for the tort of civil conspiracy. Paragraphs 62 and 63 of the Amended Amended Statement of Claim provide:

62. By entering into the Price Maintenance Agreements, and acting in furtherance of such agreements, each of the defendants entered into unlawful and tortious conspiracies to use unlawful means directed at the Class Members, knowing fully that their agreements and actions would cause injury to the Class Members, which injury has in fact resulted to the Class Members.

63. Furthermore, pursuant to the Price Maintenance Agreements and the acts particularized in paragraphs 31 to 42 hereof, the GFS companies have knowingly aided, abetted and counselled the Quiznos defendants in maintaining the prices at which the GFS companies have supplied or offered to supply products and supplies to the Class Members, which price maintenance is contrary to section 61(1) of the Competition Act and which aiding, abetting and counselling is contrary to sections 21 and 22 of the Criminal Code, R.S.C. 1985, c. C-46.

[47] As in the case of the s. 61(1) claim, the motion judge dismissed the conspiracy claim as a proposed common issue on the basis that it would be overwhelmed by the damages issue, which could not be established on a class wide basis.

[48] The Divisional Court in its analysis held that to succeed on the conspiracy claim, the appellants must prove the following elements:

1. that the respondents entered into an agreement (to permit the Quiznos respondents to enhance, fix and maintain prices to be paid by the class members contrary to s. 61 of the Competition Act);

2. that the GFS respondents' conduct (aiding and abetting price maintenance by the Quiznos respondents) is unlaw-ful;

3. that the respondents acted in furtherance of the agree-ment;

4. that the respondents should have known that the conspiracy would likely cause serious harm to the class members by forcing them to pay inflated prices for the goods; and

5. that the conspiracy has caused damage to the class members.

[49] The Divisional Court majority concluded at para. 81 of their reasons:

Given our conclusion that the fact of loss on a class wide basis is a common issue, we are satisfied that whether the respondents engaged in a civil conspiracy is a common issue. However, even in the absence of proof of the fact of loss, the first four constituent elements of conspiracy are common issues that would advance each franchisee's claim and avoid duplication of fact finding and legal analysis.

I agree with the Divisional Court's conclusion.

(iv) The Breach of Contract Claim

[50] The motion judge also disposed of the breach of contract claim as a proposed common issue on the basis that the claim for damages of $75 million arising from the breach would not permit the claim to proceed on a class wide basis.

[51] The Divisional Court majority concluded that the Quiznos appellants "are alleged to have breached certain sections of the franchise agreements by failing to ensure that its franchisees are obtaining 'commercially reasonable prices' for supplies".

[52] The Divisional Court majority was of the view that there were a number of contractual issues for determination on a class wide basis, which would advance the litigation including:

(a) the meaning of the contract provisions;

(b) the existence and nature of any common law duty of fairness; and

(c) whether the Quiznos respondents have breached a contract provision in failing to provide specifications.

[53] As in respect of the Competition Act claim and the conspiracy claim, the appellants argue that the contract claims are highly individualistic and are not conducive to a determination on a class wide basis. I am not persuaded. I accept the Divisional Court majority's conclusion at para. 93:

Based on the foregoing, we find that a significant number of factual and legal issues, integral to the breach of contract claim, are common issues. These represent substantial ingredients of the breach of contract claim that could advance the claim of each class member and will avoid duplication of fact-finding or legal analysis.

(v) Sections 23 and 24 of the Class Proceedings Act

[54] The appellants submit that the Divisional Court majority employed s. 23 to alter the constituent elements of the alleged causes of action by permitting the franchisees to establish damages on statistical probabilities or percentages. The appellants further submit that the court's right to make an aggregate assessment under s. 24(1) is only available after some liability and some entitlement are established - s. 24 merely provides a method to assess the quantum of damages on an aggregate basis.

[55] In my view, the appellants have mischaracterized the approach that the majority of the Divisional Court took in the application of ss. 23 and 24. The majority clearly recognized that s. 24 is procedural and cannot be used in proving liability. However, they observe that a breach of s. 61(1) of the Competition Act and liability for breach of contract can be established without proof of loss. The majority concluded at para. 123:

In this case, the appellants seek declaratory relief. We have found that liability for breach of the Competition Act and liability for breach of contract are common issues. Given our conclusions, ss. 23 and 24 of the CPA may be available at the common issues trial to determine damages on an aggregate basis.

[56] The judgment of this court in Cassano is supportive of the approach taken by the majority. Cassano involved an action against the TD Bank by the proposed class action plaintiff for alleged manipulation of exchange rates on charges to the plaintiff's Visa bill. At para. 38, Winkler C.J.O., writing for the court, said:

In my view, this is a case where the common issues trial judge could find, based on a review of the evidence, that it is appropriate to conduct an aggregate assessment of monetary relief under s. 24 of the CPA, as was contemplated by this court in Markson, supra. Alternatively, even if the trial judge were to conclude that an aggregate assessment of damages is inappropriate, the nature of the claim asserted is such that the provisions of the CPA might well be utilized so as to make a class proceeding under the statute the "preferable procedure for the resolution of the class members' claims": see Hollick v. Metropolitan Toronto (Municipality), [2001] 3 S.C.R. 158 at para. 29.

The expert evidence before the motion judge goes to the issue of whether the damages can be aggregated as indicated in the above passage, which is an issue to be decided by the common issues trial judge.

[57] Winkler C.J.O. adopted the approach taken by Cullity J. in Vezina v. Loblaw Companies Ltd., [2005] O.J. No. 197 at para. 25 (S.C.J.) and cited by Rosenberg J.A. in Markson v. MBNA Canada Bank (2007), 85 O.R. (3d) 321 (C.A.) at para. 44 to the effect that on a certification motion, a plaintiff is only required to establish that "there is a reasonable likelihood that the preconditions in s. 24(1) of the CPA would be satisfied and an aggregate assessment made if the plaintiffs are otherwise successful at a trial for common issues."

[58] Finally, Winkler C.J.O. at para. 52 of Cassano recognized that the ultimate decision of whether ss. 23 and 24 would be available rested with the trial judge:

Even in the event that a trial judge were not prepared to rely on ss. 24(2) and (3) to fashion a remedial order in this case, I note that the combined operation of ss. 24(4), (5) and (6) of the CPA authorize the court to require that class members submit individual claims in order to give effect to an aggregate award of damages.

[59] I would add to the above that s. 25 of the Class Proceedings Act provides a procedural code for the determination of individual issues as an adjunct to a class proceeding. It is clear that the intent of the act is to accommodate both common issues and individual issues that may arise in a class proceeding.

(vi) The Preferable Procedure

[60] The appellants rely on the reasoning of the motion judge that the proposed class proceeding would not be fair, efficient or manageable because the individual issues "overwhelm" the common issues and the resolution of the common issues would not significantly advance the litigation. I do not agree. If one accepts, as I do, that the motion judge erred in his treatment of the common issues then the rationale for his conclusion that a class proceeding is not the preferable procedure disappears.

[61] In my view, the trial of the common issues in this case will significantly advance the litigation. I agree with the conclusion of the Divisional Court majority that this is the case even if the damages issues cannot be dealt with on a class wide basis.

[62] I am also of the view that a class proceeding in this case will satisfy at least two of the objectives of the Class Proceedings Act of judicial economy and access to justice. It seems to me that this case involving a dispute between a franchisor and several hundred franchisees is exactly the kind of case for a class proceeding.

DISPOSITION

[63] For the above reasons, I would dismiss the appeal.

[64] If the parties cannot agree on costs, we will receive written submissions from counsel for the respondents within 15 days of the release of these reasons limited to 5 pages double spaced. Counsel for the appellants may respond with written submissions within 10 days of the receipt of the respondents' submissions limited to 5 pages double spaced.

RELEASED:

"RPA" "Robert P. Armstrong J.A."

"JUN 24 2010" "I agree R. A. Blair J.A."

"I agree R. G. Juriansz J.A."

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=bc935efe-5bdf-4dda-9667-de5a837bb0ad)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=f227fe93-0bae-4864-b9ac-313d19b61b46)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=706ee163-debe-4ffb-964b-a399bc400938)