In one of the best IPO results of the year, the first restaurant IPO of the year, Noodles (NDLS) raised almost $100M and stock price more than doubled from its initial pricing at $18 to close at $36.75 on its first day. The Noodles CEO, Kevin Reddy, came from Chipotle (CMG), at an earlier stop in life.

Is Noodles the new Chipotle?

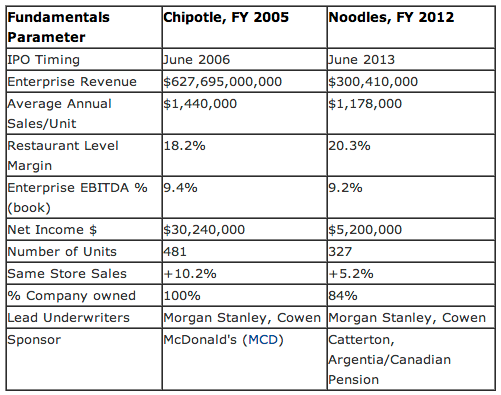

Chipotle IPO'd in June 2006. They are both fast casual concepts, Colorado based, both early movers. And there are many fundamentals comparisons. See the table below, prepared from both the Noodles and the Chipotle SEC S-1s, for their last full fiscal year before IPO, which shows the key fundamentals drivers:

Store economics look similar? Yes, in some ways:

· Fast casual operators, new buildings, new food types and popularized styles.

· Average Annual Restaurant Sales in the $1.2M to $1.4M range.

· Solid restaurant margins - Noodles now actually exceeded that of Chipotle in 2005 by 210 bpts.

· Totally or primarily company operated model.

Noodles' success demonstrates there is investor demand for new restaurant offerings and validates fast casual investor demand. I understand NDLS was twenty times oversubscribed. Catterton, Morgan Stanley and Cowen did a nice job.

The issue to keep in mind is the United States consumer space is not the same as it was in 2006.

Recession, fundamental changes in population, income, eating and dining preferences, commercial real estate site characteristics, and more U.S. restaurants in operation each year make for a more difficult 2013 and out conditions.

Noodles must deliver good quality, service, cleanliness and price/value, in a differentiated fashion, with good corporate stewardship and continue to build connections with guests, employees, investors and other stakeholders via its culture.

Mathematically, as it expands, it has to think a lot about occupancy costs. NDLS occupancy costs are now 9.9%. Chipotle's was 7.6% in 2005. Site supply is tight. Many legacy brands, the real first movers, like McDonald's and Dunkin' Brands (DNKN) got the early best U.S. sites.

Restaurants economics was built on 6-8% rent, but some restaurant operations are facing 15-20% rent for some sites. Too much push for too fast expansion will test the rent leverage especially for a $1.2 million sales concept.

The imputed IPO valuation from the NDLS IPO is already $800M, or an EV/EBITDA multiple of 26.6X. That's rich. But it's just the first day. I hope the pressure cooker investment world will take a break and give them a chance to grow smartly.

John, when the IPO pops likes this aren't the ordinary shareholders made that they left money on the table?

The corporation doesn't get any of this money from the IPO - if I am franchisee, I am ticked that the franchisor is out money.

Because eventually, it will come from my pocket.

John did the Noodles folks and their advisors underprice the IPO.

Michael: thanks for the questions.

The realities of IPO offerings in the US is that the underwriters "run" the order book around for the stock, with their big clients getting first dibs. So there are no "ordinary" stockholders at this early phrase. That will be later.

Noodles has about 50 franchisee owned units but I would imagine most of their growth for a time will be via company owned locations. The unit level profit margin is well north of the "franchsing tipping point". It's all about the store economics.

Of the $100M in proceeds, about $77M went to paydown debt (dividends paid to the private equity firm sponsor). Future offerings will raise more money for the corporation. They are generating about $30M in EBITDA now with no debt so they can fund some expansion internally.

Joe, thats a great question. Some questions on that from the analytical commentariat today.

My best thought is Noodles wanted to price at around that point to set the stage for momentum and later demand. NDLS had only about $5M in GAAP earnings in 2012 so realistically they shouldn't want the enterprise value (EV) to go too high too fast until earnings ramp up. If its too high, then the investment community has too high expectations.

John and Joel

If the corporation doesn't get max cash out of the IPO, then Noodle's advisors have failed in their fiduciary duty to the corporation.

Yes, the initial stockholders love the run-up, so that they can cash out.

John -

Shouldn't Noodles have been looking at efficient pricing of their IPO?